Attendees of ETF Stream’s flagship ETF Ecosystem Unwrapped 2024 event heard insights from academics and fund selectors on hot-button asset allocation and macro questions, spanning the role of fixed income and crypto, what to make of US equity dominance and whether it is possible to read the tealeaves of central bank policy.

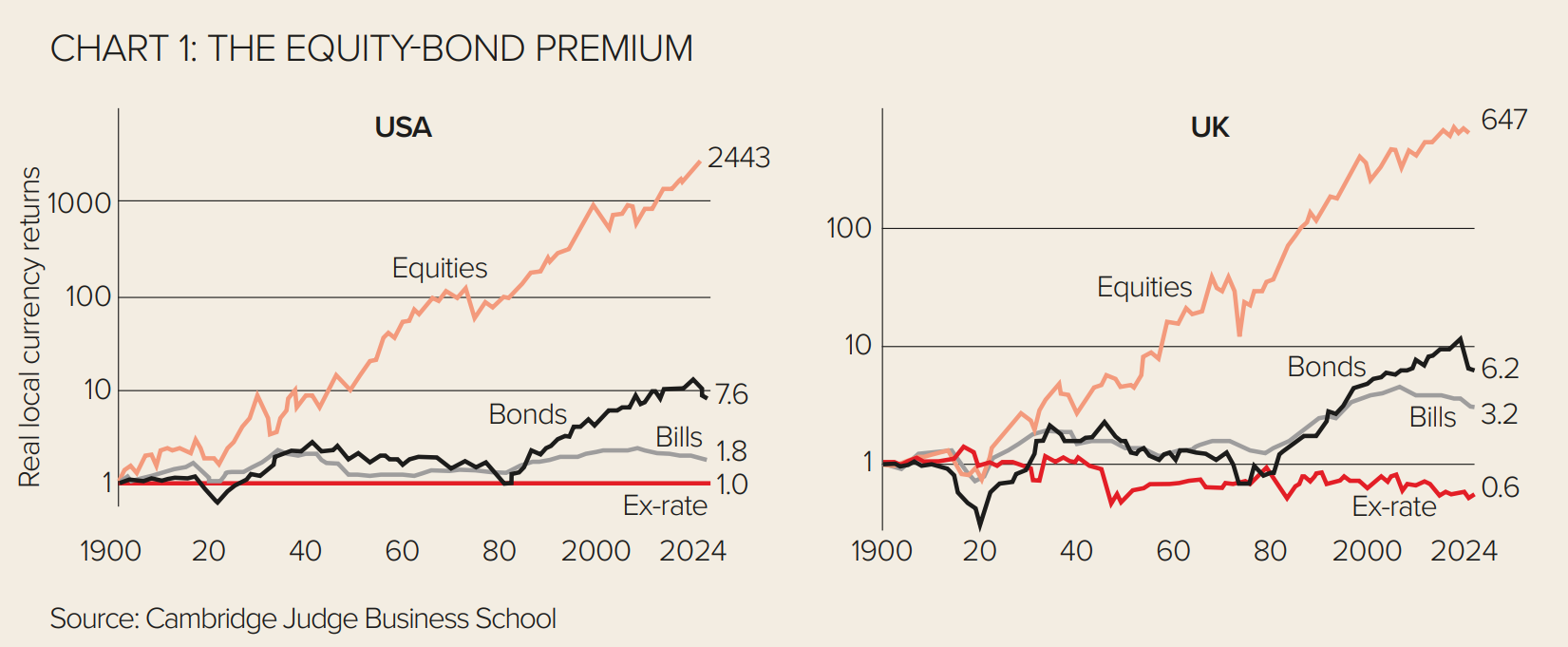

A 244-year equity premium

Elroy Dimson, professor of finance at the Cambridge Judge Business School, reflect[1]ed on research co-authored by himself and other academics, illustrating equities have been able to establish a long-term premium over equivalent government bonds over more than two centuries.

In fact, US equities commanded a 2.4% annual premium over US government bonds between 1800 and 2023, based on inflation-adjusted returns, while this premium rose to 2.7% for UK equities versus UK government bonds over the same period.

“This picture works for any country, with equities giving the highest total return, government bonds are a long way below and Treasury bills are underneath that,” Dimson said.

“Looking at data from 90 countries, the real returns are positive in all of them, meaning they were inflation beaters. If we compare that with government bonds, they did worse on balance but did give you a worthwhile return.”

Dimson added US equity dominance is not a recent phenomenon. In fact, “US stock market returns were exceptional” between 1900 and 2023 – the highest of any single country over the period – but this “may not be repeated in the future”.

He concluded by advising investors to diversify internationally, diversify across asset classes and minimise cost drag.

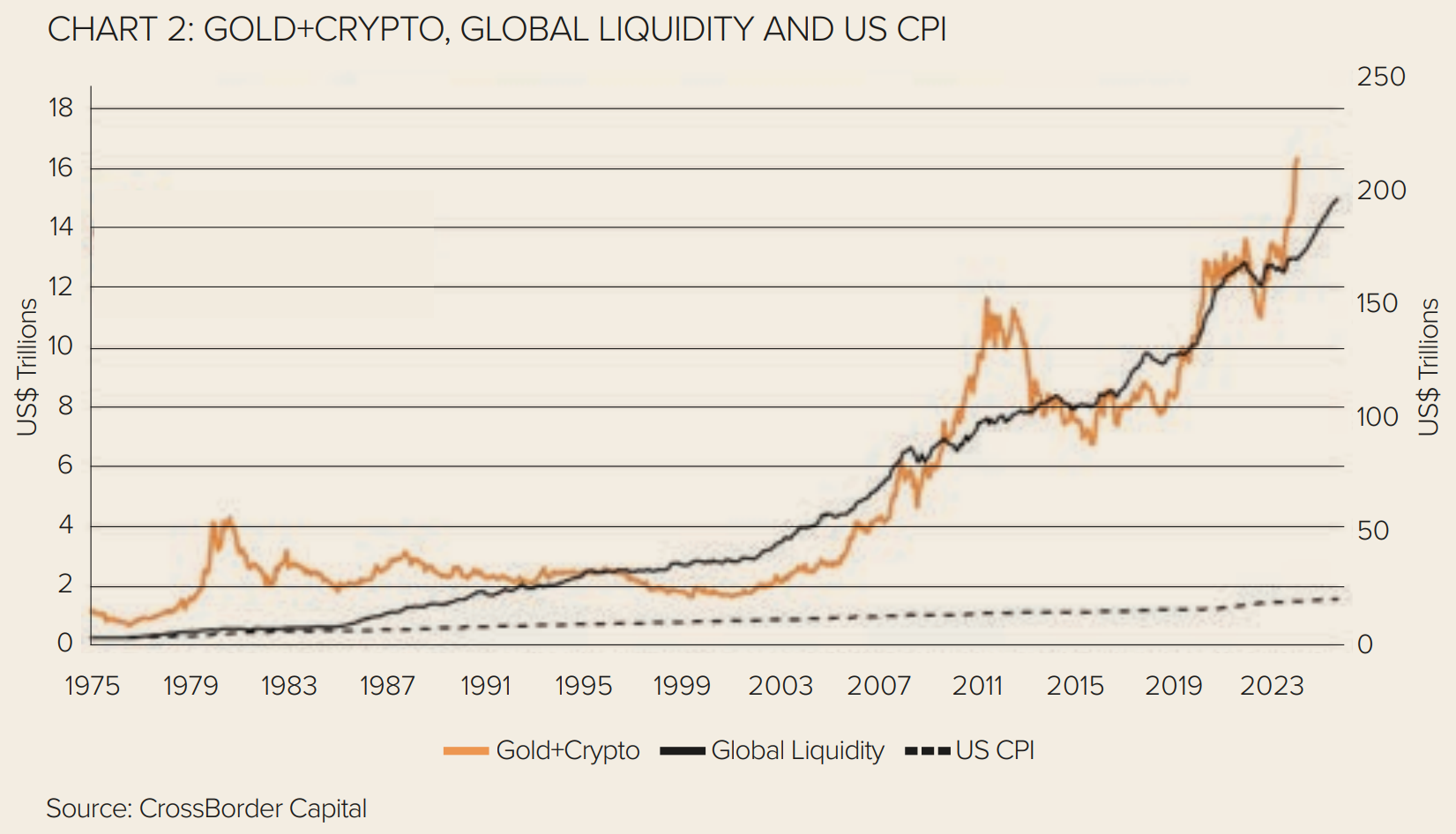

Bitcoin to $250,000

Michael Howell, managing director of Crossborder Capital, predicted bitcoin will breach the $250,000 price mark in the next three years as confidence wanes in the US Treasury market.

Amid continued expansion of the US debt-to-GDP ratio and high inflation, Howell said investors are increasingly appreciating the hedging benefits of bitcoin alongside traditional hedges such as gold.

“Bitcoin in particular is an extremely good hedging tool it tends to have a sensitivity factor, about three times out of gold,” he said.

“People are losing confidence in the US Treasury market. They are moving into alternative assets, alternative safe assets, and they are starting to move into gold and bitcoin.

“I am not advocating crypto per se, all I am saying is it has demonstrably been an extremely good monetary case over the last few years.”

Give up second-guessing the Federal Reserve

Edmund Shing, Global CIO of BNP Paribas Wealth Management, argued nobody can predict the next move of the Federal Reserve and investors should look to “lock in yield” over the next three years as US Treasury spreads tighten.

“We have massive uncertainty in the market, we have an upcoming presidential election and that is going to inject a massive amount of volatility,” Shing said.

“We can talk about what the Fed might or might not do in 2025, but who has a clue? What we do know is volatility is likely to be there, the risk and uncertainty is there. That is why we say to clients, do not try and look through the next six months because your guess is as good as mine, my crystal ball is broken.”

Speaking on the same panel, Dan Scott, head of multi-asset at Vontobel Asset Management, argued the focus on the direction of rates is “distracting”.

“The Fed is playing both sides of the table they could also turn off the stimulus of Treasury purchases through the banking sector, rather than thinking about a rate hike,” he said.

“We have an excess of liquidity sloshing around the system. Roaring Kitty is a very clear example of excess liquidity which highlights where we are on asset pricing, the cracks are appearing.”

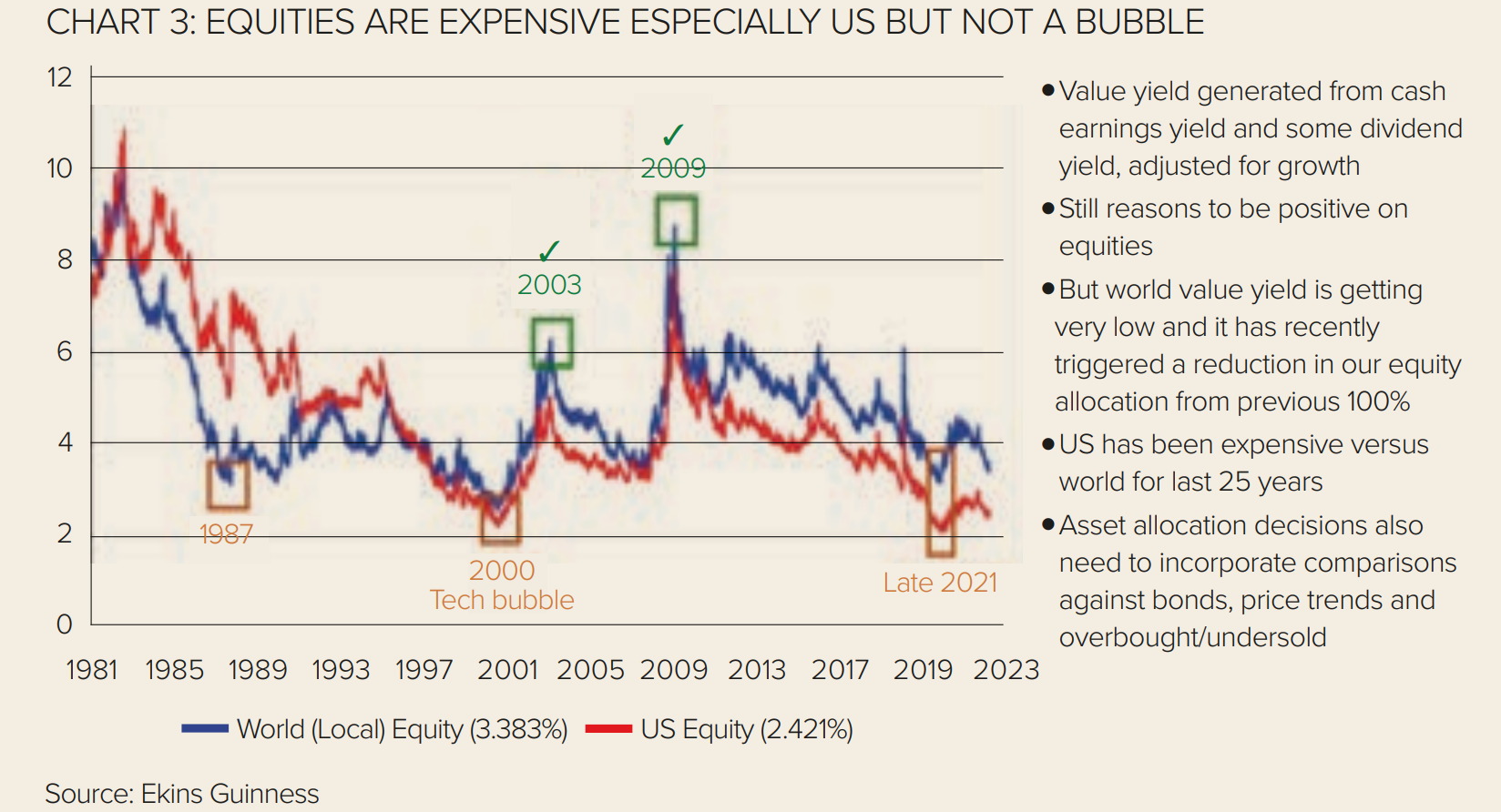

US equities not in a bubble, yet

Finally, a quantitative view of markets addressed the issue of whether US equities are currently in overvalued territory.

Trevor Neil, director of RRG Research, said: “US equities are definitely not in a bubble, but it depends what you mean by bubble. Most of us would agree that the 'dot-com' crash of 2000 was a bubble.

"The US is very strong and it has been going up for years and years. It has been consistently overbought, but that is the nature of a very strong bull market. But anybody who has sold things because they are overbought, there is a graveyard for them.”

Agreeing, Charles Ekins, founder and CIO of Ekins Guiness, said equities “are definitely expensive” and “especially in the US”, but added the US has been “expensive relative to the world for at least 25 years, but it is not a bubble, yet”.

“We have recently come down from being 100% in equities, like we did in late 2021, but we are still overweight in the US.

“The reason we are not too worried about equities right now - even though we have just taken some risk off the table - is because bonds are not really competing. With Treasuries around 4.5%, that is not too much more than inflation,” he said.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.