The growth potential of the eCommerce, software, cleaner living and air travel themes were all discussed at ETF Stream’s webinar on niches for investment in the post-COVID-19 world.

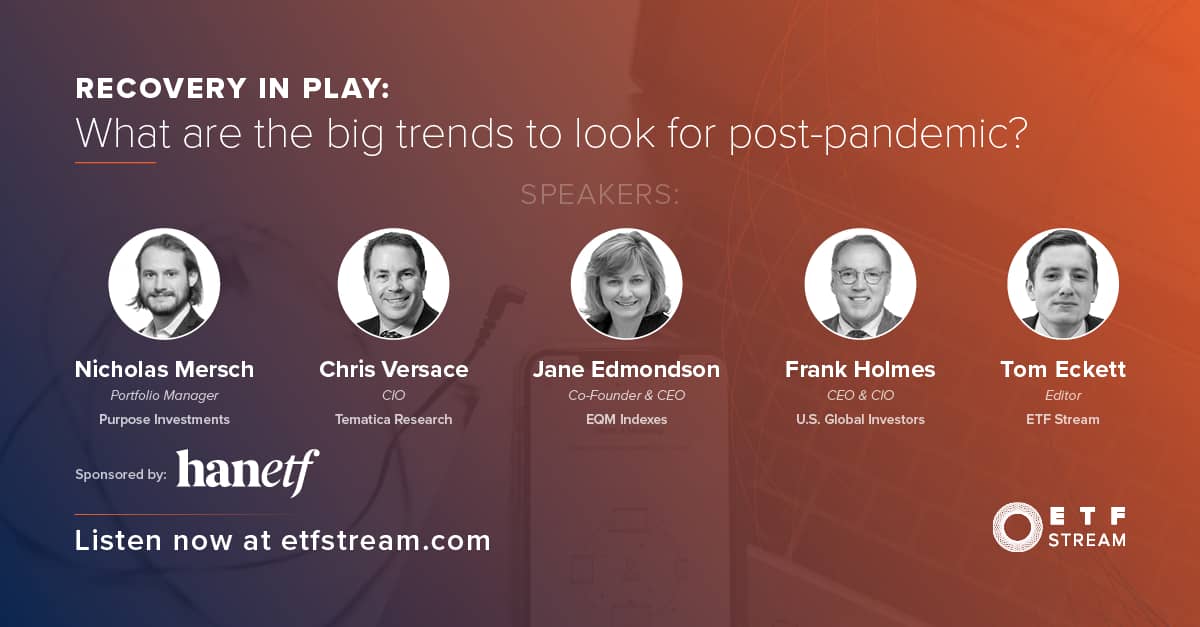

The webinar, titled Recovery in play: What are the big trends to look for post-pandemic?, started by setting the scene for a new economic and social landscape shaped by lockdown and recovery.

Chris Versace, CIO at Tematica, said: “The way we work, the way we communicate, the way we shop, the way we travel have all changed since the start of the pandemic.”

Versace continued, stating never in living memory have we seen the kind of global stoppage that lockdown brought about but even hangovers such as supply chain bottlenecks, goods price inflation and wage hikes all represent changes that companies can capitalise on.

Agreeing, Frank Holmes, CEO and CIO of US Global Investors, said the pandemic and recovery process remain a “transformative” opportunity, with first mover advantage afforded to those able to move with changes as they occur.

eCommerce and emerging markets

One sector that has thrived during the pandemic is the eCommerce sector. Jane Edmonson, co-founder and CEO of EQM Indexes, said restrictions on travel and business set in motion a series of infrastructural and behavioural changes that will carry into the future.

“The pandemic was a watershed moment for online retail,” Edmonson continued. “An IBM study said the sector was pushed ahead five years by the pandemic because of new buyers and shopping habits.”

Nowhere were these changes more pronounced than in the culture shifts that took place in emerging and developing markets in Asia and Latin America.

In particular, Edmonson pointed to countries like Mexico, Brazil and Argentina, which she said lacked the established infrastructure or habits to be considered key eCommerce locations pre-pandemic. This has changed with developments such as the shift from being primarily cash-based to increasingly payments-based economies.

Offering investors direct exposure to online retail is the firm’s Global Online Retail UCITS ETF (IBUY).

Innovation in online shopping and fintech have also played a role in developed market consumption, Edmonson highlighted, with the growth of buy-now-pay-later (BNPL) credit arrangements.

While the BNPL industry creates some credit risk due to the possibility of customers defaulting on payments, Edmonson said this way of paying for goods has added an extra layer of strength to the release of retail demand this year and the eCommerce-dominated retail environment of 2020.

Software and the metaverse

Next, Nicholas Mersch, portfolio manager at Purpose Investments, touched on the growth of software companies during the pandemic but argued their rapid expansion has long-term staying power.

Mersch said wage inflation is forcing companies to look for cost efficiencies but software expenditure would likely be bottom of the list of potential casualties of this, given businesses normally implement software with the goal of finding time and cost savings.

He added a key distinction needs to be drawn between pandemic fads and secular trends. For instance, telemedicine and online learning made significant progress during the height of lockdown but have lost steam since the ‘new normal’ began establishing itself.

In contrast, some measure of the ‘work from home’ craze looks set to stay and the recovery has created a backlog of demand for raw materials and products, problems Mersch said supply chain tech solution providers have answers to.

He was also keen to stress the fundamental shift in perspective regarding the gaming industry, which has gone from niche to popular culture as free-to-play gaming, content creators and the online ‘metaverse’ solidify gaming’s place on front pages.

Targeting these kinds of sectors, Purpose Investments launched the Purpose Enterprise Software ESG-S UCITS ETF (SOFT) in July, the first of its kind in Europe.

Looking ahead, Mersch said he is particularly excited about the DevOps space and companies like Atlassian. This sector, he said, create services such as ‘low-code/no-code’ which simplify software engineering for those who create new apps, websites and online products.

Concluding, Mersch said: “Every company that does not consider itself a tech company either has to use one, become one or get left behind.”

Cleaner living with health and sustainability trends

Killing two birds with one stone, Tematica’s Versace said consumer demand for healthier products and a more sustainable way of life have several areas of overlap.

“People are becoming more aware and in tune with personal health and we are seeing more choices from consumers about what they put in their bodies, on their bodies, in their homes and in the environment,” Versace said.

At present, McKinsey and Co. estimate the global wellness industry to be valued at $1.5trn, with annual growth of 5-10%.

Parallel to this is consumer pressure for companies such as PepsiCo, Coca Cola and Estee Lauder to steer clear of genetically modified organisms (GMOs), parabens, toxins and single-use plastics, and instead opt for recyclables, reusable packaging and organic and plant-based produce.

Going further, health-conscious consumers are increasingly making significant commitments to sustainability, as illustrated by the share prices of Tesla and Blink Charging both posting three-digit increases over the past twelve months.

On electric vehicle (EV) uptake, Versace continued: “Consumers increasing EV purchases as their price points come down and now the likes of General Motors and Ford are leaning into that.”

Through a combination of regulatory change, climate concerns and health consciousness, overhauls such as internal combustion engines to electric or even hydrogen cell vehicles and omnivorous to more plant-based diets are expected to become the norm.

Anticipating this, Tematica launched the Cleaner Living ESG-S UCITS ETF (DTOX) in September to target these subthemes simultaneously.

The return of wanderlust

Finally, US Global Investors’ Holmes set told viewers only a fraction of the pent-up demand for air travel has been released.

The US Transportation Security Administration has already recorded a doubling of daily passenger volumes since November 2020. This trend could well continue spiking further, Holmes said, as the US allows fully vaccinated international travellers to enter the country from 8 November.

He continued, noting retail investors have been front-runners of the air travel recovery over the past year, as more sophisticated investors – including Warren Buffett – reduced their positions in airline stocks in 2020. This owed to self-guided investors noticing a sharp recovery in the air travel industry following 9/11, with many anticipating a similar trajectory post-COVID-19.

Looking ahead, Holmes said he expects incoming flights to warmer destinations in the US, and outgoing flights to sunnier climates, to both pick up as winter arrives, though he admits the full recovery of the industry will be a medium-term rather than short-term process.

Offering exposure to this is a product that launched in June courtesy of US Global Investors, the U.S. Global Jets UCITS ETF (JETS).

To watch the full webinar, click here.