Online platforms are set to be the biggest demand driver for ETFs in Europe over the next three years, according to a survey conducted by PwC.

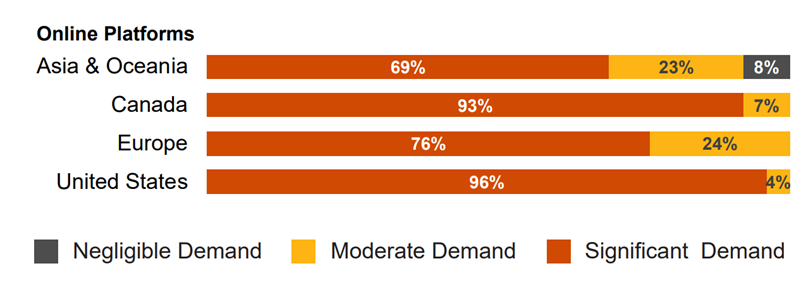

The survey, which questioned industry participants representing roughly 80% of global ETF assets, found that 76% expected significant demand for ETFs on digital platforms, while a further 24% anticipated moderate demand.

This puts it in line with demand from private banks, which respondents also considered a top growth area for ETFs across Europe.

Marie Coady, global ETF leader at PwC, said ETFs are well suited to online platforms, while their offering also proves to be a draw for new investors.

“The difficulties of engaging with advisers face-to-face during the pandemic have encouraged more investors to switch to robo-advice and online platforms. The increasing digitisation of ETF distribution can lower costs, improve accessibility and attract new investors,” Coady said.

Source: PwC

Retail uptake of online platforms differs dramatically across Europe. BlackRock recently forecast there will be 20 million people making monthly contributions to ETF savings plans by 2026, well ahead of the UK where ETF availability on retail platforms is considered woefully low.

However, there are signs the tide is turning. Online investment company Nutmeg oversees roughly £5bn of ETF assets on behalf of its clients through its managed portfolio service, while legacy platforms are also waking up to wider interest in ETFs.

Scalable Capital, a digital investment platform with roughly €6bn assets under management, has been a significant driver of ETF growth across Europe. Simon Miller, co-founder of the business, said the findings highlight a trend that has been happening for a few years.

“I think the momentum we are now seeing in retail into ETFs is confirmation of what the fund industry has known for a long time,” he said. “There is no better way to get broad exposure to a market, region or sector at a low price point.”

Last month, Hargreaves Lansdown expanded its passive research arm to include ETFs in response to client demand and industry developments.

Related articles