In EMEA for Professional Clients (MiFID Directive 2014/65/EU Annex II) only; In Switzerland for Qualified Investors (Art. 10 Para. 3 of the Swiss Federal Collective Investment Schemes Act (CISA)); In APAC and LATAM for institutional investors only; In Australia and New Zealand: for Wholesale Investors only.

In 2015, the United Nations (UN) established the 2030 Sustainable Development Agenda, which is a plan of action spanning key global issues for a sustainable future. These range from fighting poverty and hunger to combating climate change and achieving peaceful, just and inclusive societies.

To this end, the UN formulated 17 goals to address those global challenges, the Sustainable Development Goals (SDGs). From governments or supranational organisations to companies and even individual citizens, different actors can and should come together to contribute to the goals.

The road to achieving the SDGs is still long. In 2015, the UN Commission on Trade and Development (UNCTAD) estimated an annual SDG investment need of $5-7trn until 2030 with an annual investment gap for developing countries alone of $2.5trn.1

SDG investing is a form of thematic investing but instead of defining a theme, the various single SDGs are the thematic framework and define the scope of the theme. It is unlikely that one will find a universe of ‘perfect’ companies, but it is essential to distinguish companies that are net contributors from companies that are misaligned to any of the 17 SDGs. MSCI has developed a net alignment approach for this purpose to account for both the products and services a company offers (product alignment) as well as how it operates (operational alignment).

On the product side, the level of (mis)alignment is determined by the percentage of revenue a company earns with products and services that can have a positive or negative contribution to the SDGs. For operational alignment, data on corporate practices and policies is leveraged, which is among others based on the MSCI ESG Controversies data set. This allows gauging the net alignment of a company and weighing areas where a company is well aligned against those where a company harms one or more SDGs.

Implications of applying SDG metrics to a global portfolio

As of end of 2022, out of the MSCI ACWI IMI universe of around 9000 names, over 40% are deemed misaligned or strongly misaligned. While around 57% of companies are at least neutral on all SDGs, almost half even achieve an aligned assessment on at least one goal without being misaligned on another.2

These companies are the net contributors that a robust SDG methodology should focus on, meaning only companies who are not found to harm any of the SDGs, regardless of a potential single-SDG focus of the index. Only a small percentage of companies show strong alignment on at least three SDGs with no strongly misaligned assessment.

Looking at SDG-aligned revenue exposures, a similar picture emerges. Looking at the MSCI ACWI IMI, which covers a global stock universe of companies with large, mid and small market capitalisation, we see that most companies have little exposure to the MSCI actionable impact themes (0-10% of revenue). There are certainly many who have considerable exposure (>50%), but these strong SDG contributors only make up around 7% of the weight of the global stock universe. Again, this highlights the current premise of SDG investing: There is a considerable number of companies that an SDG-conscious investor will want to avoid, simultaneously there are also SDG contributors that are publicly traded, but there is also a great need for more investment in SDG-aligned activities.

Breaking down an SDG-aligned portfolio

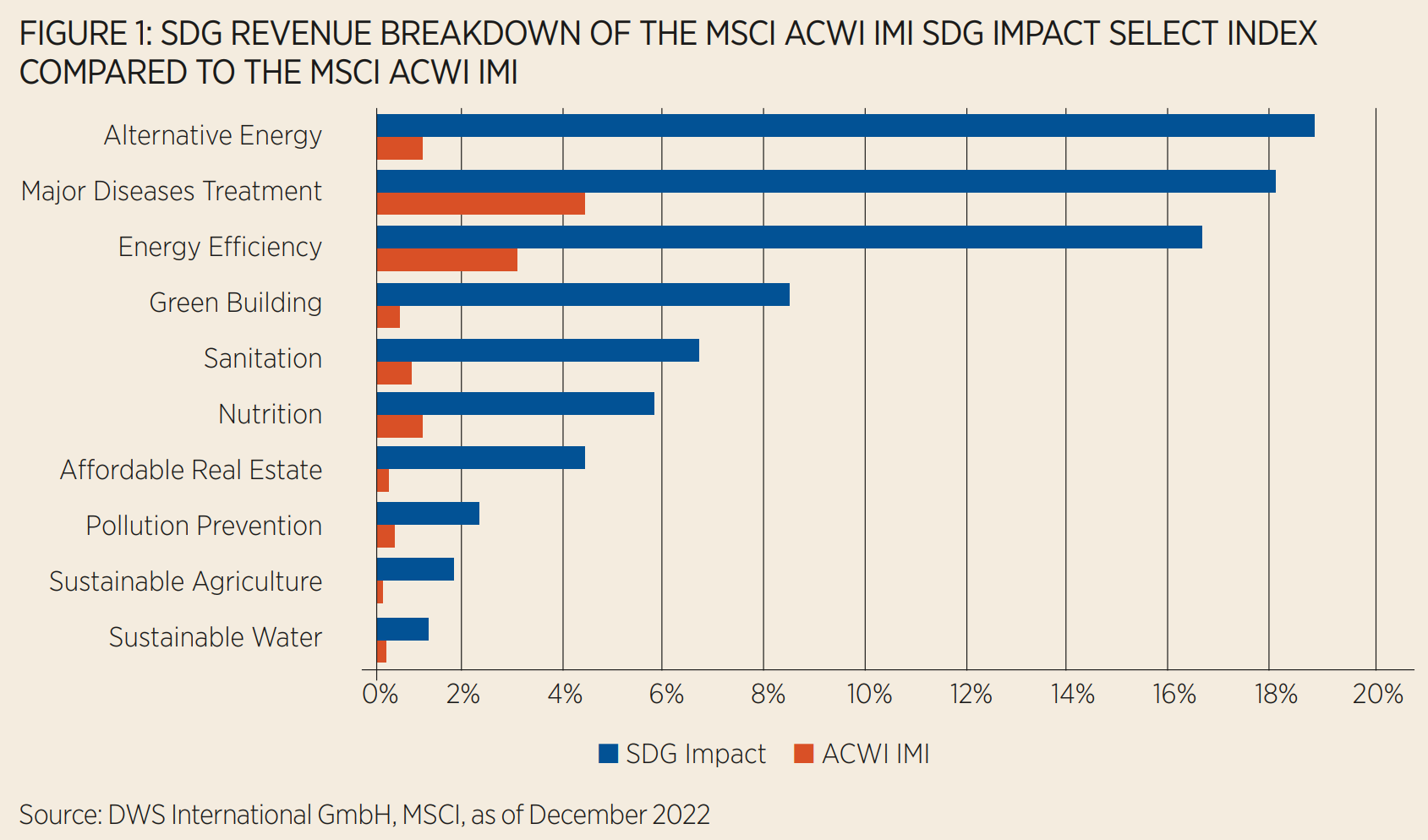

SDG-aligned activities in publicly traded companies can span many different areas, ranging from major diseases treatment to energy efficiency and sustainable agriculture. Strong SDG contributors must be companies that generate the majority of their revenues with SDG-relevant products and services. A portfolio of these companies, weighted according to the percentage of these revenues and market capital, indeed shows how investors can effectively tilt a portfolio towards more alignment with global sustainable development efforts.

A thematic SDG portfolio offers investors the opportunity to combine a thematic approach with a values-based selection process. Contrary to other thematic strategies, most of SDGs are not necessarily subscribed to the growth bias which often dominates these portfolios. Thematic strategies aim to provide tailored exposure to current and future trends – using company selection criteria that surpass the traditional sector divide.

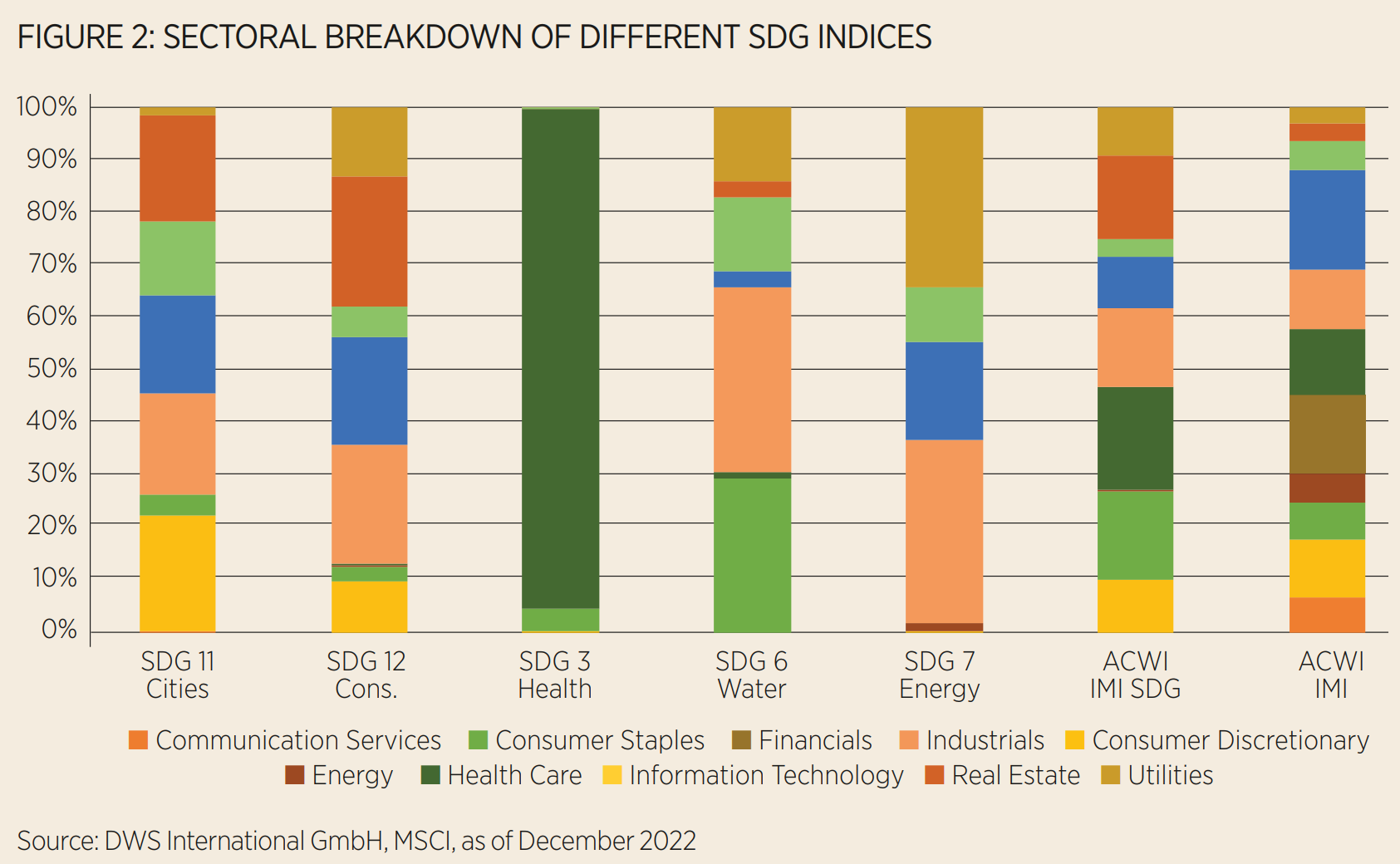

Hence, the strategies can offer diversification despite thematic concentration. While certain deviations from the benchmark and differences between single SDGs are to be expected, it is not all IT and health care. Companies which are net aligned to a specific SDG can be found in many sectors, which also underlines the importance of a broad economic collaboration towards achievement of the UN goals.

What is an SDG investment then? We must not confuse SDG investment in the ETF space with impact investing as done in private markets: The public companies in these portfolios have been shown to be aligned with the SDGs, meaning their products and services as well as operations can support one or more SDGs and simultaneously do not harm progress. Their business model, however, is unlikely to contain a direct reference to sustainable development.

SDG investing can be seen as a combination of ESG and thematic investing – the overarching goal is to further sustainability progress with the individual goals providing more granular investment themes to identify relevant companies. SDG investing is about adhering to the requirements for future sustainable developments, and within this presents a unique opportunity to bring both the ESG and thematic equity portfolios to the next level. 1 World Investment Report 2014 (unctad.org) 2 MSCI ESG Research, DWS calculations. As of 31/12/2022

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Important information

DWS is the brand name of DWS Group GmbH & Co. KGaA and its subsidiaries under which they do business. The DWS legal entities offering products or services are specified in the relevant documentation. DWS, through DWS Group GmbH & Co. KGaA, its affiliated companies and its officers and employees (collectively “DWS”) are communicating this document in good faith and on the following basis. This document is for information/discussion purposes only and does not constitute an offer, recommendation or solicitation to conclude a transaction and should not be treated as investment advice. This document is intended to be a marketing communication, not a financial analysis. Accordingly, it may not comply with legal obligations requiring the impartiality of financial analysis or prohibiting trading prior to the publication of a financial analysis. This document contains forward looking statements. Forward looking statements include, but are not limited to assumptions, estimates, projections, opinions, models and hypothetical performance analysis. No representation or warranty is made by DWS as to the reasonableness or completeness of such forward looking statements. Past performance is no guarantee of future results. The information contained in this document is obtained from sources believed to be reliable. DWS does not guarantee the accuracy, completeness or fairness of such information. All third party data is copyrighted by and proprietary to the provider. DWS has no obligation to update, modify or amend this document or to otherwise notify the recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Investments are subject to various risks. Detailed information on risks is contained in the relevant offering documents. No liability for any error or omission is accepted by DWS. Opinions and estimates may be changed without notice and involve a number of assumptions which may not prove valid. DWS does not give taxation or legal advice. This document may not be reproduced or circulated without DWS’s written authority. This document is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, including the United States, where such distribution, publication, availability or use would be contrary to law or regulation or which would subject DWS to any registration or licensing requirement within such jurisdiction not currently met within such jurisdiction. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions © 2023DWS International GmbH /DWS Investment GmbH In Hong Kong, this document is issued by DWS Investments Hong Kong Limited. The content of this document has not been reviewed by the Securities and Futures Commission. © 2023 DWS Investments Hong Kong Limited In Singapore, this document is issued by DWS Investments Singapore Limited. The content of this document has not been reviewed by the Monetary Authority of Singapore. © 2023 DWS Investments Singapore Limited In Australia, this document is issued by DWS Investments Australia Limited (ABN: 52 074 599 401) (AFSL 499640). The content of this document has not been reviewed by the Australian Securities and Investments Commission. © 2023 DWS Investments Australia Limited. CRC: 095110 As of 16.03.2023