Index provider Scientific Beta rallied to the defence of size this week following claims the factor was not just dead but never existed in the first place.

These claims were made by Cliff Asness and his team at AQR Capital Management who found the original research around the factor did not take into account the liquidity premium investors pay for owning small-cap stocks.

Once this was taken account, according to Asness, one could explain why size has almost consistently underperformed over the past four decades.

However, Scientific Beta has said the findings have “little relevance to investors” as Asness fails to take into account the way size fits into a multi-factor portfolio.

The index provider, which runs a range of multi-factor portfolios incorporating size, said the factor is a strong diversifier of other traditional factors and therefore adds value from a risk management perspective.

As Felix Goltz, research director at Scientific Beta, and co-author of the report, said: “The practically relevant case is that investors decide on their allocation to a range of factors. Consequently, to answer the question of whether the size factor adds value and improves the Sharpe ratio of a portfolio, we need to take exposures to all these other factors into account.”

Is the size factor broken? No, it never existed in the first place

According to the research, they found incorporating the size factor does improve the Sharpe ratio, a measure of risk-adjusted returns, of the portfolio.

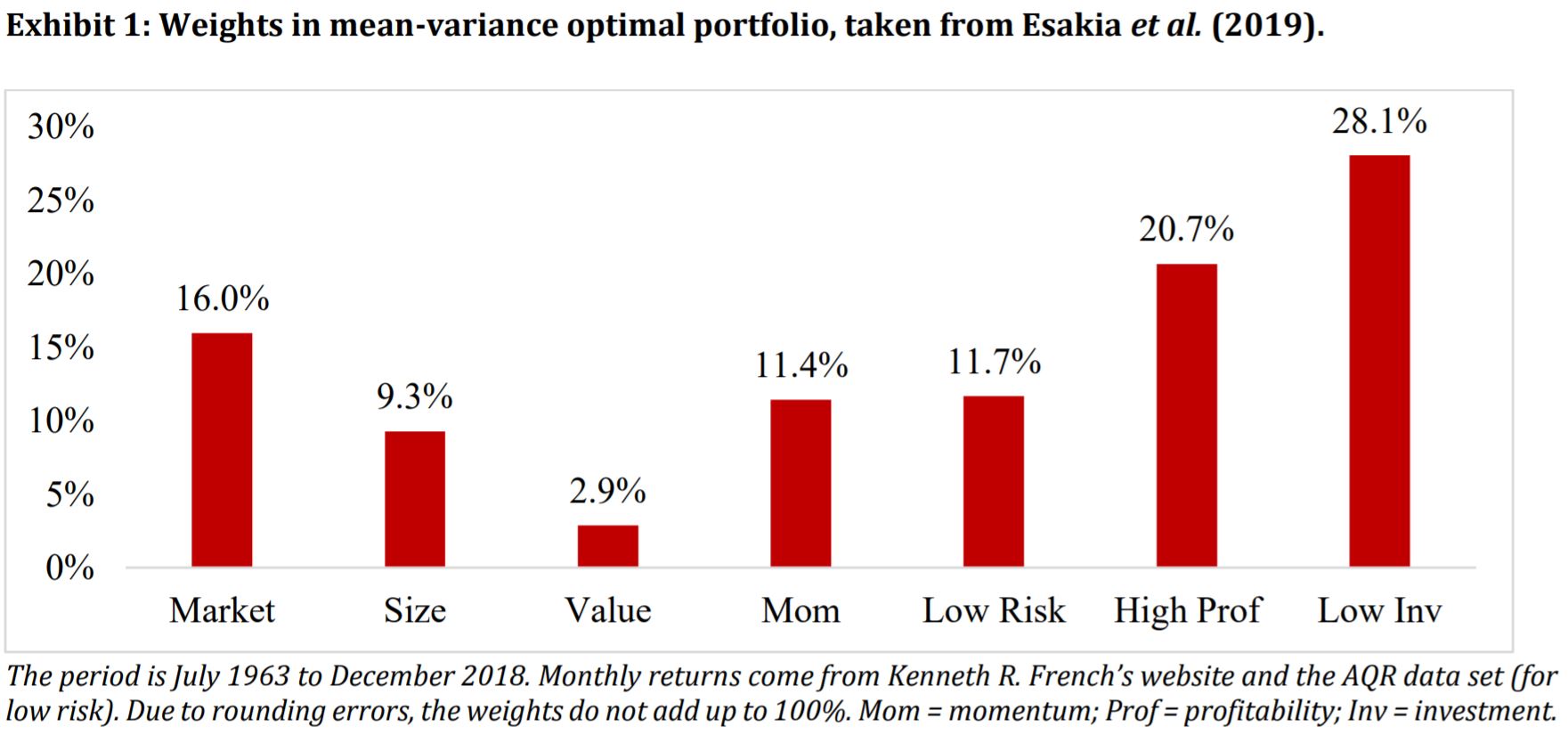

This was measured by looking at the factor weights that maximise the Sharpe ratio of an investor and found size received a 9% weight in the portfolio, far higher than value’s 2.9% weighting.

“The positive weight of the size factor in the optimal portfolio reflects the fact that including exposure to size improves the risk-return properties of a multi-factor portfolio, even though the factor may not have stellar returns,” Goltz added.

The reason for this high weighting in this optimised portfolio, he continued, was because it has a “particularly” low correlation with other traditional factors.

“By ignoring the low correlation of the size factor with other traditional factors and the accompanying diversification benefits, one also ignores its added value in a multi-factor portfolio,” the report concluded.