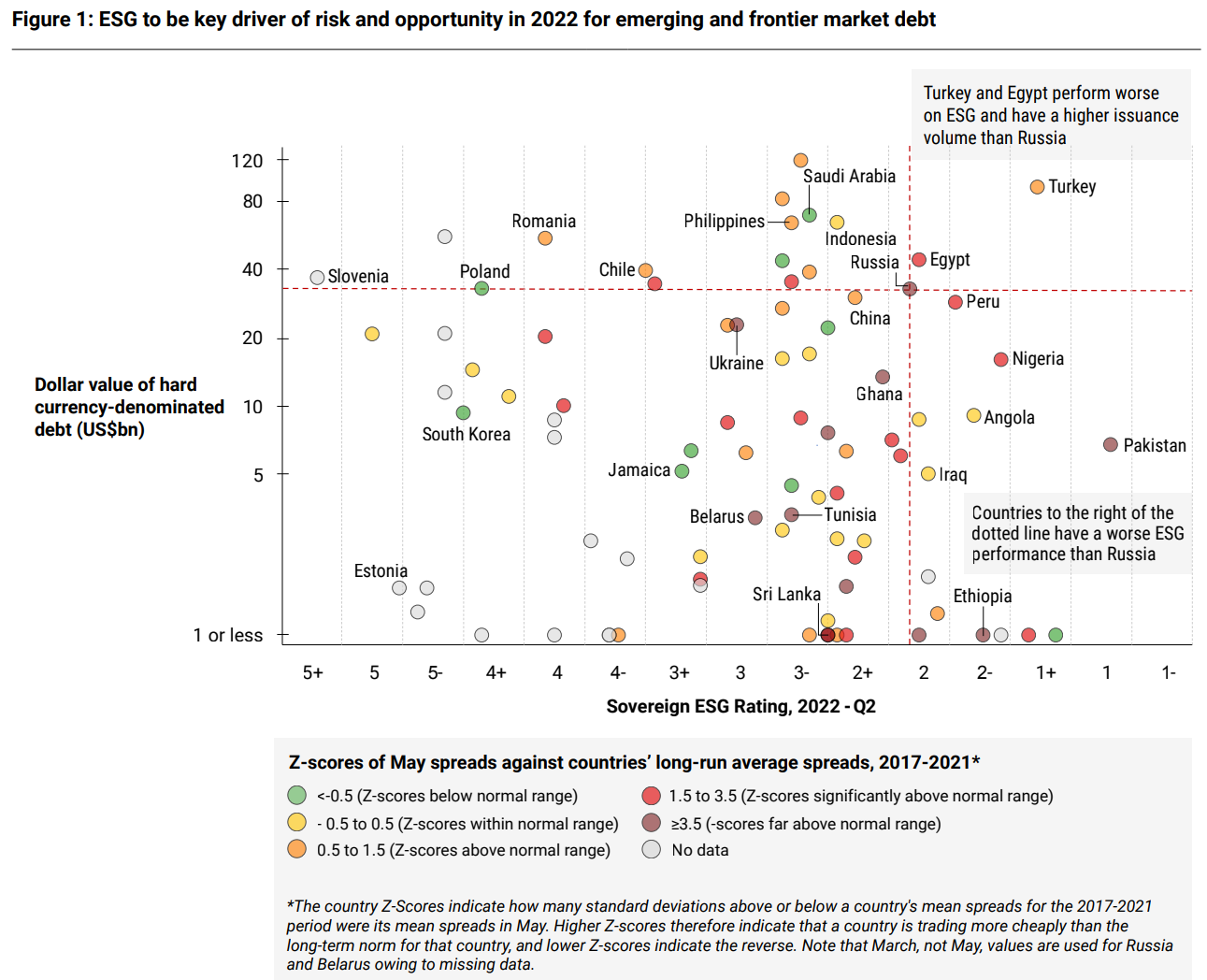

Russia’s invasion of Ukraine has asked difficult questions of how we analyse the ESG credentials of emerging and frontier market governments but interestingly, new ratings suggest Russia is far from the worst of the bunch.

In fact, new research from risk intelligence provider Verisk Maplecroft finds as many as 15 hard currency sovereign issuers have worse overall ESG profiles than Russia, including some exposures which are more heavily traded than Russia, such as Turkey and Egypt.

Source: Verisk Maplecroft

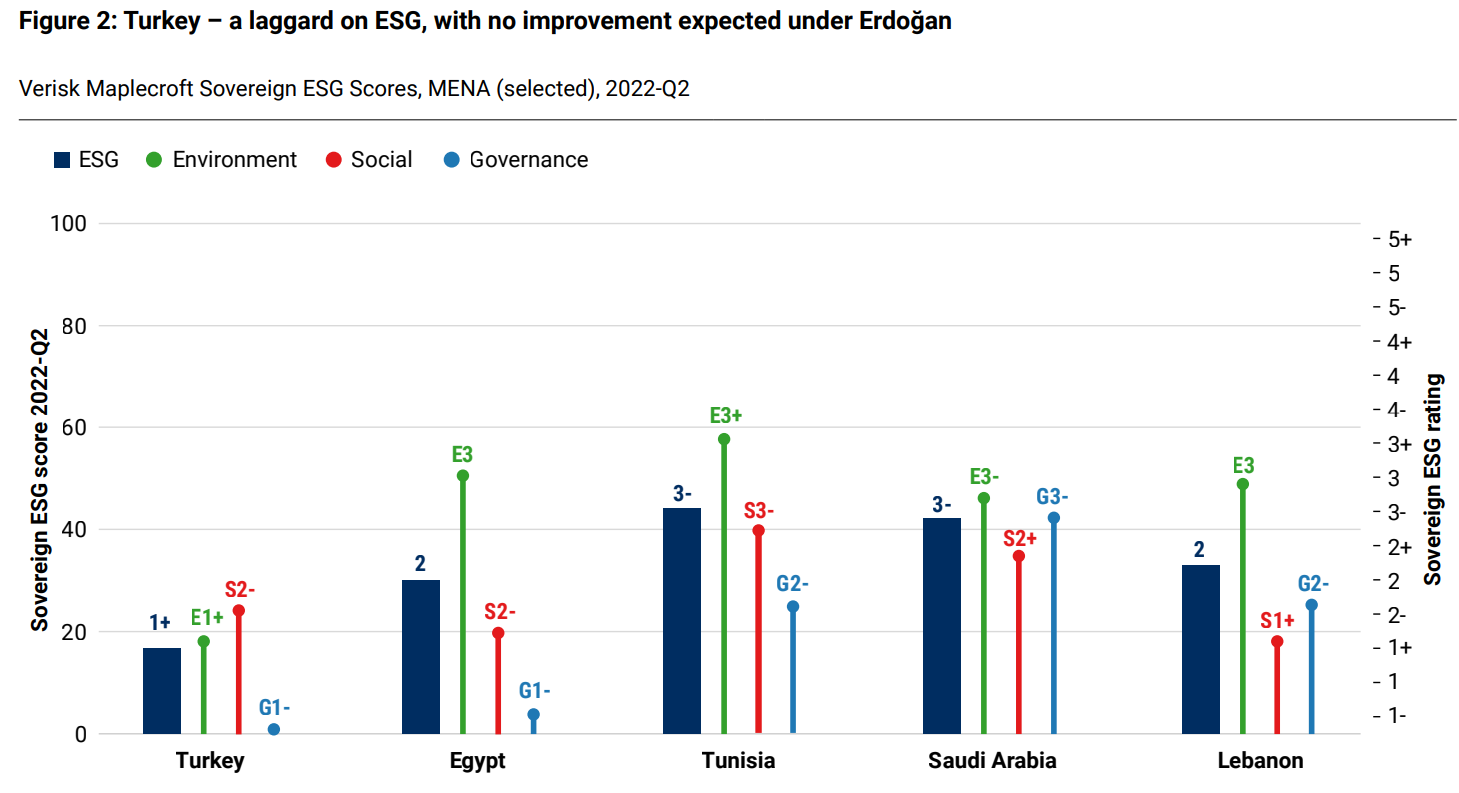

“Human and labour rights violations and governance are Ankara and Cairo’s standout weaknesses,” the research argued. “Turkey has a governance score of 1/100 – the worst of any investable market except Ethiopia.”

The authors said alongside “persistent” political risks, Turkey’s institutional environment has “unravelled” due to the spread of corruption and weakened democratic governance and judicial independence.

Egypt, meanwhile, scores only 4/100 on governance for similar reasons, after first falling into the lowest strata for the strength of political institutions in the latter stages of 2019.

Source: Verisk Maplecroft

Verisk added that if Russia is now deemed unacceptable by index providers and investors, then other bond index stalwarts with similar ESG scores – China, Saudi Arabia and Indonesia – deserve similar scrutiny.

While Saudi Arabia’s governance score has improved from 3/100 to 42/100 in less than four years, these improvements have come “at the expense of civil rights and freedoms, repression of dissent and crime, and tighter controls on sources of instability”, the research said.

More broadly, Verisk said discussions around ethics have failed to translate into significant differences between EM sovereign debt beta and supposedly ESG-adapted iterations.

“The war is piling more pressure onto managers who have so far been just about able to navigate between autocratic issuers and a new cadre of ESG-aligned clients and other stakeholders,” it continued.

“Geopolitical shifts suggest the claim that all EMs in a portfolio can be gradually prodded into alignment with the values of ESG investors no longer holds. And this, taken in combination with new regulations in Europe (and soon in the US) demanding that funds do ‘what they say on the tin’, means that something has got to give, sooner or later.”

A key change that needs to occur, it said, is for investors to look ‘beneath the hood’ of sovereign debt and pay more attention to social issues and political structures and idiosyncratic risks.

Also, while the 2022 market backdrop presents challenges, Verisk suggested ESG should not be put on the backburner and in fact, countries’ sustainability profiles are a telling factor for credit risk.

It concluded: “For government bondholders, the problem extends far beyond their Russia exposure. Our analytics identify several cases where unravelling ESG – notably governance and social risks – could plausibly deepen credit risks; as well as a handful, including Poland and Romania, where positive ESG momentum will be supportive of value.”