Companies will exhaust the remaining carbon budget to stay within the Paris Agreement’s target 1.5°C temperature rise by 2027, according to research conducted by MSCI.

The index provider’s Net-Zero Tracker said this timeline has extended by three months since their previous estimate last October, to February 2027.

However, this is a far cry from the Paris Agreement’s goals which target a 1.5°C temperature rise and a no more than 2°C increase in the coming decades.

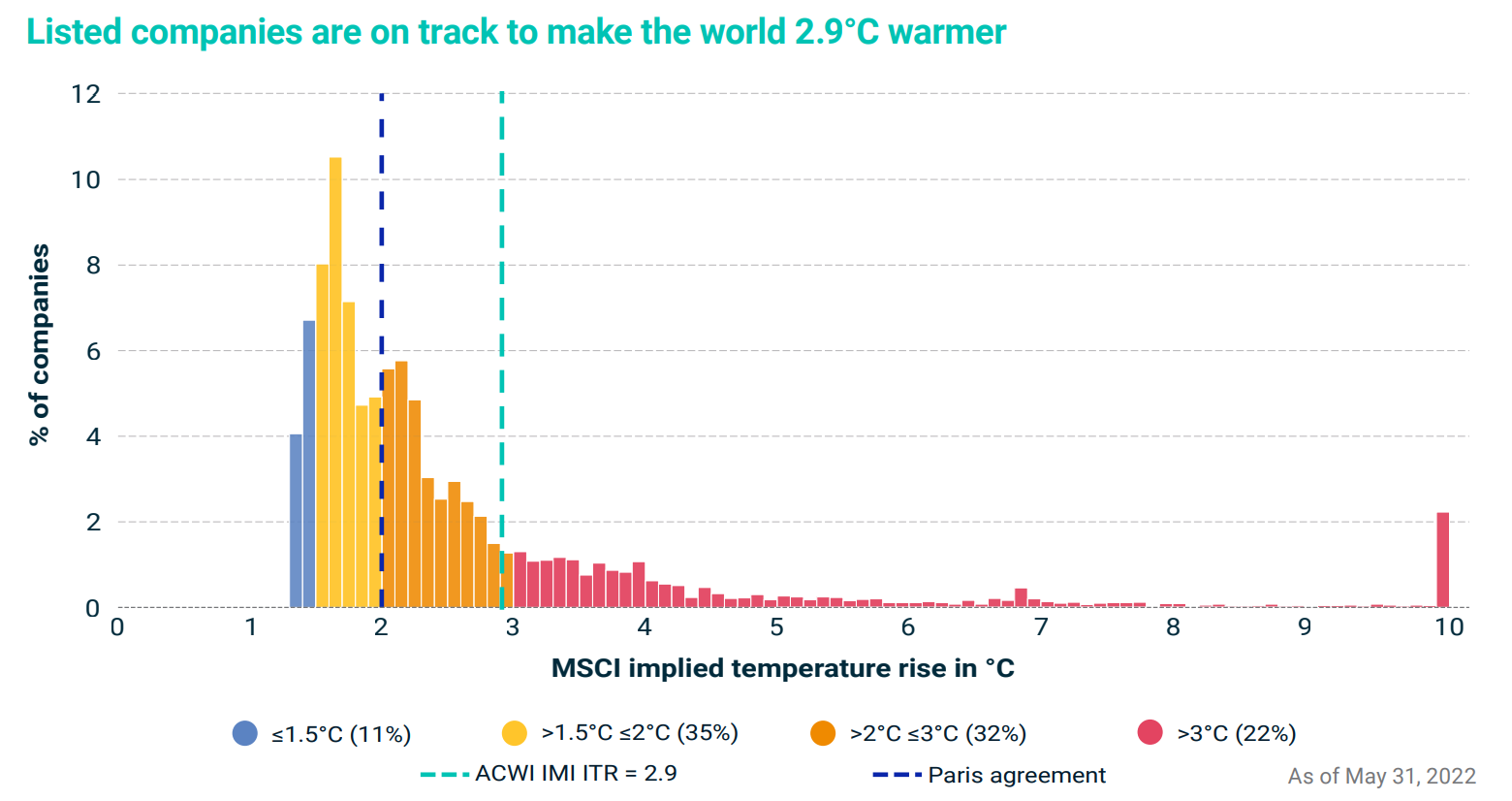

Instead, current and implied emissions of listed companies would suggest a 2.9°C increase, with only 46% on track for 2°C warming and 11% aligned with the hopeful Paris 1.5°C target.

Source: MSCI

This is not confined to energy, materials and utilities. Though these are the highest-emitting, MSCI said “all but a handful” of industries are misaligned, with food and beverage on track for a 2.7°C increase while semiconductors are on course for a 2.4°C rise.

To have a chance of keeping the temperature increase within 1.5°C, greenhouse gas emissions would have to peak by 2025 “at the latest”, drop 43% by 2030 and hit net-zero by 2050, according to the IPCC.

MSCI estimated listed companies would have to cut their carbon intensity by an average of eight to ten percent a year between now and 2050 to achieve net-zero.

Emissions from listed companies are still down 5.6% from their pre-pandemic highs and interestingly, 39% of the MSCI ACWI IMI reduced their emission intensity by enough to align with net-zero goals during the two years to the end of 2020.

Company emissions then shot up 7% in 2021 during the economic reopening period, though inflation, interest rate hikes and supply chain issues could mean emissions rise by only 0.7% this year.

On a company-by-company level, there is still a lot of work to be done on reporting. Eight of 10 of the largest companies not reporting their emissions are energy or industrial players from the US and China, with one of the remaining two out of the top ten being US conglomerate Berkshire Hathaway.

In terms of the leaders on reporting, these companies tended to come from the US, France and Japan, with implied temperature increases of between 1.3°C and 2.1°C, annual emissions reduction targets of three to six percent and all with 100% comprehensiveness on emissions reporting, MSCI said.

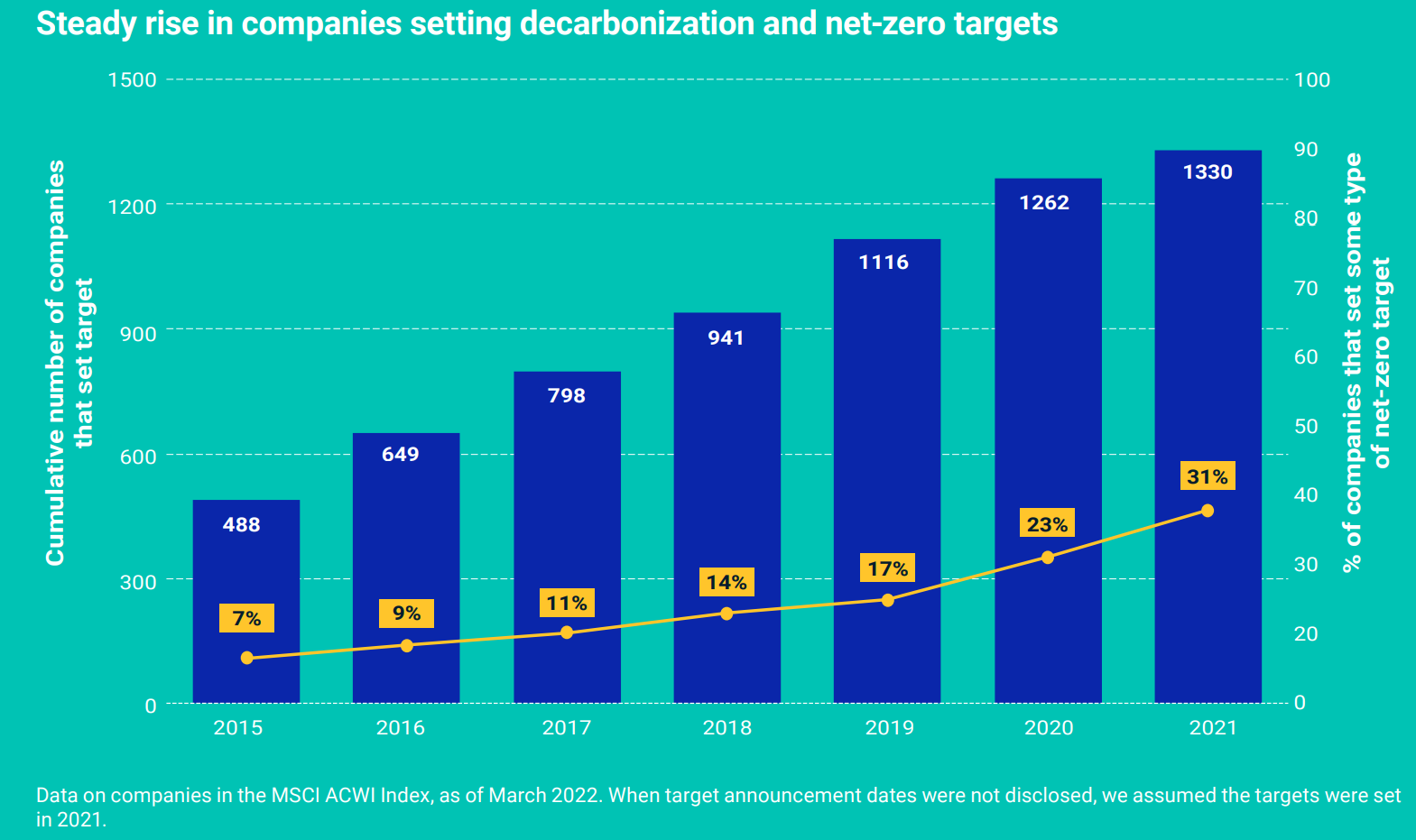

Source: MSCI

Interestingly, emissions targets and comprehensiveness factor in Scope 1 and 2 reported emissions and Scope 3 estimates. It is worth keeping an ongoing eye on the latter in particular, given there will not only be overlaps with other emissions scopes but it is currently a daunting task trying to estimate Scope 3 with the degree of granularity required.

MSCI also warned the current scramble for fossil fuels amid Russia’s invasion of Ukraine is adding strain to the already narrow window to mitigate the worst effects of a changing climate.

It added Saudi Aramco’s standing as the world’s most valuable company and the listed company with the largest carbon footprint suggests valuations still reflect the prospect of future cash flows into fossil fuels.

MSCI concluded: “The findings in this report underscore the importance of mandatory climate disclosures that would equip investors with the data they need to separate climate leaders from laggards and assess which companies may be most likely to thrive in a net-zero economy.

“They also highlight how the global effort to standardise climate transition data holds the potential to help investors and policymakers incentivize action to reduce our reliance on fossil fuels and catalyse the massive investment needed to bring a sustainable energy economy to scale.”

Continued efforts are also needed to hold ESG strategies accountable for their promises of sustainability and relative underperformance on some metrics.

Last year, InfluenceMap found 71% of ESG funds currently fall short of Paris Agreement goals while EDHEC-Risk Institute said only 21% of ESG funds’ weighting considerations are based on E, S and G factors, adding many ESG core ETFs allocate towards the same usual suspect holdings as their non-ESG equivalents.