This marketing communication is for professional investors only. Investors should read the legal documents prior to investing.

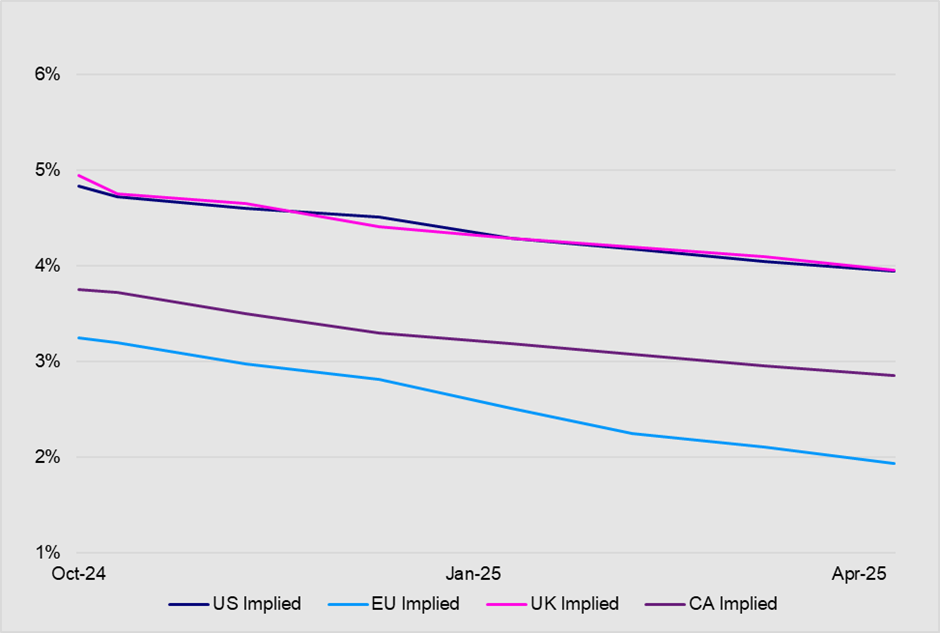

While the ECB and Bank of Canada were first out of the blocks to cut interest rates in early June, followed by the Bank of England, the Fed’s outsized 50 basis point reduction in September was when the race got interesting. Indeed, the Fed indicated that they would need to cut rates more quickly and more deeply than previously anticipated to fulfil their dual mandate. Importantly, while economic data remains mixed, most western central banks are indicating their focus has switched from needing tight policy to reduce inflation to easing rates to less restrictive levels to support growth. Therefore, with more rate cuts expected in the coming months and in 2025 pushing government bond yields lower, we consider where bond investors may want to look for higher yields while balancing the risks involved.

Interest rates expected to move lower

Sources: Bloomberg, implied based rates, as at 23 October 2024

Duration versus credit risk?

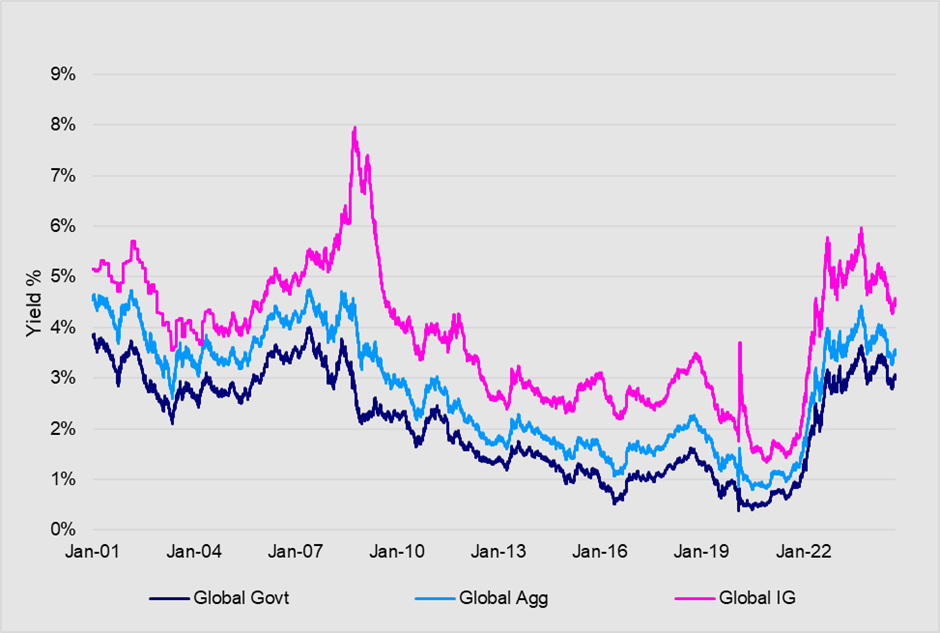

Investors searching for higher yield often have to decide whether taking on more interest rate risk by extending duration or taking on more credit risk by going into lower quality bonds is the more attractive option. Investors haven’t really had any incentive to take on credit risk since the Fed started raising rates in March 2022 as inflation ran out of control. The tightening cycle drove yields on low-risk government bonds to attractive levels, which made credit markets relatively less attractive than they had been when yields hit record lows during the pandemic.

Now, however, with government bond yields destined to move lower over the next year, as central banks continue to ease, investment-grade credit could look more attractive to investors wanting to maintain a higher quality bias.

Historical yields of global benchmarks

Source: Bloomberg, as at 23 October 2024

Although yield curves are likely to steepen as rates are cut, longer duration should be more favourable in an easing cycle. Whether investors are incentivised to take on more duration risk really depends on the evolution of the yield curve and the economic outlook. Investors can increase duration by moving further out the yield curve on their government bond holdings or through broad funds.

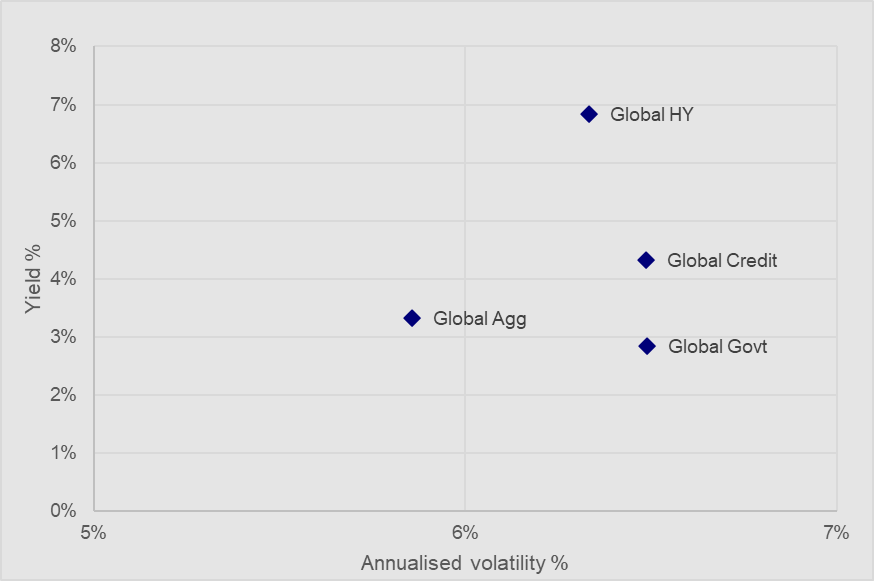

Current yield and duration profiles

Source: Bloomberg, as at 23 October 2024

As could be anticipated, the global investment grade credit market offers a pick-up in yield over global government bonds but, perhaps surprisingly, with a comparable level of volatility. It also provides investors greater diversification compared to single currency credit exposures because it includes a broader range of issuers from different countries and in different currencies.

Gaining exposure to global investment grade

The Invesco Global Corporate Bond ESG UCITS ETF may be worth considering if you’re looking for global exposure to investment grade credit markets that incorporates ESG into the selection and weighting methodology. The ETF follows an index that seeks to increase overall exposure to those issuers demonstrating a robust ESG profile. The ETF is classified as an Article 8 fund under the EU’s SFDR framework. It was launched in April this year and has already accumulated US$280 million of assets under management.

Any investment decision should take into account all the characteristics of the fund as described in the legal documents. For sustainability related aspects, please refer to www.invescomanagementcompany.ie/dub-manco.

Index methodology: The index applies both exclusions and ESG tilting. Securities are excluded if they have an MSCI ESG rating below BBB (or do not have an MSCI ESG rating), have faced very severe controversies pertaining to ESG issues over the last three years (or do not have an MSCI ESG Controversy Score), are involved in alcohol, adult entertainment, controversial weapons, conventional weapons, GMOs, firearms, nuclear weapons, nuclear power, oil sands, thermal coal, tobacco, unconventional oil, gas, gambling and fossil fuels, or are issued by emerging market issuers.

Each of the eligible component securities is then assigned an ESG score using MSCI ESG metrics. This ESG Score is then applied to tilt allocations compared to their market values in the Global Aggregate Corporate Index, along with limiting the market value weight of issuers to a cap of 5%. The index rebalances monthly.

Investment risks – for more information, please see below. For complete information on risks, refer to the legal documents. An investment in these funds is an acquisition of units in a passively managed, index tracking fund rather than in the underlying assets owned by the fund. Applies to all: Value fluctuation, credit risk, interest rates, securities lending, environmental, social and governance, concentration risk, currency hedging.

Other options for investors with more risk appetite

For even greater yield, investors have a variety of options available. This includes traditional segments such as high yield and emerging market debt, but also more innovative areas of the market, such as hybrid securities, preferred shares and AT1 capital bonds. These may be worth considering either on their own or as part of a broader diversification strategy.

Economic outlook

The attraction of any of the options discussed are going to be heavily reliant on your risk appetite and views but also how economic conditions develop not only in the US but also in Europe. Today’s markets would appear to be factoring in a scenario whereby central banks are able to manage a slowdown in the economy through conventional means, avoiding a hard landing, while lower borrowing rates support companies. This fairly benign outlook should benefit corporate bond investments including higher yielding segments of the market.

Should conditions deteriorate beyond what is currently expected, however, we acknowledge that many investors will find the environment for corporate bonds less attractive although it should see credit spreads widen to compensate investors for the additional risk. Uncertainty is another reason for investors to favour broad global exposure to higher quality corporate bonds.

Investment risks

For complete information on risks, refer to the legal documents.

Value fluctuation: The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Credit risk: The creditworthiness of the debt the Fund is exposed to may weaken and result in fluctuations in the value of the Fund. There is no guarantee the issuers of debt will repay the interest and capital on the redemption date. The risk is higher when the Fund is exposed to high yield debt securities.

Interest rates: Changes in interest rates will result in fluctuations in the value of the fund.

Securities lending: The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

Environmental, social and governance: The Fund intends to invest in securities of issuers that manage their ESG exposures better relative to their peers. This may affect the Fund’s exposure to certain issuers and cause the Fund to forego certain investment opportunities. The Fund may perform differently to other funds, including underperforming other funds that do not seek to invest in securities of issuers based on their ESG ratings.

Concentration: The Fund might be concentrated in a specific region or sector or be exposed to a limited number of positions, which might result in greater fluctuations in the value of the Fund than for a fund that is more diversified.

Currency hedging: Currency hedging between the base currency of the Fund and the currency of the share class may not completely eliminate the currency risk between those two currencies and may affect the performance of the share class.

Important information

This marketing communication is exclusively for use by professional investors in Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the UK. It is not intended for and should not be distributed to the public.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change.

For information on our funds and the relevant risks, refer to the Key Information Documents/Key Investor Information Documents (local languages) and Prospectus (English, French, German), and the financial reports, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements.

UCITS ETF’s units / shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units / shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units / shares and may receive less than the current net asset value when selling them. For the full objectives and investment policy please consult the current prospectus.

Index: “Bloomberg®” and the Bloomberg MSCI Global Liquid Corporate ESG Weighted SRI Sustainable Bond Index (the “Index”) are trademarks or service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Index (collectively, “Bloomberg”) and/or one or more third-party providers (each such provider, a “Third-Party Provider,”) and have been licensed for use for certain purposes to Invesco (the “Licensee”). To the extent a Third-Party Provider contributes intellectual property in connection with the Index, such third- party products, company names and logos are trademarks or service marks, and remain the property, of such Third-Party Provider. Bloomberg is not affiliated with the Licensee or a Third-Party Provider, and Bloomberg does not approve, endorse, review, or recommend the Invesco Global Corporate Bond ESG UCITS ETF (the “Financial Product”). Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Index or the Financial Product.

Issued by Invesco Investment Management Limited, Ground Floor, 2 Cumberland Place, Fenian Street, Dublin 2, Ireland, regulated by the Central Bank of Ireland.

Belgium: This product is offered in Belgium under the Public Offer Exemption. This material is intended only for professional investors and may not be used for any other purpose nor passed on to any other investor in Belgium. Switzerland: Issued by Invesco Asset Management (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland. The representative and paying agent in Switzerland is BNP PARIBAS, Paris, Zurich Branch, Selnaustrasse 16 8002 Zürich. The Prospectus, Key Information Document, and financial reports may be obtained free of charge from the Representative. The ETFs are domiciled in Ireland. Germany: German investors may obtain the offering documents free of charge in paper or electronic form from the issuer or from the German information agent (Marcard, Stein & Co AG, Ballindamm 36, 20095 Hamburg, Germany). Italy: The publication of the supplement in Italy does not imply any judgment by CONSOB on an investment in a product. The list of products listed in Italy, and the offering documents for and the supplement of each product are available: (i) at etf.invesco.com (along with the audited annual report and the unaudited half-year reports); and (ii) on the website of the Italian Stock Exchange borsaitaliana.it.

EMEA 3888176/2024