Entrepreneur and venture capitalist Marc Andreessen famously argued that “software is eating the world”. Some 12 years later, that has proved prescient, although he likely underestimated how narrowly concentrated tech growth would be.

Large software firms like Apple and Microsoft now have outsized weights in index-linked ETFs, driven by price appreciations of 49% and 45%, respectively, this year through July 20. This necessitated a special rebalance of the Nasdaq 100 on 24 July, where the weights of the index constituents had to be redistributed to prevent overconcentration in a few large-cap stocks.

The Nasdaq 100 rebalance should not be viewed as a failure of index design, since indices merely reflect the dynamics of the underlying markets they measure. Instead, the rebalance is symptomatic of two trends. The first is the short-term run-up in prices in 2023 of large-cap tech stocks like Nvidia Corp. due to enthusiasm around artificial intelligence.

The second is a multiyear trend of software-driven businesses accounting for a growing share of the US stock market cap. As of July 20, the information technology GICS sector accounted for a significant 28% of the weight of the iShares Core S&P 500 UCITS ETF (CSPX). This is despite many stocks, formerly classified as IT stocks, having been reclassified into other GICS sectors since 2018. Hypothetically, if we were to “unwind” the GICS classifications changes of the last five years, IT stocks would make up about 38% of SPY’s current exposure.

These trends have resulted in a few stocks having a disproportionately large weight in popular tech-heavy ETFs like the SPDR S&P U.S. Technology Select Sector UCITS ETF (SXLK) and the Invesco EQQQ Nasdaq 100 UCITS ETF (EQQQ).

Nasdaq 100 rebalance

The Nasdaq 100 measures the performance of the 100 largest nonfinancial companies listed on the Nasdaq. On 7 July, Nasdaq announced that the index would undergo a special rebalance to address the overconcentration in a few large-cap stocks.

The index is usually reconstituted annually in December, with additional quarterly rebalancing opportunities. As part of the index methodology, every individual stock must be below a specific weight threshold (20% at quarterly rebalances and 15% at the annual reconstitution). Similarly, stocks with individual weights above 4.5% must have an aggregate weight below specified thresholds.

The goal of the special rebalance in July 2023 was to reapportion some of the weight of the largest constituents to other constituents to meet these weighting threshold requirements.

On 14 July Nasdaq released the pro forma weights, which projected that Microsoft, Nvidia and Alphabet would have the largest reduction in weight, with Apple, Amazon, Meta Platforms and Tesla also likely to have weight reductions. These changes impact the 16 US-listed ETFs tracking the Nasdaq-100 or a derived index, which had $260bn assets, as at 20 July.

Nasdaq 100 concentration of large-cap tech before rebalance

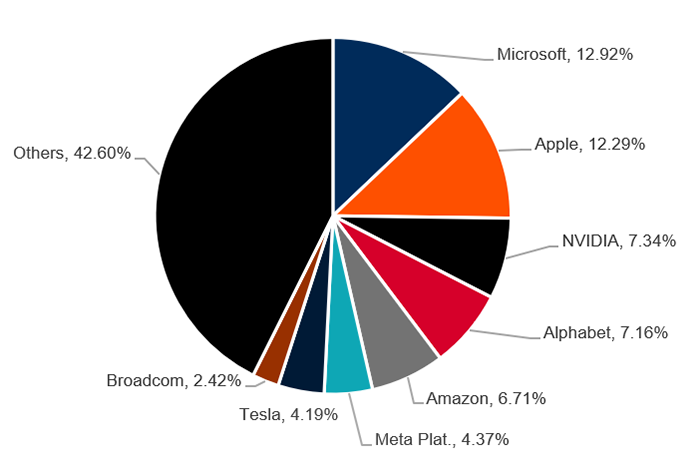

The rapid run-up in prices for stocks like Nvidia, Apple and Microsoft in the first half of 2023 resulted in these stocks having a disproportionally large weight in market indices and the ETFs that track them (see Chart 1).

Narrow-breadth and top-heavy concentration in indices can create challenges for both indexed and active fund managers. Indexed ETFs need to ensure that their funds continue to be diversified, sometimes necessitating rebalances in the underlying indices. Active ETFs, especially those with a high active share (i.e. divergence from the benchmark), may find it more challenging to beat a benchmark where a small set of constituent stocks drive performance.

Chart 1: Top Holdings in QQQ Prior to the Special Rebalance

Source: CFRA ETF Database; Data as of July 20, 2023

However, it can also create an opening to appeal to those investors concerned about market-cap-weighted ETFs being concentrated in potentially overvalued large-cap tech stocks. This segment of investors may look to mitigate that risk by considering “smart beta” ETFs, where stocks are selected and weighted based on fundamental factors. These investors may also consider going down the cap scale by investing in equal-weighted ETFs or in mid-cap and small-cap ETFs.

GICS lens and the Nasdaq 100 rebalance

In his widely read 2011 blog post, Andreessen argued that software had reached the stage of maturity where it could transform entire industries. The evolution of the GICS sector classification framework provides an interesting lens through which to view this growth of tech in investing.

Since 2018, S&P Dow Jones Indices and MSCI, who jointly maintain the GICS framework, have reclassified technology stocks to accommodate their growing role in the broader economy. First, mega-cap stocks like Meta (then called Facebook) and Alphabet were moved from the IT sector to an expanded communication services sector in 2018. More recently, stocks like Visa, Mastercard and PayPal were moved from IT to the financials sector.

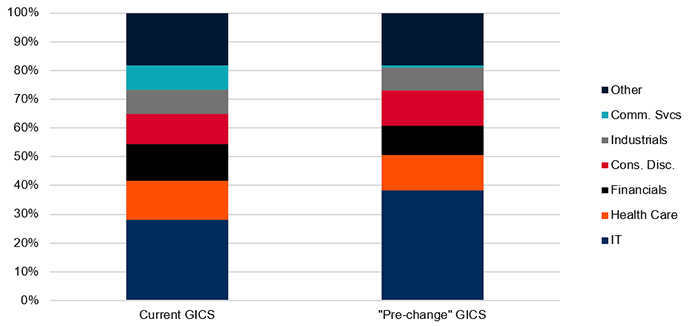

An interesting thought experiment is to ask what aggregate weight IT would have in SPY if these stocks had not been reclassified away from IT. As of 20 July, IT comprised a high 28% of SPY’s exposure.

If we were to “unwind” the reclassifications, IT would make up a staggering 38% of SPY’s exposure (see Chart 2). Stated differently, 38% of the exposure in SPY is from stocks that have at some point been classified into the IT GICS sector. Furthermore, this does not include mega-cap stocks like Amazon and Tesla, which are classified as consumer discretionary but are often viewed by investors as tech stocks.

Chart 2: SPY GICS weights: Actual classification vs hypothetical ‘unwound’ classification

Source: CFRA ETF Database; Data as of July 20, 2023

Such an analysis, however, must be caveated. If these stocks had not been reclassified away from IT, it is possible that the constituent holdings in SPY might have looked different, since sector composition impacts which stocks are added to and deleted from the S&P 500 Index.

Nevertheless, it still provides directional insight into how technology-driven businesses have come to dominate the broader investable universe. As of June 20, 2023, 59% of the exposure in the Communication Services Select Sector SPDR Fund (XLC) and 20% in the Financial Select Sector SPDR Fund (XLF) came from stocks that have at some point been previously classified as IT stocks in the GICS framework. It underscores how software is becoming embedded into the broader economy and how it is “eating the world”.

What the Nasdaq 100 rebalance means for the future

The recent Nasdaq-100 rebalance necessitated by stock concentration underscores how tech stocks have dominated the investable universe, both due to this year’s AI-driven run-up and longer-term software-driven growth.

This creates challenges for indexed ETFs in meeting diversification requirements and active managers in trying to beat the benchmark. However, it could also create opportunities for providers of fundamentally weighted smart beta ETFs and small-cap ETFs, as investors more closely examine their exposure to large-cap tech stocks.

This article was originally published on ETF.com