BlackRock Australia is gutting the fee on its flagship ETF, the iShares Core S&P/ASX 200 ETF (IOZ).

IOZ, which contains a massive $1.2 billion assets under management, will see its fee dropped from 0.15% down to 0.09% as of today.

The cut represents a 40% discount and will require BlackRock to give up almost $800,000 in annual revenue.

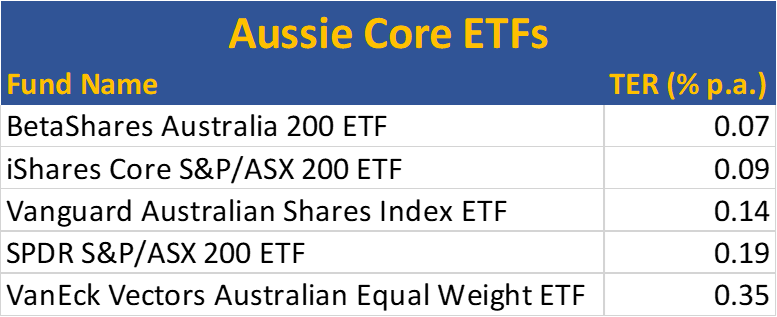

The new price makes IOZ the second cheapest Australia share ETF and brings the fund within striking distance of the cheapest, BetaShares Australia 200 ETF (A200), which charges 0.07%.

“IOZ is part of the iShares “Core Series” designed to serve as long-term, cost-effective building blocks in investors’ portfolios. This change is part of the regular review of our pricing strategy, reflecting our continued growth and ability to leverage our scale for the benefits of clients,” Christian Obrist, boss of iShares Australia, said in a statement.

The fee cuts come at an important moment.

ASX data increasingly suggests that the lion’s share of ETF money is flowing into the funds that charge the lowest fees. This is reflected in the declining asset weighted average ETF fee, which has fallen from 0.31% in January 2014 down to 0.26% in May 2019.

But perhaps more crucially, the IOZ fee cut comes as BetaShares’ A200 continues its blitzkrieg through the ETF heartland.

Related: BetaShares shirtfronts Vanguard

A200 was built as a challenge to the big three ETF providers: BlackRock, State Street and Vanguard. It did the same thing their flagship ETFs did: provided cheap market-weighted exposure to the Australian share market. And had the same sales strategy: as a core building block in “model portfolios”, targeting advisors and planners.

It constituted a rare example of a small local ETF provider sounding the battle horn against the big three.

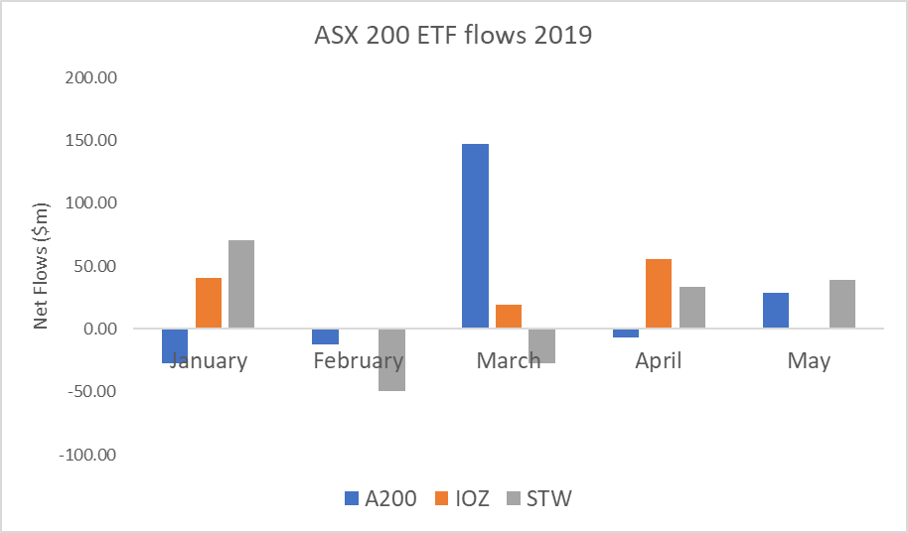

Source: ASX, ETF Stream

Despite listing a mere 13 months ago, A200 has sucked up almost $500M in assets – a record haul and at lightning speed. Industry sources suggest A200's success owes partly to its cannibalising the assets of ASX 200 ETFs.

“The decision… is not surprising. [BlackRock] simply has to respond to competitive pressures, specifically from… BetaShares,’ said Harry Chemay, boss of Clover, a Melbourne-based robo-advisor.

“The move is also a recognition among advisers and retail investors alike that when it comes to market cap-weighted ETFs, the management fee should be a material consideration, alongside the choice of index used and the ETF’s liquidity.”

“The pricing pressure on these Beta-1 products will continue to escalate, if the US is any guide.”

iShares Core ETFsFund NameMER (% p.a.)iShares Core MSCI World All Cap AUD Hedged ETF0.12iShares Core MSCI World All Cap ETF0.09iShares Core Cash ETF0.09iShares Core Composite Bond ETF0.20iShares Core Global Corporate Bond (AUD Hedged) ETF0.26iShares Core S&P/ASX 200 ETF0.09

The fee cut has the potential to leave State Street and Vanguard in awkward positions.

The cut leaves Vanguard, primus inter pares fee-cutter by reputation, as one of the most expensive providers of core Aussie exposure. At 0.14%, the Vanguard Australia Shares ETF (VAS) is double the price of A200 and now two-thirds more expensive than IOZ.

State Street, which depends heavily on its ASX 200 fund, STW, for revenue, will face mounting pressure for additional fee cuts. State Street has repeatedly refused to cut its fees the past several years, only to witness its market share shrivel like a grape in summer sun.

But for BlackRock the cuts will likely add a competitive edge to IOZ and make its model portfolios an all the more compelling proposition.