A lot has recently been written on the exceptional concentration at the top of the S&P 500 and in technology stocks. In this two-part series, we want to first dig into the drivers and impact of such concentration before focusing on the potential ramifications on US equity investments for the medium to long term.

In the first article, we focused on the S&P 500 itself. In this second half, we will look at the impact of this concentration on non-market cap weighted investments in US equities like income strategies and quality-focused strategies.

Looking back at the first 9 months of 2020, we observe that:

Growth and momentum have strongly benefited from it

Income strategies, value-oriented strategies and small caps have suffered significantly from it

Quality has managed to navigate the environment relatively unscathed.

Strategies have not been impacted in the same way by this technology run bull market

Companies that do not pay dividends have had a disproportionate impact on the S&P 500 this year and this hurt income strategies almost proportionately to how high was their dividend yield.

Looking forward, if we observe a mean reversion of the concentration of the index, the role could be inverted with growth suffering the most and Income or value strategies benefitting from the reversal.

Not all equity portfolios are as concentrated as the S&P 500

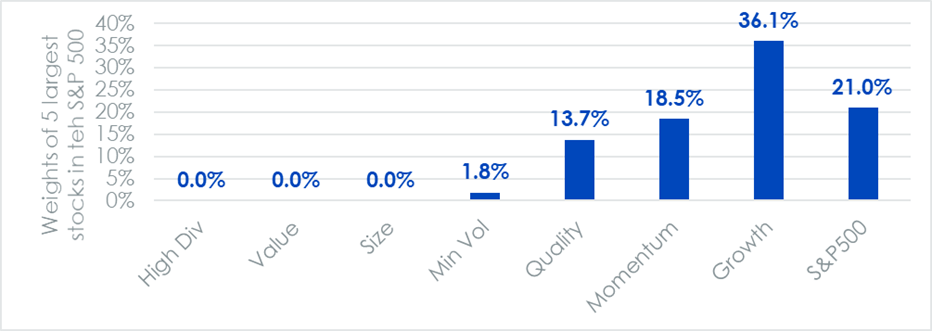

At the end of September, Apple, Microsoft, Amazon, Facebook and Alphabet represented 21% of the S&P 500. As shown in figure 1, this concentration is not shared by all equity factors. Momentum and even more so growth show a large investment in those five stocks.

However, on the other side, high dividend, value, or size were not invested in any of those five stocks because they have too low dividend yields, are too expensive and are too big respectively. In the middle, quality showed a decent investment in those stocks without reaching the concentration of the S&P 500.

Figure 1: Weights of Apple, Microsoft, Amazon, Facebook and Alphabet in different US equity factor indices

Source: WisdomTree, Bloomberg. As of 16 October 2020. Definitions of each factor are available at the end.

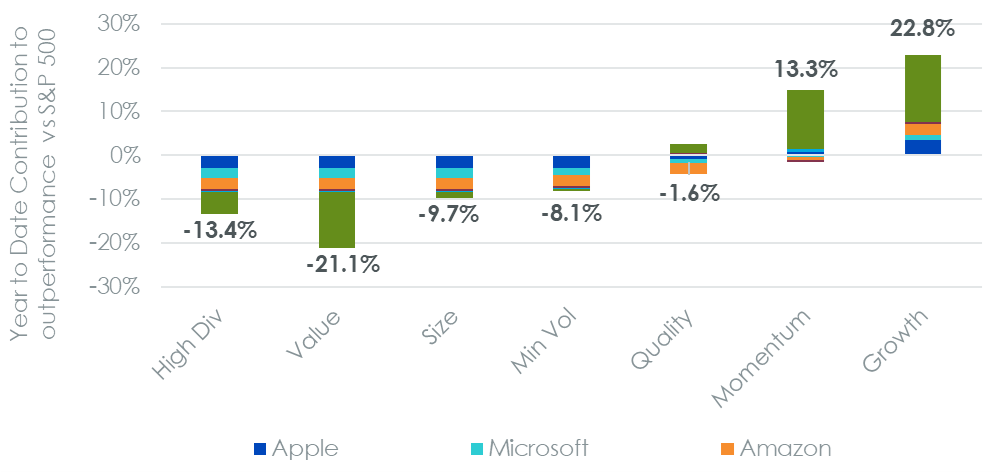

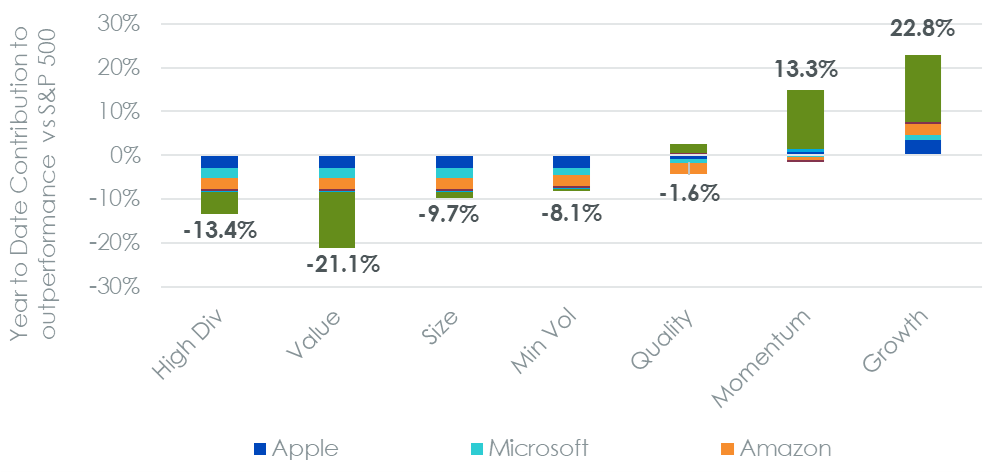

Looking at performance year to date of such equity factors, there appears to be a direct relationship between the weight in the top five stocks and such performance. In figure 2, we show the contribution of the 5 largest stocks in the S&P 500 to the outperformance or underperformance of the equity factors versus the S&P 500.

Without surprise, momentum and growth have been the best performers on a year to date basis in 2020, outperforming the S&P 500 by 13.3% and 22.8% respectively. Growth, for example, benefitted from a 7.56% contribution to the outperformance of the mega-cap stocks that is on top of the 8.35% performance that those stocks contributed to the S&P 500 itself.

Value and high dividend, with their non-exposure in the tech mega stocks, were the worst performers with -21.1% and -13.4% underperformance to the S&P 500, respectively. Having a zero exposure to those stocks means that, like size, they did not benefit at all from the 8.35% contribution of those stocks to the S&P 500 and basically started the year with a -8.35% handicap.

Quality is in the middle once again with a slight underperformance of -1.6% (i.e. it is up 7.8% year to date vs 9.5% for the S&P 500). Looking at the contribution to the underperformance of the Top 5, we observe that quality suffered a -3.57% negative contribution which means that on the rest of the quality portfolio outperformed the S&P 500 by 2%.

Figure 2: Year to Date contributions to outperformance vs the S&P 500 of the five biggest stocks in different US equity factors

Source: WisdomTree, Bloomberg. 31 December 2019 to 16 October 2020. Using Gross TR Index in USD. Definitions of each factor are available at the end.

So looking forward to a potential mean reversion of US stocks and of their impact on the S&P 500 as discussed last week, it stands to reason that roles could be inverted with momentum and especially growth suffering from the correction while high dividend, size or value would benefit from it.

Beware market-cap weighted indices late cycle

We have already discussed extensively of quality in other publications, highlighting its capacity to behave in a stable manner across the market environment. In this instance, it would appear that once again quality is the middle of the road factor which did not benefit nor suffer much due to the recent tech run and which therefore would probably resist well to both a continuation or reversion of that trend.

In a way, quality is the ‘all-weather’ type of play, where high dividend, size or value would be a more overt expression of an expectation of a mean reversion of the growth versus value unbalance.

The disproportionate impact of companies that have not paid dividends on the S&P 500

Another interesting angle to look at the impact of Technology on the performance of US equities year to date is dividend payers versus non-dividend payers. Historically, since the launch of the S&P 500 Index in 1957, non-dividend payers were relatively rare and had the tendency to underperform the rest of the stocks.

This trend has been fading. Non-dividend payers contributed 6% of the 9.45% performance of the S&P 500 year-to-date i.e. 63% when the average weight of companies which have not paid any dividends in the last 12 months in the index was 20.5%. Looking at the companies that did not pay a dividend and that contributed the most to the performance of the S&P 500 Index, we find familiar names: Amazon (+2.4%) Facebook (+0.55%), PayPal (+0.51%), Netflix (+0.4%), Salesforce (+0.35), Adobe (+0.32%), Alphabet (+0.49% across its 2 listings)...

Is issuer concentration a risk for the European ETF industry?

As discussed above this translated into a difficult year for all income-oriented strategies in US Equities. In figure 3, we look at a range of such strategies and we observe that they all consistently underperformed the S&P 500 in 2020. What is even more striking is that there is an almost linear relationship between the Dividend Yield of the index and the performance year to date: The higher the dividend yield, the worse the performance. This clearly illustrates the strong impact of the divide between dividend payers and non-dividend payers this year.

Figure 3: Year to Date Performance of different income-oriented strategies in US equities

Source: WisdomTree, Bloomberg. 31 December 2019 to 16 October 2020. Using Net TR Index in USD. The dividend yield is calculated as the gross dividend amount paid by each stock in the index divided by the price of the index as of 16 October 2020.

Pierre Debru(pictured) is director of research at WisdomTree