The debate surrounding the legalisation of marijuana for medical purposes and for recreational use has been rife in the last few years. In November last year the UK legalised medical marijuana under strict guidelines. The debate opened the marijuana market for investment and the sector has since boomed.

One ETF, the Horizons Marijuana Life Sciences Index ETF (HMMJ) - launched in 2017 - is set to become the second most profitable ETF in Canada having returned more than 50% this year.

But is this success just a fad or here to stay?

One of the reasons for the sector taking off is the liberalisation of the drug in North America. Marijuana used for medical purposes is now legal in more than 30 countries - including the UK - and its recreational use is also legal in a handful of countries, not including the UK. However, this number could grow.

In the US more than 30 states have legalised medical marijuana and some of these have even legalised its recreational use. This is despite marijuana remaining illegal at federal law level.

The popularity of the sector has seen the Horizons Marijuana Life Sciences Index ETF grow to $1.3bn in assets despite some outflows this year, making it the 18th largest Canadian ETF, according to data provider ETFGI. The ETF tracks an index compiled of North American publicly listed companies with significant business activities in the marijuana industry. This ETF is available on the Toronto Exchange and in Munich. In the US it is available in the OTC market.

Alternatively, the ETFMG Alternative Harvest ETF is listed on NYSE Arca. It is also the oldest cannabis ETF in existence. It was launched in 2015 and has assets just over $1.1bn. It is also listed on various other exchanges including the Berlin Bourse (ticker: 034B).

The ETFMG Alternative Harvest ETF tracks the Prime Alternative Harvest Index which tracks companies likely to benefit from the increasing global acceptance of various uses of the cannabis plant.

There are differences between these ETFs, but they are subtle.

According to The Motley Fool there are three primary kinds of marijuana companies. Marijuana growers -- companies that cultivate marijuana (typically in indoor facilities and greenhouses); cannabis-focused biotechs -- companies that develop prescription drugs based on ingredients found in cannabis; and providers of ancillary products and services -- companies that provide key products and services to the marijuana industry.

Interestingly, the UK is the world's largest producer of legal cannabis, according to a report last year from the United Nations. The report found that 95 tonnes of marijuana (or 44.9% of the world total) was produced in the UK for 2016 for medicinal and scientific use, according to the International Narcotics Control Board (INCB). The UK also exports the most in the world, according to the report.

The future also looks rosy.

According to This is money, legal cannabis sales are set to quadruple from around $6.5billion (£4.8billion) in 2016 to $24.5bn (£18.2bn) by 2021 in North America alone.

And more ETFs are on the way. ETF.com reported in February that in late November 2018, Innovation Shares filed for a marijuana ETF that would use a broker-dealer instead of a bank to custody its marijuana stocks, thus potentially resolving the custodial reticence that has up to this point prevented many issuers from launching their own funds.

At the moment, both current ETFs are cross listed in German but they also both have a hefty price tag of 0.75%.

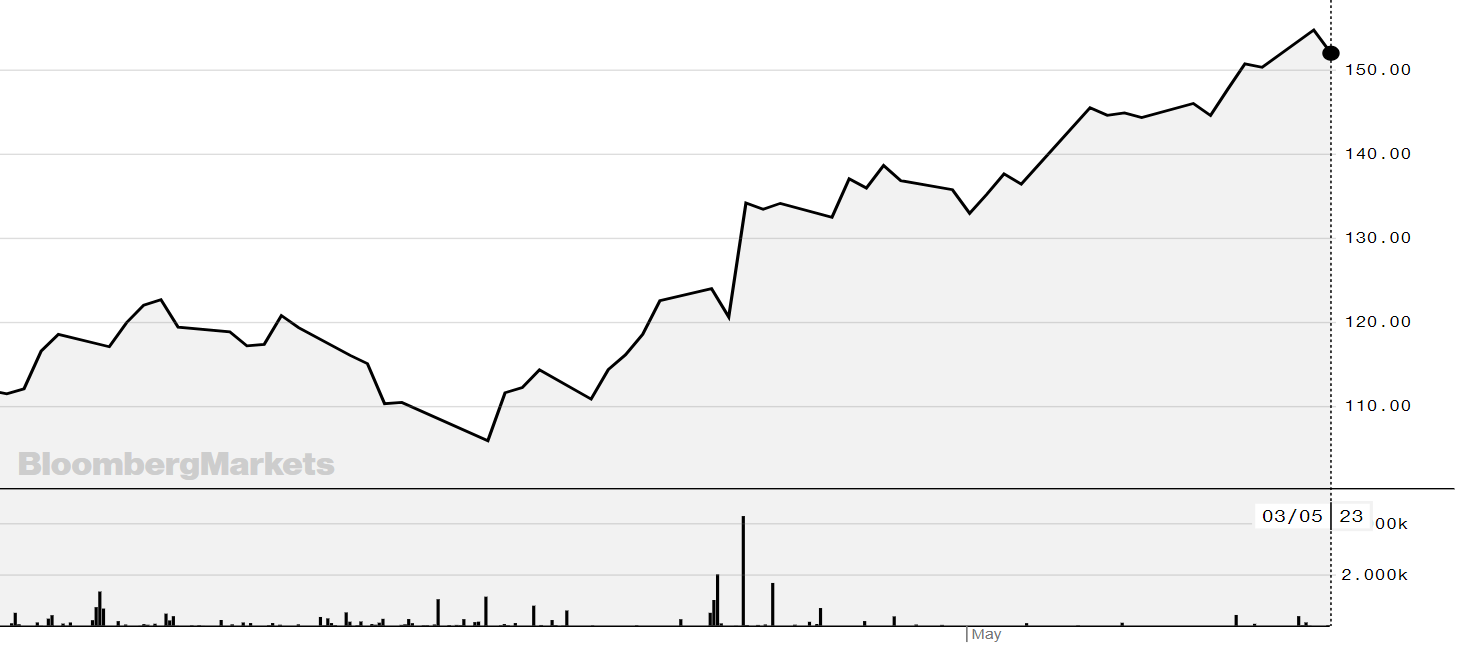

One option to possibly get around these costs and exposure to one of the companies the Horizons ETF (HMMJ) tracks is through GW Pharmaceuticals, (see its performance over the last year below). The company researches and develops cannabinoid prescription medicines for the treatment of cancer pain, Multiple Sclerosis, and neuropathic pain.

Source: Bloomberg

GW Pharmaceuticals is also the third largest holding in the Horizons ETF (HMMJ).

It is unclear how long it will be until the UK has access to Marijuana ETFs through its own stock exchange. Typically, with ETFs, where the US goes, the UK follows, but there are still some wrinkles that need ironing out in both countries. One industry expert said that the biggest issue they are coming up against in trying to launch a cannabis ETF is finding a custodian.

The ETFs in existence are also costly. The Horizon's ETF and the ETFMG Alternative Harvest ETF have high management fees of 0.75%.

There are also those who aren't convinced that this isn't just a fad.

Peter Sleep, senior portfolio manager at 7IM told This Is Money that it "is absolutely a faddish area of investment. It sounds interesting superficially, but if investors fail to understand the basics of investing in commodities and buy in without understanding the risks, they could end up losing a lot of money."

Regardless of the great performance, investors will need to remember that marijuana is a commodity and will therefore be subject to the supply and demand rules as found in the asset class.

Below is a table of some of the marijuana ETFs in existence and their cross listings at the time of writing.

MJ

034B

034B

034B

APW2

HMMJ

HMMJ

SOIL

ACT

ETFTERYTD RTNINDEXEXCHANGEETFMG Alternative Harvest ETF0.75%48.25%Companies likely to benefit from the increasing global acceptance of various uses of the cannabis plant.NYSE ArcaETFMG Alternative Harvest ETF0.75%n/aCompanies likely to benefit from the increasing global acceptance of various uses of the cannabis plant.GettexETFMG Alternative Harvest ETF0.75%50.25%Companies likely to benefit from the increasing global acceptance of various uses of the cannabis plant.Bourse BerlinETFMG Alternative Harvest ETF0.75%54.77%Companies likely to benefit from the increasing global acceptance of various uses of the cannabis plant.TradegateHorizons Marijuana Life Sciences Index ETF0.75%60.13%A basket of North American publicly listed companies with significant business activities in the marijuana industryMunichHorizons Marijuana Life Sciences Index ETF0.75%57.91%A basket of North American publicly listed companies with significant business activities in the marijuana industryTorontoHorizons Marijuana Life Sciences Index ETF0.75%A basket of North American publicly listed companies with significant business activities in the marijuana industryPeruGlobal X Fertilizers/Potash ETF0.69%7.14%Solactive Global Fertilizers/Potash IndexNYSE ArcaAdvisorShares Vice ETF0.75%17.06%Securities of companies that derive at least 50% of their net revenue from tobacco, alcoholic beverages, and companies that derive at least 50% of their net revenue from the marijuana / hemp industry.NASDAQ