The world’s largest petroleum-processing facility based in Saudi Arabia was victim to a drone attack over the weekend, causing the oil price to soar in the early moments of Monday morning.

The facility, which is managed by energy company Aramco, accounts for 5% of the daily global oil production.

As a result, the price of Brent Crude oil climbed from $60 a barrel on Friday’s close to over $68 when markets opened on Monday.

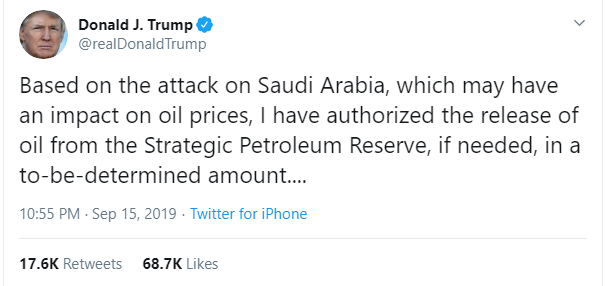

President Donald Trump has since taken to twitter saying he has authorised the release of US oil reserve and that there is “plenty of oil”. Oil’s price has declined slightly by 3.9% to around $65 a barrel following the President's announcement.

2019 has seen several other incidents involving oil production and transportation including two oil tankers being attacked in June and had a similar effect on the price of oil and ETFs exposed to the commodity.

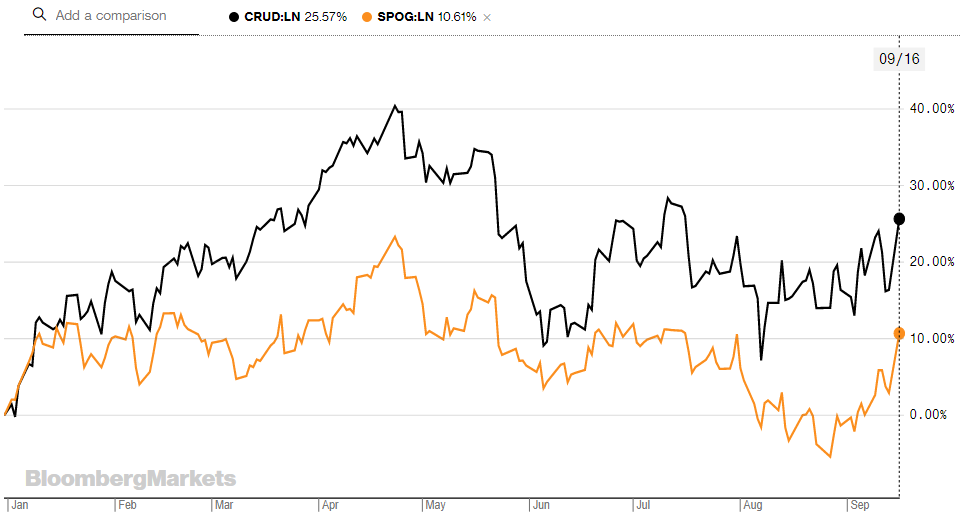

At the time of writing, the WisdomTree WTI Crude Oil (CRUD) jumped 8.3% from its Friday close to $8.70. Over the same time period, the iShares Oil & Gas Exploration & Production UCITS ETF (SPOG) also saw its Net Asset Value rise 7.6%.

Aussies use American ETFs to punt on oil prices

This event has bolstered CRUD’s and SPOG’s Year-to-Date returns, which sit at 26% and 10.6%, respectively.

CRUD’s and SPOG’s YTD performance – Source: Bloomberg