How do you make smart beta work in a country that worships dividends? VanEck's answer is to go for equal weight.

Everyone loves a fat dividend cheque—but Australians more than most.

Why do Aussies love dividends so much? Partly due to franking credits, a tax peculiarity which allows dividends to be excluded from taxable income. But also due to what Alan Kohler, the business editor of The Australian, has called "our toxic dividends culture."

Aussie companies that try reinvesting dividends are often punished by investors (like Telstra earlier this year). Thus Australia has no growth companies, like Berkshire Hathaway and Amazon, that continually reinvest dividends into creating cheaper products and better services. The dividend culture has drawn comment from the Reserve Bank of Australia, which blames it on Australia's retail-driven equity market.

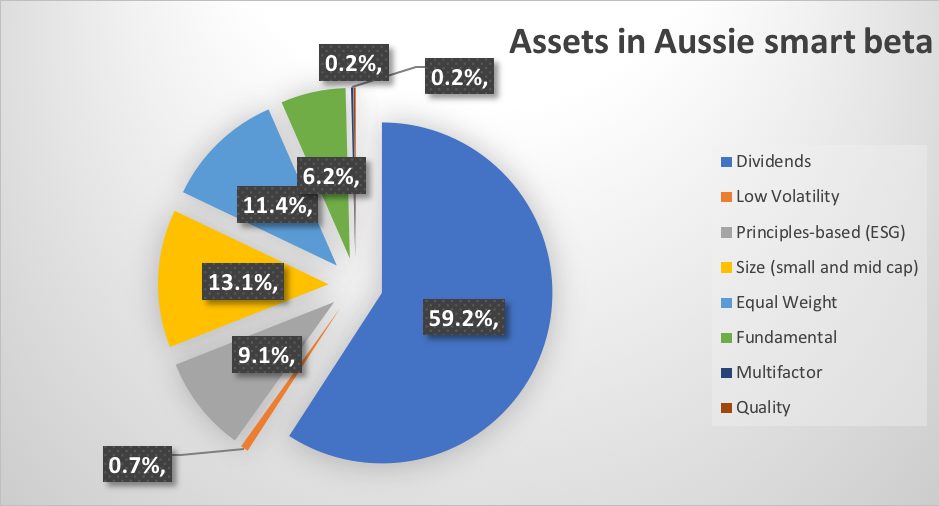

[caption id="attachment_3956" align="alignnone" width="525"] Graph 1: Assets in Australian Smart Beta. Source: ASX[/caption]

Thanks to a passion for dividends, Australia has mostly been spared the lashings of the smart beta revolution. Of the assets that sit in Aussie smart beta ETFs, almost 60% sits in dividend ETFs - a concentration unique to Australia.

For ETF providers, the dividends culture means that listing a smart beta ETF can be a bit of a roll of the dice. For example, Russell Investments tried its hand at listing a value ETF with Australian equities - of a kind seen in many other markets - only to witness it starve from a lack of assets. Almost two years in, BlackRock's multifactor ETF (AUMF) contains only $8 million in assets. The stagnant flows come despite AUMF's record of outperformance.

VanEck's equal weight gambit

In this setting, the VanEck Australia Equal Weight ETF (MVW) has proved something of an anomaly.

MVW is equally weighted, meaning it buys the same amount of every company in an index. If the fund buys, say, $1 of the Commonwealth Bank, it then has to buy $1 of every other company.

The past three years MVW has delivered a return of 11.86%, comfortably above the 8.58% delivered by VAS, Vanguard's plain vanilla ETF. Money goes where it's treated best, and thanks at least in part to its performance, MVW has been raking in cash. So much so that it now sits on a $521 million asset mountain, making it the fastest growing smart beta fund.

What's more - the inflows come despite the fact that MVW has a lower dividend yield than its rival plain vanilla funds.

[caption id="attachment_3955" align="alignnone" width="495"] Graph 2: The performance history of MVW versus VAS. Source: Google Finance[/caption]

Criticism: it's just underweight banks

The success has made MVW something of a poster boy for Aussie smart beta and taken as evidence that non-dividend smart beta ETFs might yet work down under. But with success has come criticism - and not just because of its lower dividend yield.

One of the popular lines of attack has been that MVW has outperformed (and thus attracted flows) only because it underweights banks, which have hit a run of bad luck in recent years.

"MVW continues to perform well due to the outperformance of small shares relative to banks," wrote Chris Brycki, head of Sydney-based robo-advisor Stockspot, in his annual report on Australian ETFs.

"Australian banks… [are] the largest swing factor in determining whether large cap beats small cap and if market-cap ETFs beat equal weight ETFs."

This impression is given body by a comparison with Canada. The TSX 60, like the ASX 200, gets one third of its weight from banks. But in Canada, banks have performed well the past several years. Equal weighted TSX 60 ETFs have still (narrowly) outperformed - but only in the past 12 months, as the Canadian banks' growth has slowed.

[caption id="attachment_3954" align="alignnone" width="498"] Graph 3: The performance of HEW with XIU since inception. Source: Google Finance[/caption]

But for Mr Neiron, boss of VanEck Asia Pacific, Australia's underperforming banking sector is only one part of the story.

"If you look at the index back-tests between 2005 - 2007 when the banks were performing in line with the market, even then the MVW index outperformed," Mr Neiron said.

"Is it to do with the banks underperforming? Well, if you go back to the skewness and look at midcaps like BlueScope which are achieving 400% returns - you're going get more exposure to that through equal weighting. Even in a market where banks do well we're not going to see banks achieve 400% growth."

Criticism: it's riskier

The other criticism of MVW is that it outperforms because it takes on more risk. On rebalancing, MVW invests as much money in the Bank of Queensland as it does the Commonwealth Bank; as much in Whitehaven Coal as in BHP.

To many financial eyes, this style of investing bears a strong resemblance to size premium harvesting, where funds juice up returns by buying smaller companies with more room to grow.

Size premium harvesting is a known method for beating the market. But the strategy is, by all accounts, riskier than market weighted approaches. And indeed, it is its very riskiness, its advocates argue, that ensures the premium does not get arbitraged away.

But for Mr Neiron, MVW is in important respects less risky than its market weighted rivals.

"How do you define risk? By diversification, you're addressing stock and sector risk. We've demonstrated within the live performance of MVW that banks are a sector risk. In using equal weight, you mitigate that sector risk," he said.

"In market and fundamental weighting, you've got significant stock bets on the likes of BHP. So these other approaches are taking stock bets of a kind that we aren't."

VanEck to the future

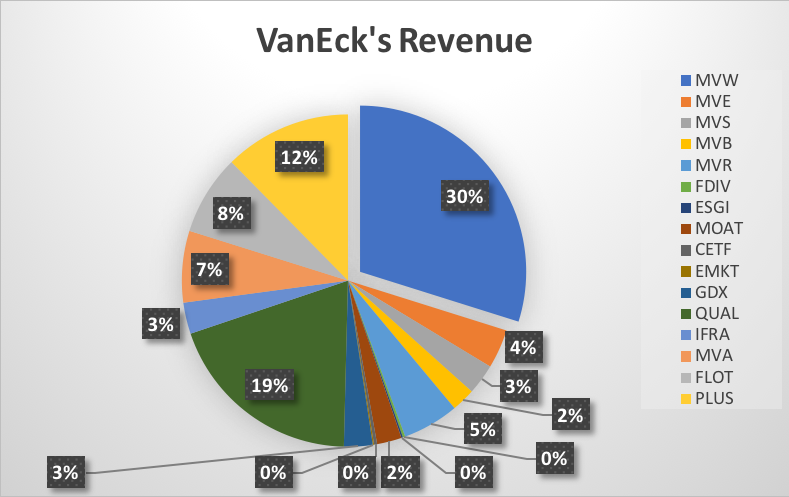

As well as smart beta, MVW is also proving critical in shaping the future of VanEck. MVW accounts for just under one-third of VanEck's total revenue, ASX data indicates. In recent months it has dominated the company's inflows, with more money going into MVW than the rest of VanEck's products combined.

These inflows have helped edge VanEck closer to profitability. As of 31 May, VanEck generated $4.8 million in annual run rate revenue - with $5 million typically cited as profitable territory for Australian issuers.

[caption id="attachment_3953" align="alignnone" width="492"] Graph 4: Percentage of VanEck's revenue created by each fund. For a list of tickers click here. Source: ASX[/caption]

The product's success has also shaped VanEck's brand identity, helping the company to position itself as an alternative ETF specialist and steer clear of the fee war, which has gutted profit margins on plain vanilla ETFs.

What the future holds for VanEck we'll have to wait and see. But if MVW can continue its three-year tear, then one suspects that future will be bright.