As fears of a no-deal Brexit escalated over the summer, the value of the pound against the US dollar, yen and euro fell significantly between March and August of this year however, a confident Boris Johnson stepping in as Prime Minister has increased the confidence in a deal being implemented as well as strengthening the pound.

Johnson assumed office on 24 July and shortly after resulted in long sterling currency ETFs bounce back in the following three months, rectifying any losses made in H1 2019.

While the current state of Brexit is improving the UK's domestic currency, it has recently had mixed results on its domestic equity ETFs.

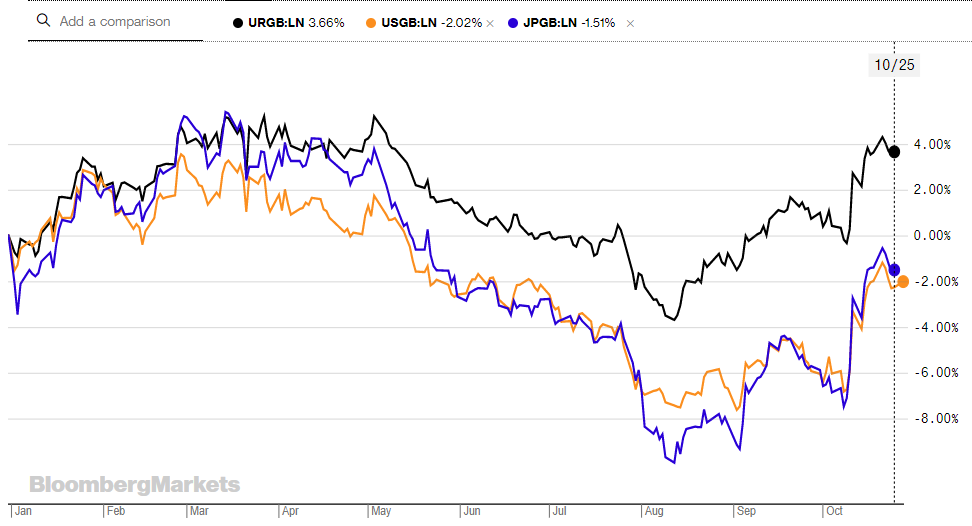

The WisdomTree Short USD Long GBP ETF (USGB), as the name suggests, tracks the performance of sterling against the US dollar by shorting the USD/GBP exchange rate.

It has been one of the best performing currency ETFs for October, climbing 4.4% between the beginning of the month and 24 October. This has boosted its three-month return to 1.9%.

USGB’s return for the month is second to its long sterling-short yen counterpart, the WisdomTree Short JPY Long GBP (JPGB), which saw its net asset value rise 5.4% over the same period and similarly elevated its three-month return to 2.4%.

ETFs can reduce your currency risk

In comparison with the GBP/USD exchange rate, the GBP/EUR has been less volatile and has resulted in the WisdomTree Short EUR Long GBP (URGB) offering positive returns for most of the year.

URGB has produced similar returns across its month-to-date, three month and year-to-date time frames, having produced returns of 3.2%, 3.4% and 3.6%, respectively.

USGB (Yellow), JPGB (Blue) and URGB (Black) YTD returns – Source: Bloomberg