Olivier Paquier, head of ETF distribution EMEA at J.P. Morgan Asset Management (JPMAM), has stressed the “paramount” importance of portfolio construction and the role active ETFs have to play in the current macroeconomic environment.

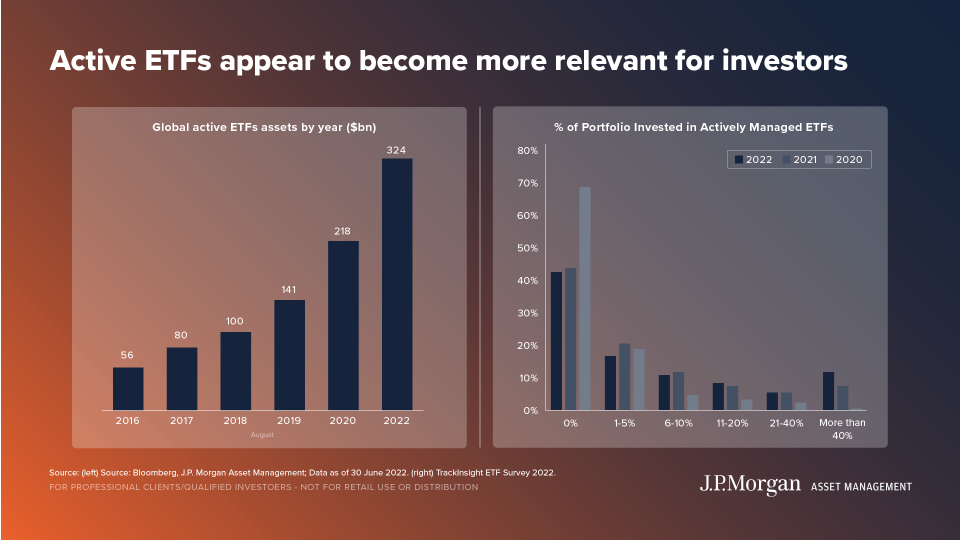

Speaking to ETF Stream, Paquier pointed to the significant growth in demand for active ETFs over the past few years with global assets under management (AUM) rising to $324bn by the end of June, up from $56bn in 2016, according to data from Bloomberg.

Furthermore, an investor survey conducted by TrackInsight earlier this year found over 50% of respondents have an allocation to actively-managed ETFs, a significant increase from the previous two years.

In particular, Paquier highlighted four reasons why investors are increasingly allocating to active ETFs within their portfolios.

1. Passive replacement“Investors have been using index-tracking ETFs and are disappointed with either the cost or underperformance and are switching to active capabilities through an ETF wrapper instead of moving back to a mutual fund”2. Active for active“Investors are replacing an underperforming active mutual fund with an active ETF in order to reposition their convictions through an easier wrapper”3. Risk management tool“Investors are simply holding active ETFs as a transparent risk management tool”4. Diversification tool“Through our REI ETF range, we feel we offer something that does not currently exist in the ETF market in Europe, in terms of combining the best of active and passive.”

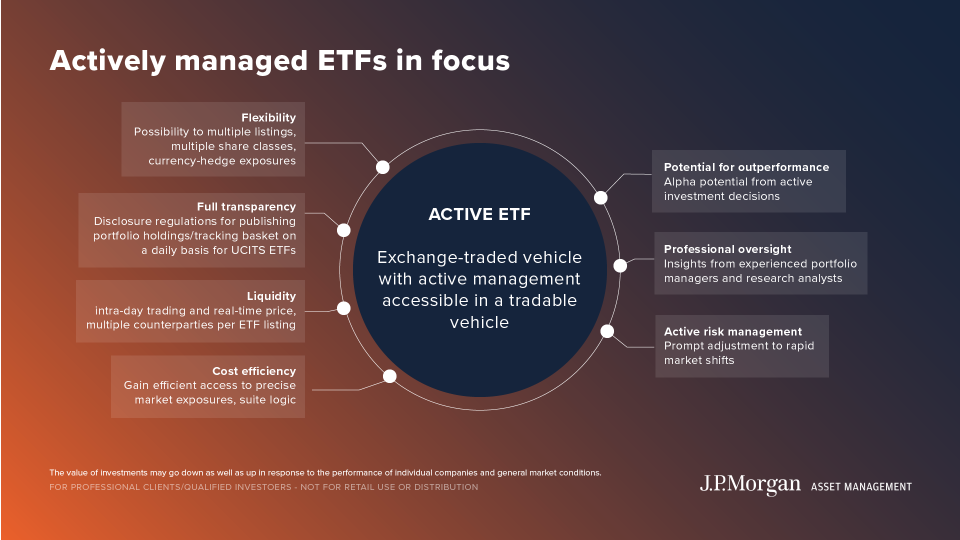

“ETFs can be active as they are purely an investment engine,” Paquier continued. “It is part of the natural evolution of ETFs. If simplicity, tradability, liquidity and transparency are kept as key features of ETFs, I do not see anything that stops ETF issuers from offering active capabilities.”

In Europe, JPMAM offers both active and passive ETFs. One question he said the firm receives a lot from investors is around active and passive implementation. For Paquier, choosingwhich market to employ an active strategy is a matter of efficiency.

Taking emerging markets as an example, he said there can be many discrepancies and opportunities for active managers because the market is far less efficient than others such as the US.

“The governance component of ESG makes a big difference in emerging markets because there is a big divergence in the way companies are managed, for example,” Paquier stressed.

“There are very few markets that are extremely efficient over the long term. Since the pandemic, investors have learned they need to be flexible, adaptable and agile with their portfolios. The ETF wrapper is particularly well suited in this new era of investing whether passive or active.”

Elsewhere, Paquier said now is the right time for active management for two reasons; the short term and the long term horizons. In the short term, because market conditions are so “complex” at the moment, he stressed the importance of employing active managers to guide investors through the challenges of high inflation, rising recession risks and low valuations.

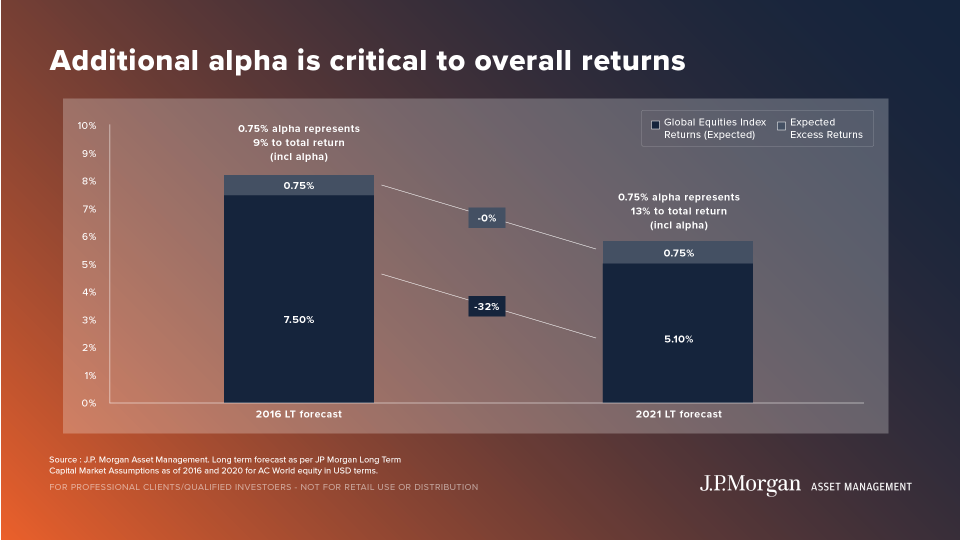

While over the long term, he pointed to return forecasts from J.P. Morgan AM which expects global equities to return 5.1% per annum over the next decade at the end of 2021, down from 7.5% in 2016. “There is a need for alpha generation,” Paquier continued.

“Selecting the right approach and the right ETF issuer makes a paramount difference, especially in the active ETF space.”

Industry Interviews is a series where ETF Stream and its partners analyse some of the key trends from across the European ETF market

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.