It has been a challenging start to the year for bond investors. The types of strategy that have performed strongly have been shorter duration, risk-on assets such as high yield and convertibles, whereas faith in the duration trade has not been rewarded, due to expectations for central bank easing being pushed further out into the year.

While markets were ambitious in pricing the turn in the Federal Reserve’s policy cycle quite early in 2024, the strength of the US economic activity data has been a genuine surprise and the Consumer Price Index (CPI) has proved slower to decline than had been expected.

Even in Europe, where moribund growth and CPI data that continue to converge on the European Central Bank’s (ECB) target, creates a strong case for rate cuts, the first cut has been pushed back from March to June.

The compression of credit spreads has provided some protection for investors in investment-grade credit, but any assets with a meaningful amount of duration have struggled as underlying government bond yields have pushed higher. Volatility in returns at the turn in the cycle is not unusual, as the market tries to second guess central banks, which in turn are trying to estimate how growth and inflation are likely to evolve.

A more defensive approach given this uncertain backdrop is to focus on shorter maturity investment-grade strategies. There are several aspects to this:

Higher yields on offer. Investment-grade offers a pick-up to government yields, even at the front end of the curve. For instance the SPDR Bloomberg 0-3 Year Euro Corporate Bond UCITS ETF has an option-adjusted spread to governments of over 75bp. This may not be particularly generous by historical standards, but with outright yields currently high and the curve inverted, there is little additional yield to be harvested by extending out along the curve. This yield is the key driver of total returns in an environment where rates are relatively stable.

Shorter maturity generally equates to a lower duration risk. This means the fund will have a lower sensitivity to any rises in rates. The SPDR Bloomberg 0-3 Year Euro Corporate Bond UCITS ETF has just a third of the duration of the all maturity euro investment-grade ETF. This enables it to better survive swings in the data and changes in market sentiment over the pre-cise timing of an ECB easing.

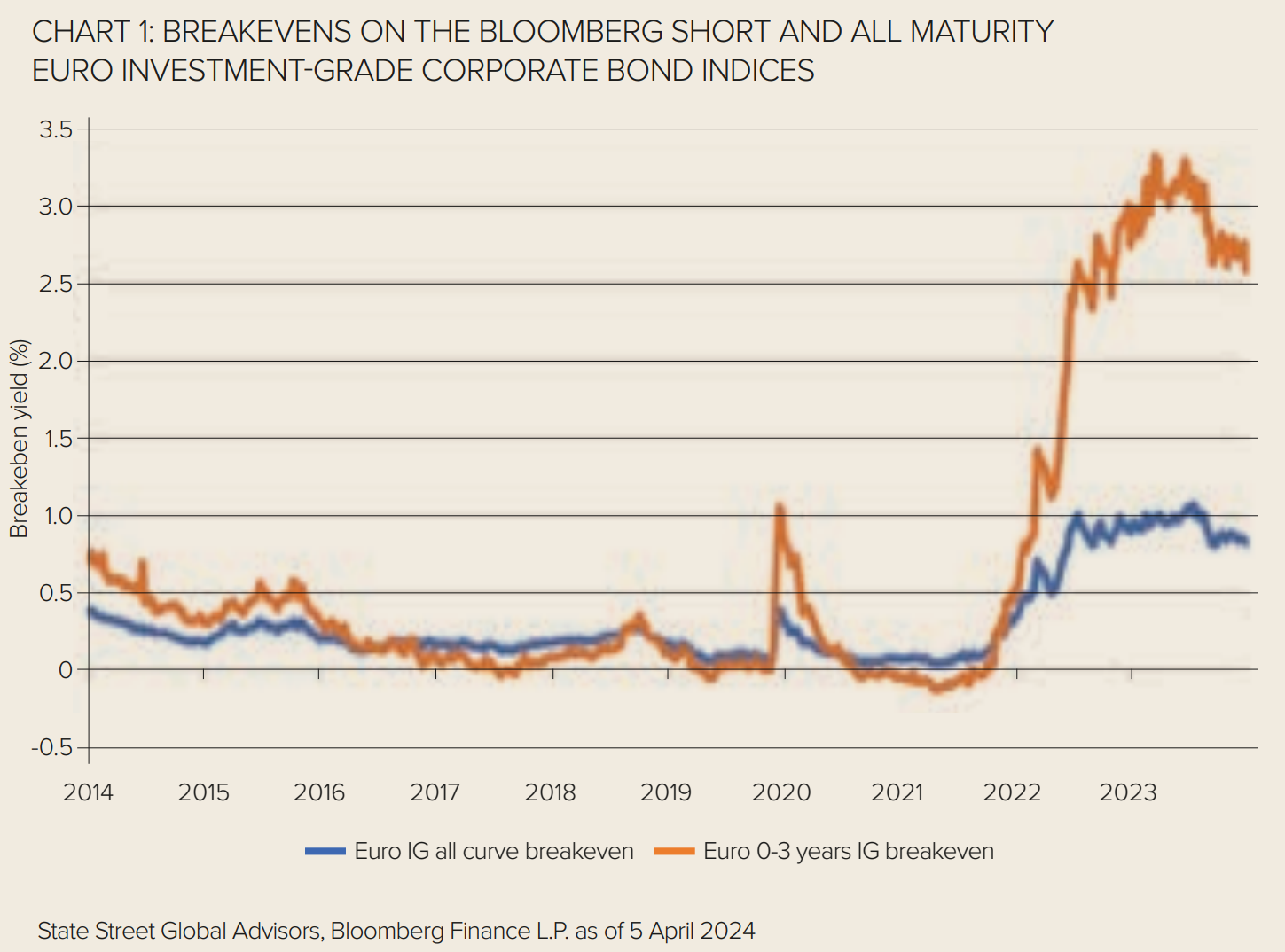

The yield and duration can be combined to create a fund’s ‘breakeven’ rate. This is the yield-to-worst divided by the duration and is an approximation of how far yields can rise before the price loss from the fund wipes out the annual yield.

The breakevens for the Bloomberg 0-3 Year Euro Corporate Bond index and the Bloomberg Euro-Aggregate: Corporates index are shown in Figure 1.

This should make clear how much more defensive the short-end exposures are: yields have to rise by over 250bps on the 0-3 Year index before the index yield is neutralised, against just over 80bps for the all maturity index.

Turn of the cycle

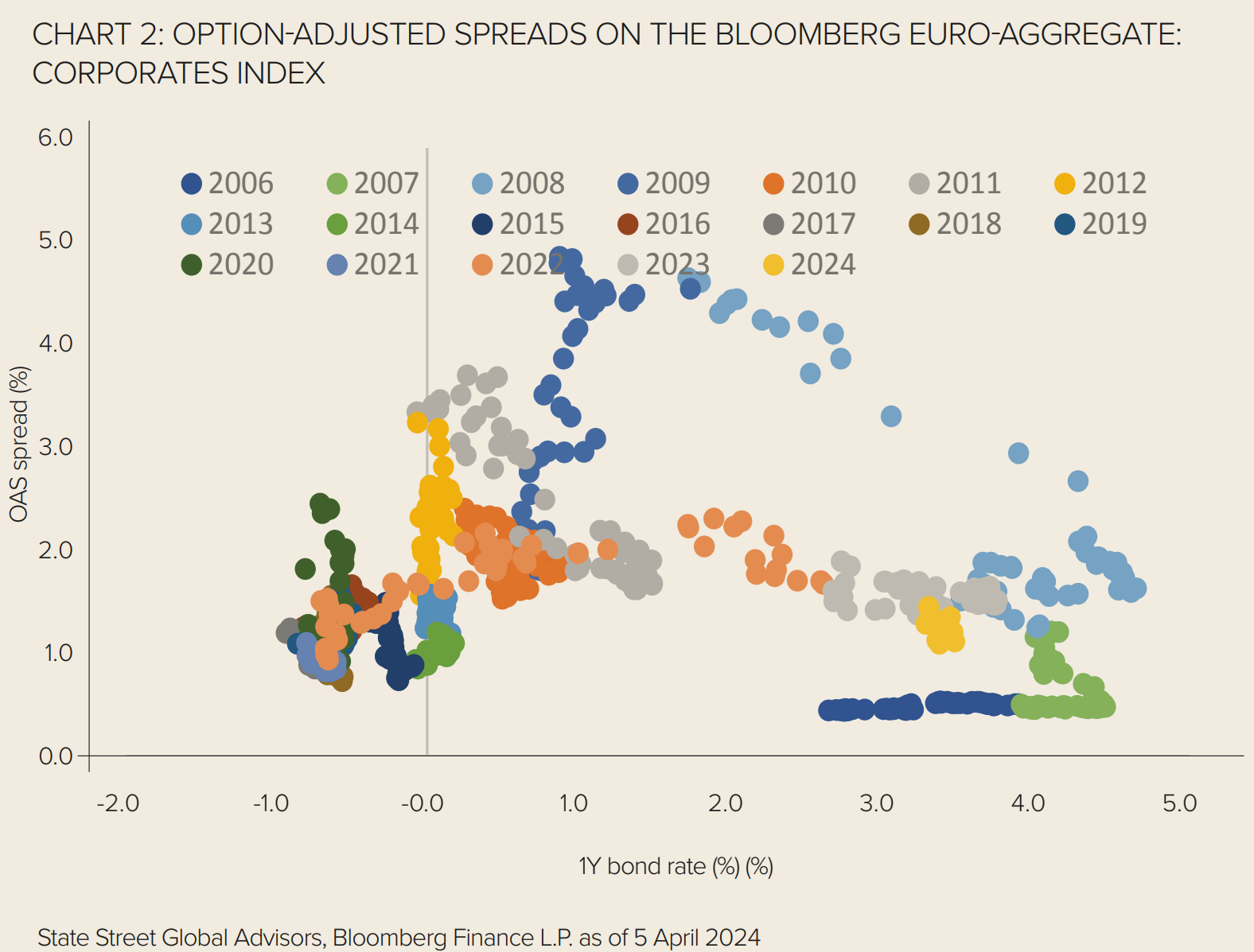

There are two arguments against opting for short-duration credit strategies. The first is that credit spreads are already historically tight. This is certainly the case relative to where spreads have been during the low/zero rate regime.

However, stretching further back to the 2006-2007 period, option-adjusted spreads on the Bloomberg Euro-Aggregate: Corporates index traded consistently at around 50bps when ECB rates were around current levels.

The higher all-in yield of the strategy and therefore higher breakeven rates, may encourage bond investors to accept tighter spreads. Nonetheless, tight spreads do raise the risks that a sharp slowing in growth from current levels would cause spreads to blow-out. There are few signs that data is weakening from current levels.

It is also worth noting that spread widening would not result in negative returns if the decline in underlying government bond yields is a main driver of the spread widening. The second argument is that with central banks on the cusp of cutting rates, it is time to be taking on duration risk.

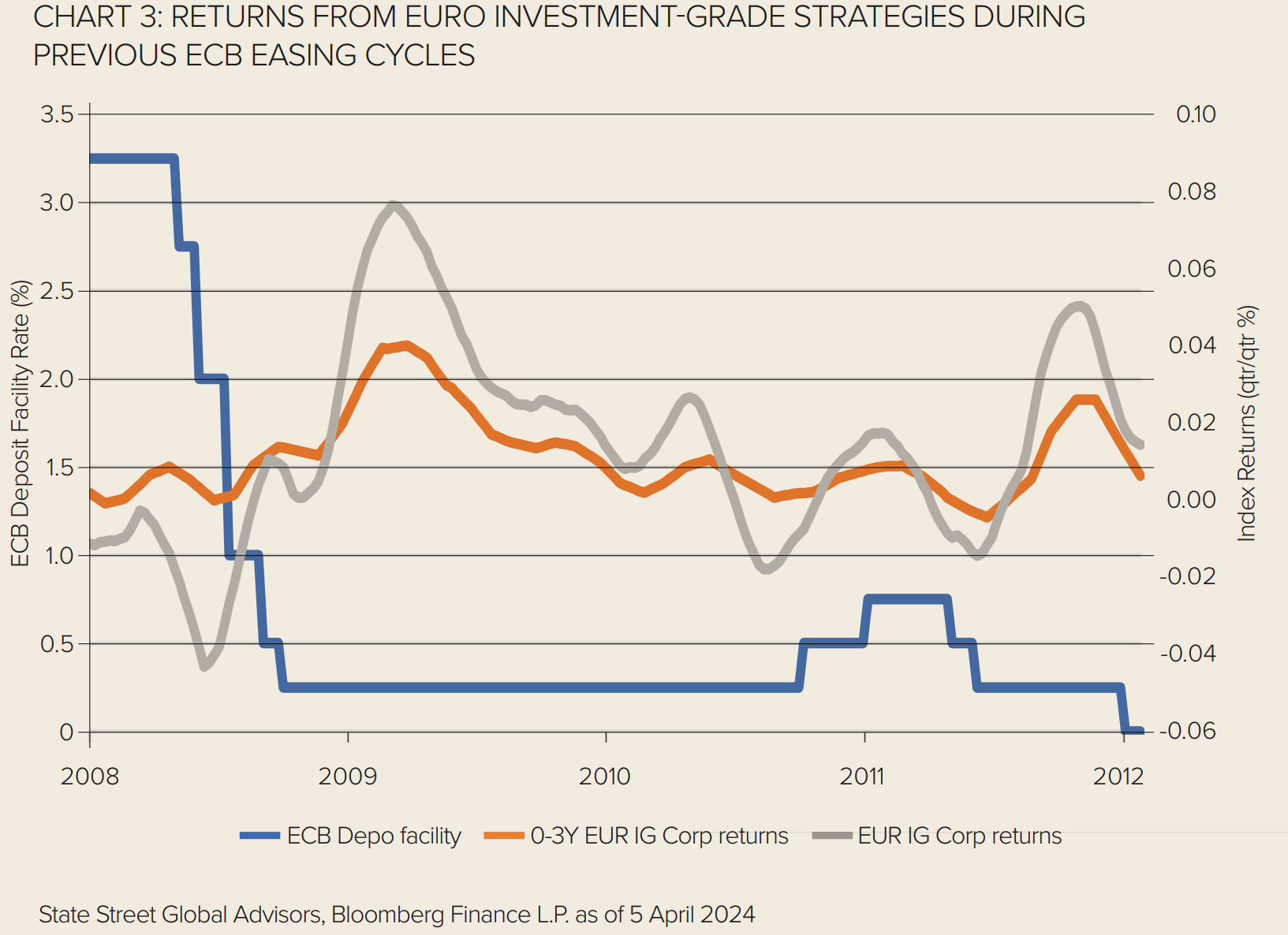

However, history suggests that sticking with the front end of the curve can produce better returns at the start of the cycle. Figure 3 shows the rolling 13 week/13 week (effectively quarter-on-quarter) returns from the Bloomberg 0-3 Year Euro Corporate Bond index and the Bloomberg Euro-Aggregate: Corporates index. Returns were higher for the 0-3 Year index in the early stages of both the 2008-2009 cycle and the more curtailed 2011 cut cycle.

This may be a reflection of the curve steepening move that occurs as cuts get underway, or general uncertainty over the extent of cuts that a central bank will deliver at the start of the cycle.

In summary, short-dated euro investment-grade credit is a strategy that has so far proved resilient in 2024 due to its relatively high yields and short-duration profile.

With the ECB seen moving towards easier monetary policy around the middle of the year, investors may be tempted to extend duration. However, history suggests that there is logic to sticking with front end exposures until the cut cycle becomes more mature.

Non-euro based investors can still participate through a hedged share class ETF. With euro rates lower than those in the US or the UK the currency hedging process is additive to yield. So the one-month forward euro/US dollar rate increases yield by just under 13.5bps and for euro/sterling close to 9bps¹.

1. Source: Bloomberg Finance LP as at 10 April 2024

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

Important information. Marketing Communication. For professional clients use only. SSGA Global Entities. This document has been issued by State Street Global Advisors Europe Limited (“SSGAEL”), regulated by the Central Bank of Ireland. Registered office address 78 Sir John Rogerson’s Quay, Dublin 2. Registered number 49934. T: +353 (0)1 776 3000. Fax: +353 (0)1 776 3300. Web: www.ssga.com. The views expressed in this material are of SPDR EMEA Strategy and Research through 10 April 2024 and are subject to change. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please see important information at ssga.com/etfinsider-important-information

©2024 State Street Corporation. All Rights Reserved