Observing the monthly flows into the European ETF industry, one might get the impression the majority of assets flow into a small number of issuers and a handful of ETFs.

As a result, only a limited number of ETFs should show significant growth in assets under management.

If this thesis were true, the market share of the ETFs with high assets under management (AUM) would increase more and more over time, up to a point where these ETFs would dominate the entire European ETF industry.

On the other hand, the European ETF industry is very innovative and widens its product offerings permanently, enabling existing clients and new investors to participate in new asset classes and rising trends in the markets, which should lead to inflows into these new ETFs and the European ETF industry as a whole.

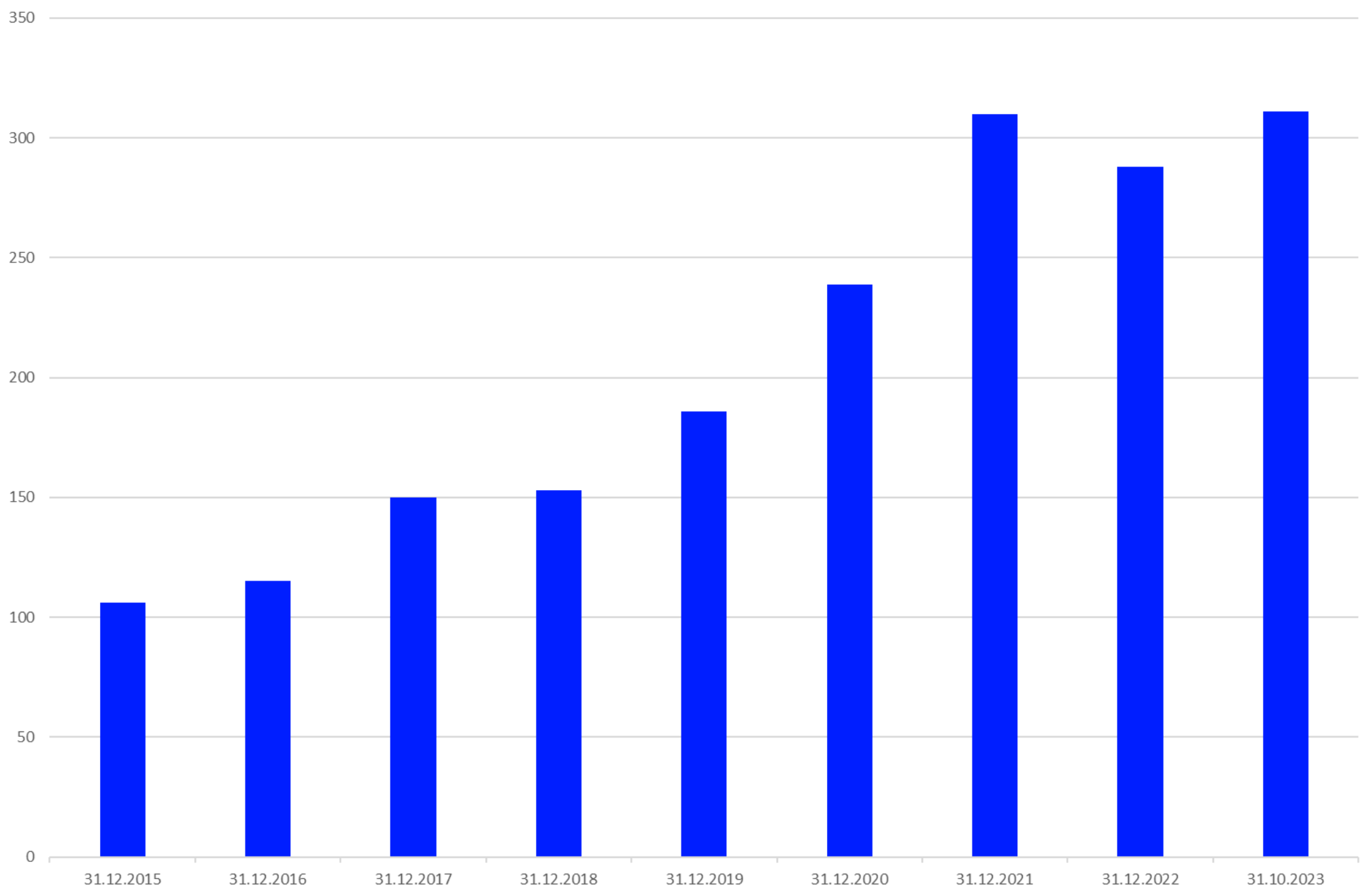

Chart 1: Number of ETFs with more than €1bn AUM (31 December 2015-31 October 2023)

Source: LSEG Lipper

Chart 1 shows the number of ETFs with over €1bn AUM has significantly increased since 2015. This increase can be explained by the rising popularity of ETFs launched during this period.

The core asset classes such as equity US, equity global, equity Europe, equity emerging markets global or US government bond have profited the most from this trend.

This is because these asset classes normally comprise a large share of the portfolios of all kinds of investors. Within these asset classes, ETFs that already had large AUM have profited the most since these products have enough capacity for institutional investors and, because of their size, high liquidity with low trading spreads.

But besides these established ETFs, there are also a number of newly-launched products that have been able to gather more than €1bn AUM as well.

This has driven the overall number of ETFs with more than €1bn AUM from 106 in 2015 to 311.

Compared to the overall number of ETFs registered for sales in Europe the market share of these products grew from 7.1% to 16.1%, as at the end of October.

More important in helping measure the concentration within the European ETF industry is a view of AUM. The overall AUM held by these ETFs is €1.1trn, up from €261bn in 2015.

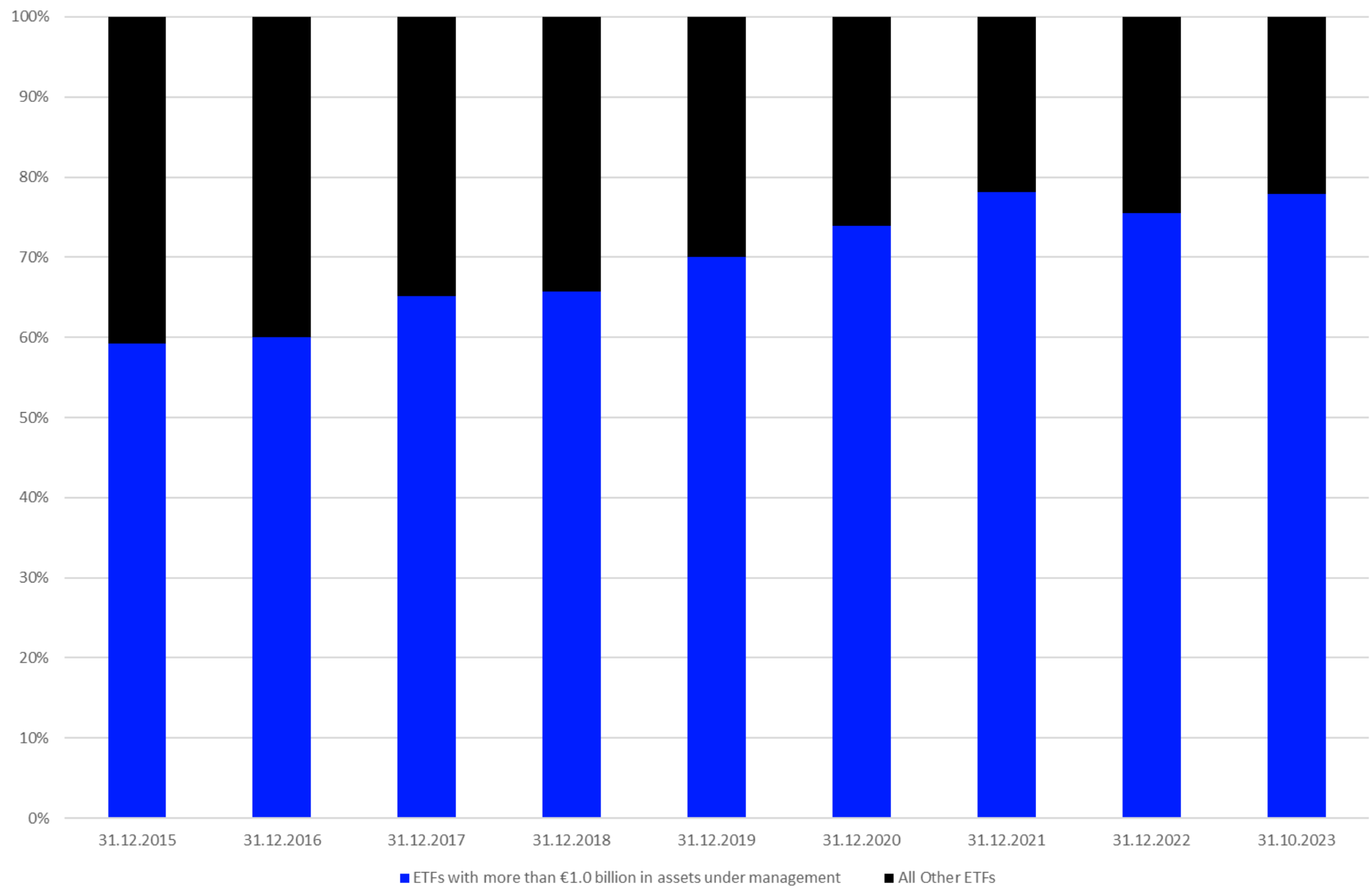

Chart 2: Market share of the overall AUM of ETFs with more than €1bn versus all other ETFs in the European ETF industry

Source: LSEG Lipper

As shown by Chart 2, the market share of the ETFs with over €1bn AUM grew from 59.2% in 2015 to 77.9% by October this year.

These numbers show that the European ETF industry is dominated by a relatively small number of ETFs.

Nevertheless, these numbers also show that the European ETF industry is still competitive as newly launched ETFs have the chance to gather significant assets.

Such a market concentration can be seen as a threat to overall competition in the industry and should therefore be seen as critical.

Finally, ETF growth in Europe shows issuers want to remain competitive. Even if the industry is quite concentrated, some of these new products will be able to become “blockbuster” products themselves.

Time will tell whether all these new products are really needed and necessary, but for the time being there is quite lively competition between European ETF issuers.

Detlef Glow is head of Lipper EMEA research at Refinitiv, an LSEG business