Myth #1: Thematic investing is easy

Rather than making a subjective and generalised statement about whether thematic investing is ‘easy’ or ‘hard’, we believe it is most helpful to share our approach to thematic investing to convey the rigour of our process.

While there are numerous approaches to thematic investing, depending on the asset manager or investor, we are confident that Global X’s in-depth, research-driven approach meets the challenges of thematic investing head-on, while offering efficient and precise solutions to investors.

In our view, there are broadly three stages to thematic investing, each with several sub-steps:

THEME IDENTIFICATION: identifying a powerful structural theme that is expected to disrupt major segments of the global economy

METHODOLOGY DEVELOPMENT: establishing a repeatable process to accurately and comprehensively identify and weigh the companies well-positioned to benefit from the materialisation of the theme

ONGOING ANALYSIS: constantly monitor the theme to determine how it is evolving over time and adjust as necessary

For theme identification, we start by maintaining a ‘thematic universe’ of approximately 70 themes suggested by financial firms, consulting groups, futurists and other organisations. We evaluate and re-evaluate each of these themes across dozens of dimensions that broadly fall into the categories of conviction, investability and time horizon.

For example, to determine our conviction for a specific theme, we consider assessments of the theme’s total addressable market, how much of that market has already been penetrated, shortand long-term catalysts, and potential pitfalls. If it is a technology-oriented theme, we may further consider the current state of the technology, whether there is a path to profitability, and if there are co-dependencies on the emergence of other technologies, among several other factors.

For investability, we run an analysis of the potential opportunity set of companies with high exposure to the theme, and further evaluate dynamics like upcoming IPOs, private companies, and venture capital trends. Finally, we consider the time horizon of the theme, estimating how quickly the theme may play out, based on historical and anticipated adoption patterns.

After identifying a powerful theme, we move to the methodology development stage. Working with an index provider, we can spend roughly six months fine-tuning an index methodology to create a repeatable process that accurately captures companies that we believe will benefit from the materialisation of a theme.

This requires defining the scope of a theme such as each of the sub-themes that are involved and relevant sectors and industries. It also requires a close examination of potential companies to ensure they meet strict thematic purity levels based on their percentage of revenue or assets. And it further means assessing different weighting schemes, liquidity thresholds, rebalance schedules, and IPO inclusions, to ensure a well-designed and liquid basket.

Once the theme is identified and a methodology developed, ongoing analysis spans the entire lifecycle of a theme, often decades. The goal of this ongoing analysis is to monitor, anticipate and react to potential changes in the theme including changing drivers or risks and an evolving opporand fundamentals and other dynamics that impact the theme’s trajectory.

Our goal at Global X is to make thematic investing as seamless and rewarding for investors as possible. Our diligent approach to theme identification seeks to curate a list of powerful themes for investors.

Our methodology development efforts with index providers seeks to ensure the exposures remain pure and relevant throughout the life cycle of a theme. Additionally, our ongoing analysis and freely available research is designed to optimise our themes over time and assist investors with their own monitoring efforts, so they can make informed decisions about potential entries and exits.

Not all investors and asset managers take the same approach to thematic investing. Indeed, some may opt for a less rigorous approach but in our experience at Global X, thematic investing is anything but easy and we embrace the challenge.

Myth #2: Thematic investors are mostly self-directed retail

The recent attention on certain investment-focused internet message boards and other social media channels highlighted that self-directed retail investors are an active and impactful constituency.

The rise of ETFs, as well as zero-commission trading at many brokerages, has played a meaningful role in levelling the playing field and empowering self-directed retail investors to efficiently access strategies previously limited to sophisticated institutions, including not only thematic investing, but also other areas like alternatives, smart beta/factor investing, currency hedging and more.

There is a common narrative that thematic investing is dominated by self-directed retail investors. This assumption likely stems from the relatability of thematic investing. People often assume that retail investors tend to ‘invest in what they know’ and a theme like electric and autonomous vehicles is likely more familiar to a retail investor who has seen or owns a Tesla, compared to a quantitative investment strategy developed by a team of PhDs.

Myth #3: Thematic is just repackaging the tech sector

Within our thematic classification framework, we identify three categories propelling powerful themes: disruptive technology, people and demographics and physical environment. Indeed, technology plays a major role in thematic investing today as rapid advancements in areas like robotics, fintech, connectivity, and mobility change the way we leverage technologies in our everyday lives. Yet thematic investing is hardly just repackaging the tech sector for several reasons:

SECTOR-AGNOSTIC APPROACH: we believe thematic investing is best conducted when not constrained to a particular sector. Whether a robotics company is classified as industrials, information technology or even health care is irrelevant compared to whether the company is a leader in robotics development.

LOW OVERLAP: even for themes that source more holdings from Information Technology, they tend to share low overlap with technology sector indices. Differences in selection criteria, weighting schemes, small cap vs. large cap allocations, and international exposures contribute to this low overlap.

BEYOND TECH: it is important to recognise that while technology is a major thematic driver it is not the only source of disruption in the global economy. Changing demographics and consumer habits, as well as an evolving relationship with the physical environment, also play major roles in driving certain themes. For example, ageing populations around the world, rebuilding and revitalising US infrastructure and an accelerating movement to legalise cannabis are a few examples where technology is not a major contributor to the disruptive potential of the theme. Therefore, we encourage investors to look beyond technology when considering thematic investments.

Myth #4: Thematic investing encourages chasing ‘shiny objects’ or following popular fads

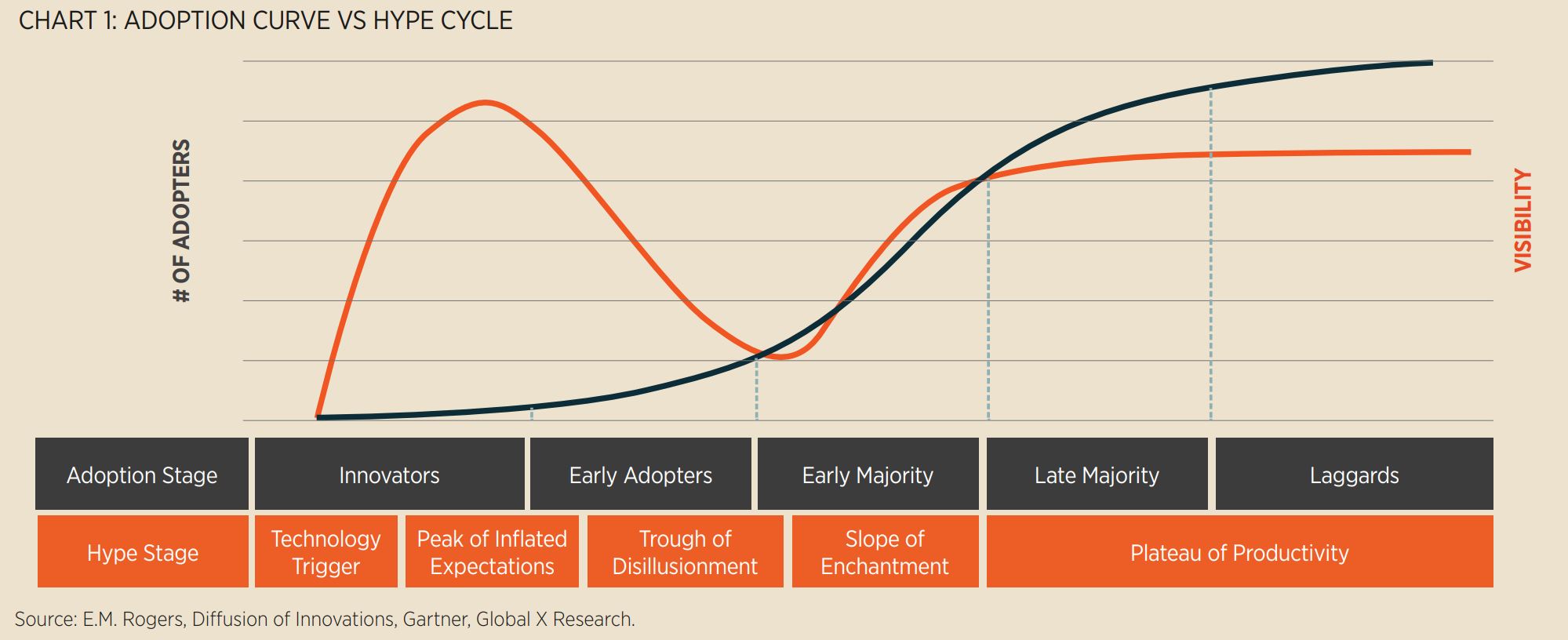

The diffusion of innovations theory, popularised by Professor Everett Rogers, explains how new products or ideas are adopted across a market.

The theory holds that adoption starts slowly among a small group of innovators as an unproven product is tested. As the product improves, innovators share their excitement and the product gains more acceptance, expanding to early adopters. Early adopters further evangelise the product’s benefits and growth accelerates as the mass market, the early majority and late majority, adopt the technology. Finally, the laggards, or the holdouts, eventually adopt the technology as growth tapers.

By contrast, the hype cycle, popularised by the IT research firm Gartner, holds that excitement around new technologies tends to precede actual adoption. As a new technology is developed, it gains outsized visibility as the market fantasies about its potential. Reality tends to settle in, with this visibility normalising with actual adoption patterns over time.

It is important to note that both the diffusion of innovations theory and the hype cycle are theoretical and Chart 1 is purely illustrative. The actual speed, timing, and magnitude of adoption and hype vary product by product.

It is also useful to clarify that hype itself is not necessarily a bad thing or a good thing. A new product receiving lots of attention can still meet or even exceed those expectations. A technology company with outsized media attention does not necessarily make it overvalued. And sometimes hype can even be self-fulfilling in that it brings outsized visibility to certain products, advancing adoption faster than otherwise.

But as it relates to our myth #4, the concept of ‘chasing a shiny object’ implies that thematic investing is predominately a play on the hype cycle. It is true that some investors may be impacted more by media awareness of certain themes than thorough research. Unfortunately, such an approach can lead to several adverse investing behaviours such as taking shorter-term views on themes, chasing themes not validated by thorough research or improperly concentrating on only a small group of popular companies. We do not advocate for this approach to thematic investing.

In our opinion, thematic investing should take a research-driven approach to identifying powerful macro-level trends, accurately target a comprehensive list of companies that stand to benefit from the materialisation of that trend and be implemented over a long time frame to maximise the opportunity to capture its growth potential. It should play the adoption curve, not the hype cycle.

Myth #5: It is too late to invest in certain high growth themes

As mentioned earlier in this piece, thematic investing is a long-term approach to capturing structural disruptions. Therefore, we believe recent high or low performance in individual themes is more often noise than a signal that a theme is ‘too early’ or ‘too late’.

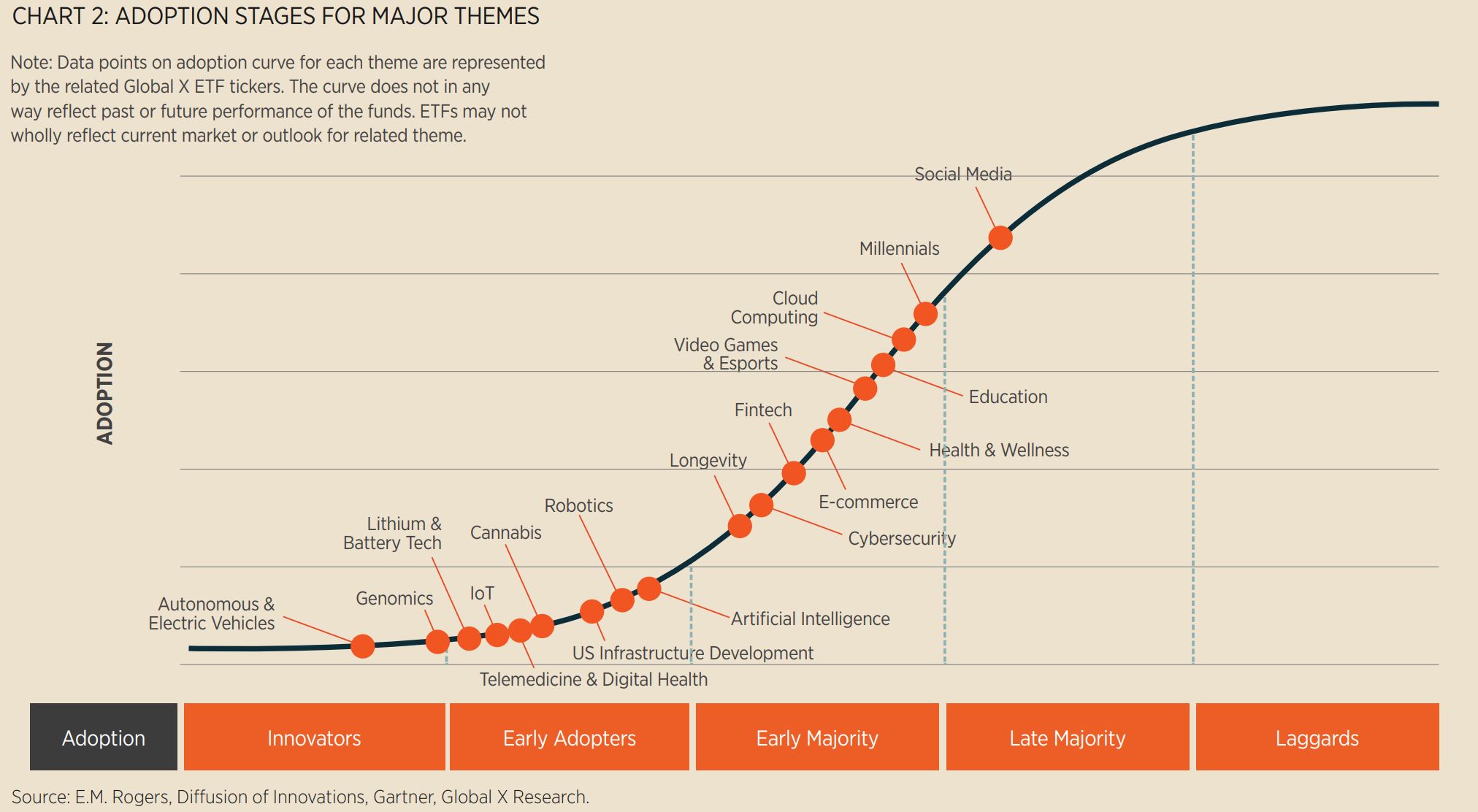

Instead, we prefer to lean on the adoption curve, including estimating the total addressable market for each theme and current levels of penetration. In the chart below, our research team has estimated levels of adoption for each theme using quantitative and qualitative analyses. It is important to note, however, that the total addressable market and the speed of adoption for each theme is not the same (i.e. they will each follow their own adoption curves over time).

In addition, changes in technology, consumer habits, regulations, and other factors can accelerate or decelerate adoption, as well as expand or contract the total addressable market over time, meaning adoption curves and penetration are dynamic by nature.

As you can be seen in Chart 2, many themes are estimated to be in the early majority stage or earlier, suggesting substantial room for future growth, even perhaps despite recent high performance.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.