Today's new ETF listings from around the world.

USA

Invesco is listing two more multi-factor bond ETFs, this time targeting defensive and income opportunities. Both funds track an "index of indexes" where the underlying indexes are made of lots of little Invesco sub-indexes.

Invesco Multi-Factor Defensive Core Fixed Income ETF (IMFD)

Invesco Multi-Factor Income ETF (IMFI)

IMFD

will track an index made of

four sub-indexes. Their target allocations are:

Invesco U.S. Treasury 1-3 Years Index (55% weight);

Invesco U.S. Fixed Rate 30 Year MBS Index (20% weight);

Invesco Investment Grade Defensive Index (15% weight);

Invesco Emerging Markets Debt Defensive Index (10% weight).

Each subindex is quite straightforward. The emerging market index is "defensive" in that its US dollar denominated and all securities must have a rating of B- or better. The index is rebalanced monthly.

IMFI will track an index made of a massive seven subindexes. Their target allocations are:

Invesco U.S. Fixed Rate 30 Year MBS Index (25% weight);

Invesco Emerging Markets Debt Value Index (15% weight);

Invesco High Yield Defensive Index (15% weight);

Invesco Investment Grade Value Index (15% weight);

Invesco Emerging Markets Debt Defensive Index (10% weight);

Invesco High Yield Value Index (10% weight);

Invesco Investment Grade Defensive Index (10% weight).

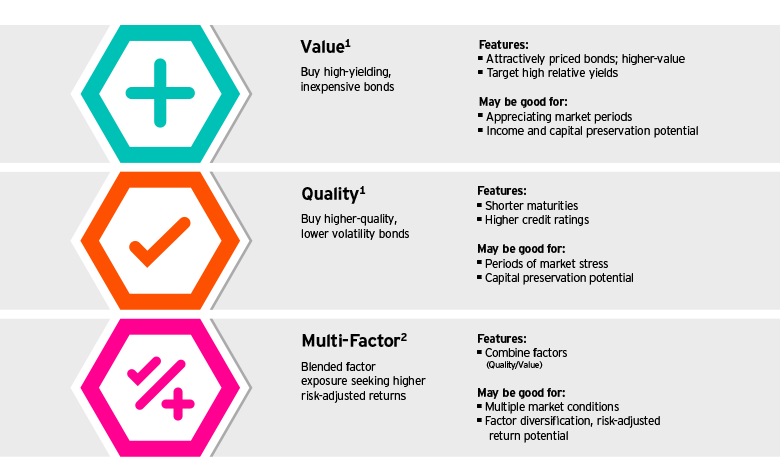

The difference between the "value" and "defensive" versions of these indexes is the value indexes target higher yield. To ensure the resulting index doesn't fill up with junk, Invesco adds a quality screen. The quality screen looks at credit ratings and maturity.