In Lewis Carroll's novel

Through the Looking Glass

, Alice falls through a mirror and finds everything is turned upside down. Winter is hot. Staying still makes you go faster. Eating quenches thirst.

A new generation of indexes is trying to do exactly this. Called "reverse capitalisation weighting" the line of product takes popular indexes - like the S&P 500 - and turns them upside down.

In a conventional index, the biggest companies get the most weight. As they grow, they get more.

But in reverse weighted indexes, the opposite occurs: the smallest companies get the most weight, and as they shrink, they continue to take a bigger slice. The index goes through the looking glass.

Why would anyone do this? Apparently it works. Or so says a new white paper from Exponential ETFs, the chief architect of the strategy.

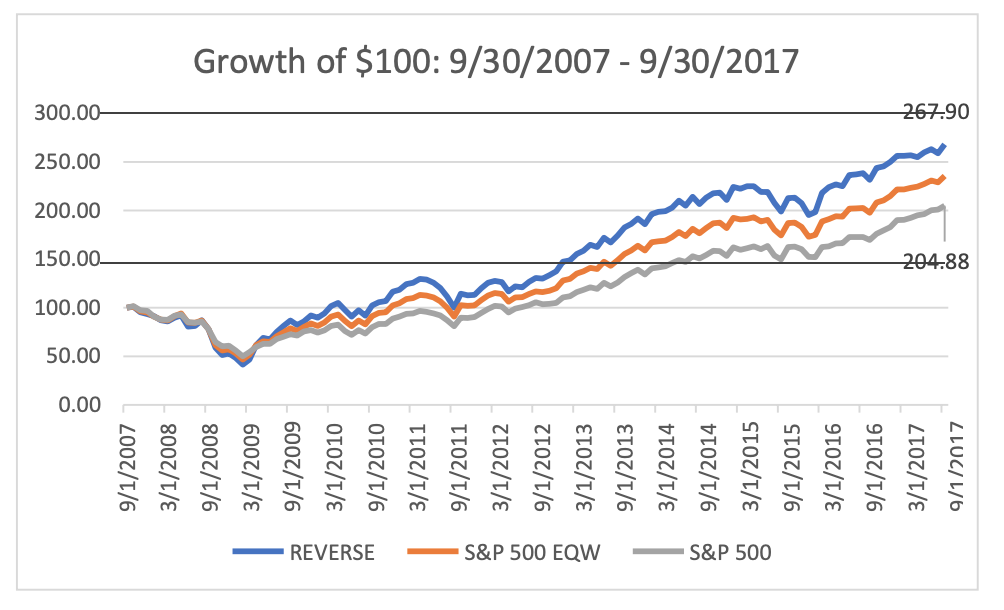

Source: Exponential ETFs

When index investing got going in the early-1970s all indexes were intended to be equally weighted, the paper claims. But index pioneers quickly found that transaction costs destroyed the viability of equally weighted indexes. Meaning the industry adopted market-weighted indexes instead, as they incurred no transaction costs.

"Cap-weighting became the indexing standard as a direct result of implementation issues, no efficient-market theory," it says.

"From an index portfolio manager's viewpoint, market-cap weighting is as good as it gets. The only time portfolio trading is needed is when there is a corporate action or a constituent change in the index. It should be no surprise that market-cap-weighted indices became the standard for core equity index investment."

While easy to run, market-weighted indexes had limitations, the paper says. Notably, they contained a momentum bias, as they allow their winners to expand indefinitely. More importantly, they had something near a large-cap growth bias, as they always concentrated their holdings in big expensive stocks, which tend to be growth stocks.

This bias is problematic because scholarship shows it is small value stocks that tend to outperform. While practitioners were always aware of these limitations, they opted for market weighted indexes anyway, the paper says.

Reverse and equal weighting

In the 2010s, however, the battlefield looks quite different. Since, the mid-1990s, transaction costs have become "trivial" as more money and better technology has flooded the market. This means transaction costs have fallen and alternative weighting schemes are more viable. This is particularly true in the US large cap space.

As such, non-market weighted indexes can now reliably beat their market weighted counterparts. A good example of this, the paper says, is equally weighted indexes. Rydex's equally weighted S&P 500 tracker (RSP - now owned by Invesco) has comfortably beaten the S&P 500 over the past 15 years.

But a better example still, the paper claims, is reverse weighted indexes, which turn index weighting upside down. By turning the index on its head, and giving the smallest companies the most weight, large cap indexes can avoid the anti-value and momentum biases of market-weighted indexes. Instead they can benefit from the opposite dynamic: tilting towards small value stocks.

"Reverse-cap weighting provides a viable alternative to the momentum, concentration and anti-value biases inherent in capitalisation weighted indices," the paper concludes.

The paper backtested the strategy, finding it delivered a 10.4% annual return over 10 years, compared with the 7.4% earned by the S&P 500.