Industrial ETFs booked strong inflows last week as investors followed the cyclical recovery narrative despite concerns around raw material shortages and transportation delays.

According to data from Ultumus, the $570m Xtrackers MSCI World Industrials UCITS ETF (XDWI) saw its assets under management (AUM) rise by more than 13.6% in the week to 26 February, courtesy of $75m inflows.

Likewise, the $193m iShares S&P 500 Industrials Sector UCITS ETF (IUIS) saw its AUM shoot up 34.1% as it collected over $49m inflows over the same period.

This industrials sector optimism is based on the broad assumption that an economic recovery will continue the bounce-back of cyclical equities, with the sector expected to benefit directly from demand in other sectors, such as consumer goods, hospitality, and travel.

Toby Dudley-Smith, head of UK passive sales at DWS, said: “In recent weeks there has been heightened demand for our World Industrials ETF, as investors increase their exposure to unloved cyclicals sectors, buoyed by improving optimism for a global recovery.”

The particularly strong inflows into IUIS are justified given that S&P 500 industrials equities posted world-leading growth during February.

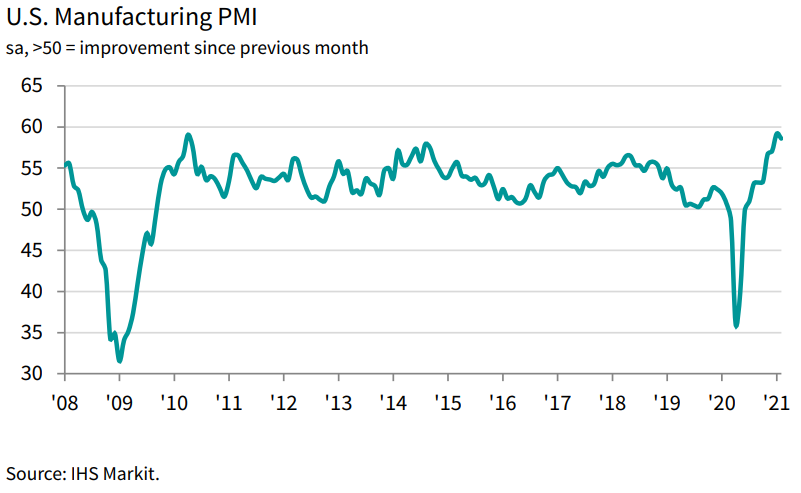

According to IHS Markit, US manufacturing production posted its second-fastest rate of growth since April 2010 – with a purchasing managers’ index (PMI) rating of 58.6 comfortably ahead of the growth-contraction benchmark of 50.0.

This is second only to January’s reading of 59.2 and is supported by production growth hitting one of its highest rates in six years while new export orders booked their second-steepest gain since 2014.

These gains are also expected to continue going forwards. Chris Williamson, head business economist at IHS Markit, said US manufacturing is close to recouping the output lost in 2020, and that the recovery may have the energy to go further still.

Williamson said: “Business expectations about the year ahead jumped to a level only exceeded once over the past six years, buoyed by a cocktail of stimulus and post-COVID-19 recovery hopes as life continues to return to normal amid vaccine rollouts.”

However, while demand for machinery and consumer goods appear to be growing month-on-month, Williamson noted shortages in raw material supplies and transportation delays could see a continued trend in price inflation being passed onto consumers – a trend only set to worsen as companies continue to eat away at their existing inventories of materials and goods.

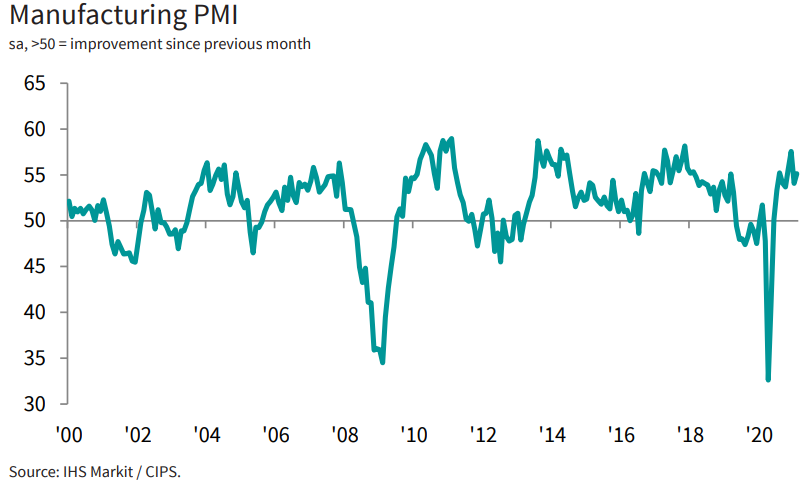

In the UK, trends were similar to those seen in the US with the added consideration of Brexit weighing on supply chains.

While posting its ninth month of consecutive growth and the February reading of 55.1 coming in ahead of January’s 54.9, the UK manufacturing rebound has fallen back from its record growth rates seen in the final months of 2020.

Between supply chain disruption and raw material shortages, 64% of firms reported higher input prices, as input cost inflation rose for the tenth month in a row in February – to its highest level in more than four years.

Rob Dobson, director at IHS Markit, said: “The UK manufacturing sector was again hit by supply chain issues, COVID-19 restrictions, stalling exports, input shortages and rising cost pressures in February. Look past the headline PMI and the survey reveals near stagnant production, widespread shipping and port delays and confusion following the end of the Brexit transition period.

“With current constraints likely to continue for the foreseeable future, pressure on prices and output volumes may remain a feature during the coming months.”

Despite these concerns, expectations of strong domestic demand seem to be offsetting some of the fears surrounding Brexit’s impact on exports. In fact, 77% of UK manufacturers surveyed by IHS Markit said they expect their output to be greater than current levels in a year’s time.

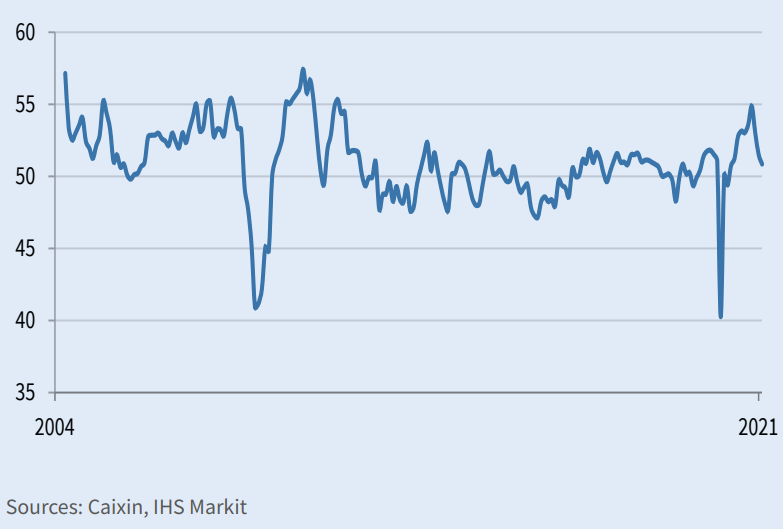

While being ailed with similar concerns about raw material shortages and transport delays, Chinese manufacturing is in a different position to western countries, in that its industrial sector is closer to dipping below the threshold for month-on-month growth.

With new export work declining for the second month in a row and suppliers’ delivery times lengthening, China saw its manufacturing PMI fall from 51.5 in January to 50.9 in February – its lowest level since its recovery began in May 2020.

Despite these facts, Dr. Wang Zhe, senior economist at Caixin Insight Group, said companies remained strongly optimistic about a rise in output in the coming year. It should also be noted that having had a head start in its pandemic recovery, China’s export volumes are now falling as western manufacturers recover to full capacity.

Zhe said: “The prices of raw materials continued to increase and inflationary pressure continued to grow. Despite the headwinds mentioned above, manufacturers became more optimistic about the outlook for their businesses.

“The confidence mainly came from the accumulation of the experience in fighting the pandemic over the past year, as well as the expectation that the winter COVID-19 flare-ups were coming to an end.”