S&P 500 equal-weight ETFs have returned to asset gathering territory as investors either profit-take on market cap-weighted gains or become increasingly wary of the index’s over-concentration in a handful of tech giants.

According to data from ETFLogic, the $2.9bn Xtrackers S&P 500 Equal Weight UCITS ETF (XDEW) has seen $127m inflows over the past week, as at 9 June.

This trend was even more pronounced in the US, with the $35bn Invesco S&P 500 Equal Weight ETF (RSP) adding a considerable $1.7bn in its strongest week of inflows since its inception.

It follows a flight to more risk-on allocations so far in 2023 amid headline-grabbing developments in artificial intelligence (AI) technology and expectations the Federal Reserve could start to cut interest rates by the end of the year.

While the latter may be supportive for debt-laden information technology and communications names, it could also signal the Fed deciding to halt its hawkish monetary policy programme as the US economy shows signs of weakness.

With equal-weight ETFs having relatively outsized positions in ‘old economy’ sectors such as energy, materials and industrials, the possibility of recession and a return to optimism in tech has seen XDEW book $647m outflows this year, until last week.

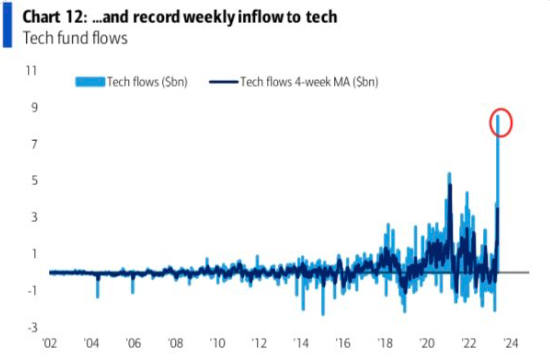

However, onlookers are becoming increasingly sceptical of the surge enjoyed by the ‘magnificent seven’ so far this year, with a combination of organic flows and index rebalances pushing unprecedented sums into tech names.

Source: Bank of America

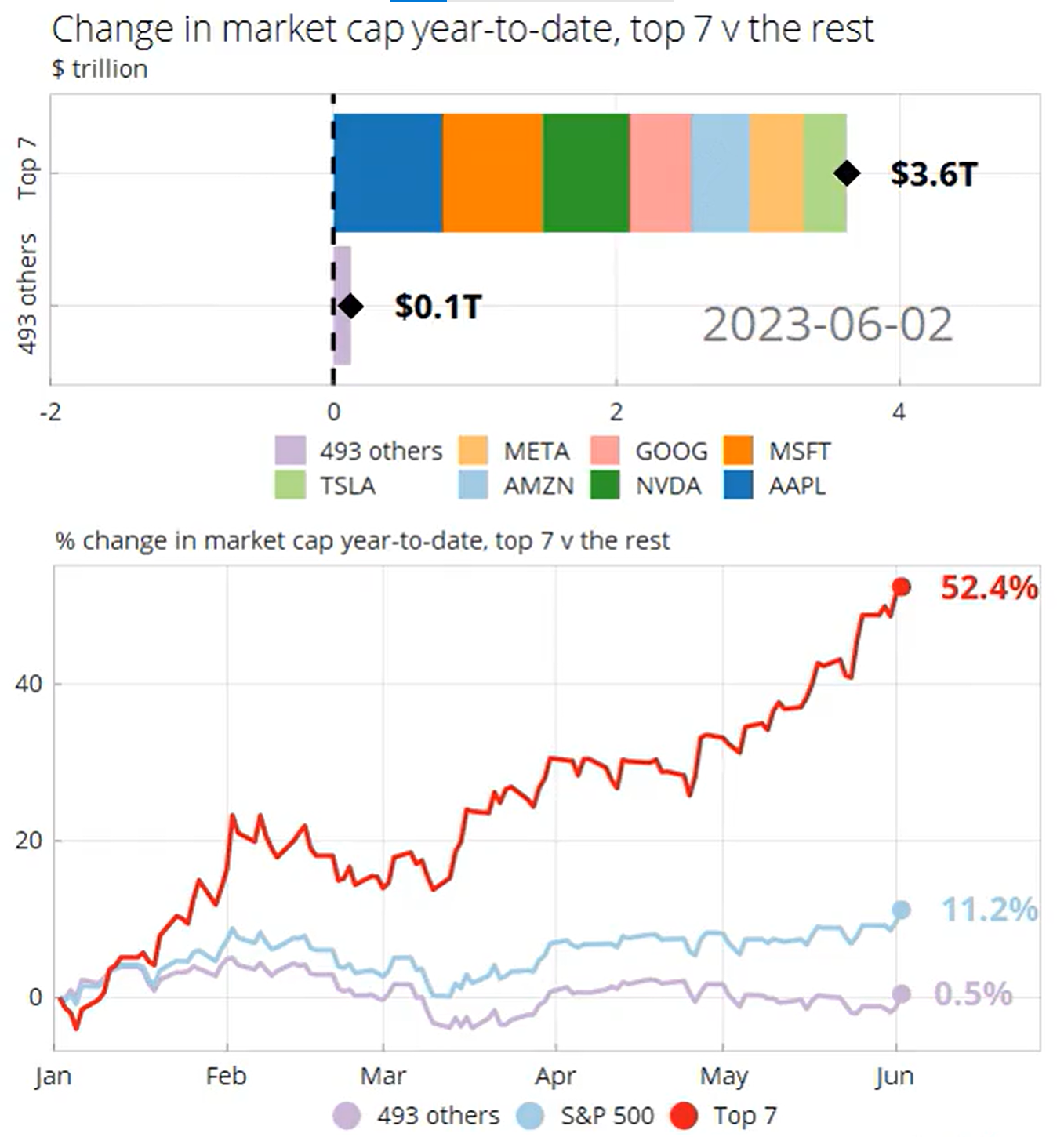

“Essentially all of the S&P’s year-to-date return comes from its top seven constituents – Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla,” Ben Bakkum, lead investing researcher at JP Morgan, said.

“Those companies have together added over $3.6trn in market cap in 2023 while the other 493 companies in the index have together added almost $0.”

Source: JP Morgan

At the time of writing, Apple’s $2.7trn market cap is equivalent to market cap of the bottom 200 companies in the S&P 500 and more than $100bn larger than the combined size of all Russell 2000 index constituents.

Despite becoming more cautious about headiness in tech valuations, investors have also lost enthusiasm for 2022 safe havens.

The $271m iShares S&P 500 Utilities Sector UCITS ETF (IUUS) shed more than half its assets following $336m outflows in the week to 9 June while the $1.1bn iShares S&P 500 UCITS ETF (IUES) also saw a $289m exodus.

UCITS ETF investors also still favour vanilla US equity, with $334m flowing into the $37.7bn Vanguard S&P 500 UCITS ETF (VUSA).

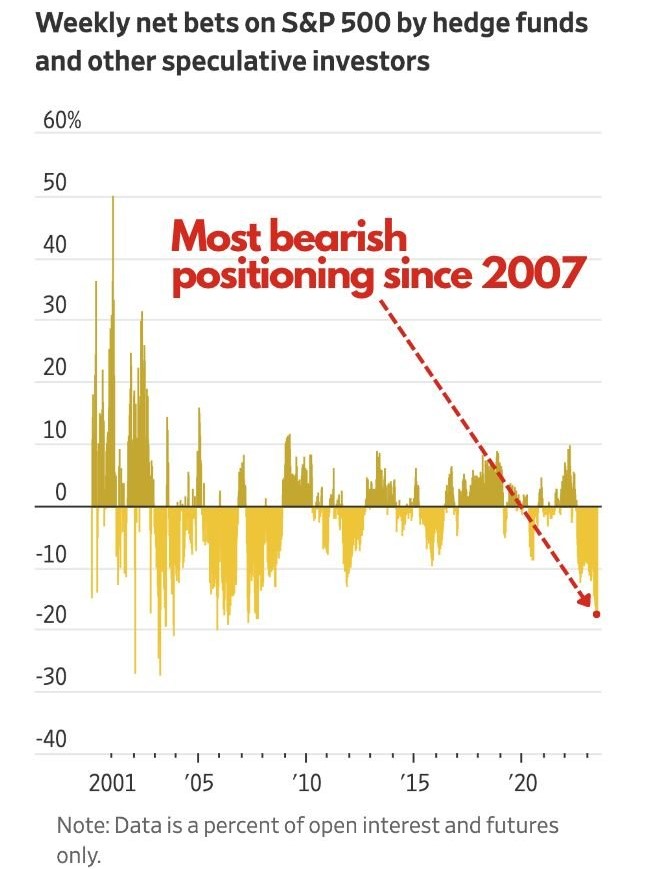

Meanwhile, weekly net short positions on the S&P 500 hit their highest level since 2007 at the start of June, according to the Commodity Futures Trading Commission (CFTC).

Source: CFTC, Bespoke Investment Group