That active managers’ shine in down markets is one of the more persistent notions in asset management.

Index funds and ETFs are often said to be fair weather friends: they are there when the sun is shining. But because they just follow the market, and because they do not take defensive positions, they go for long bear-like naps in winter.

But how true is this popular notion? Almost completely false, S&P Global’s new SPIVA scorecard suggests.

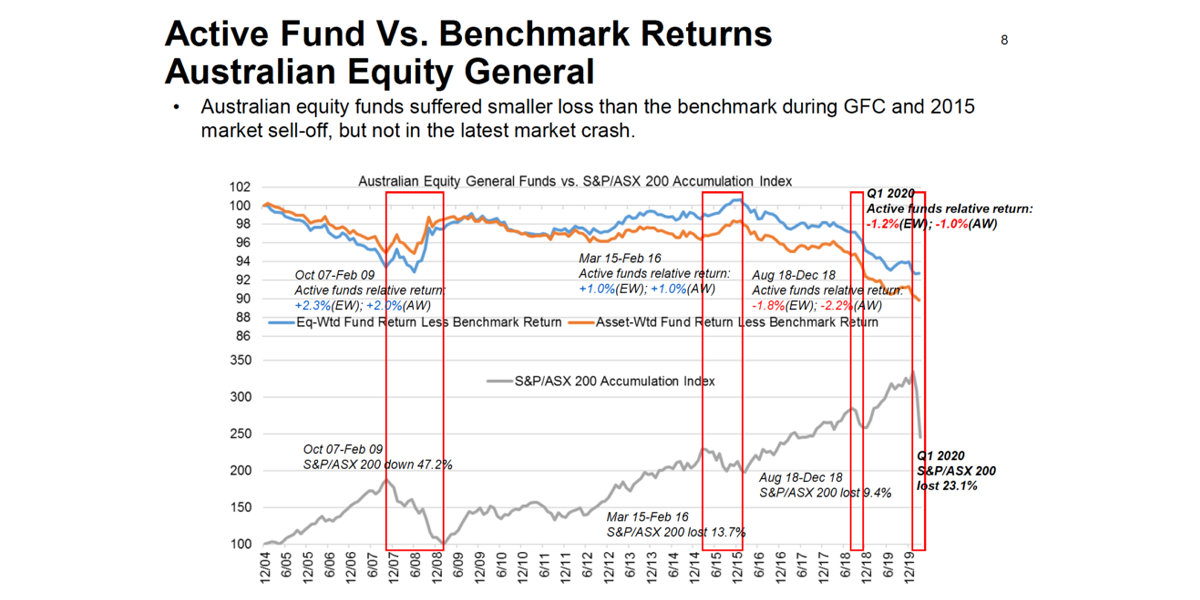

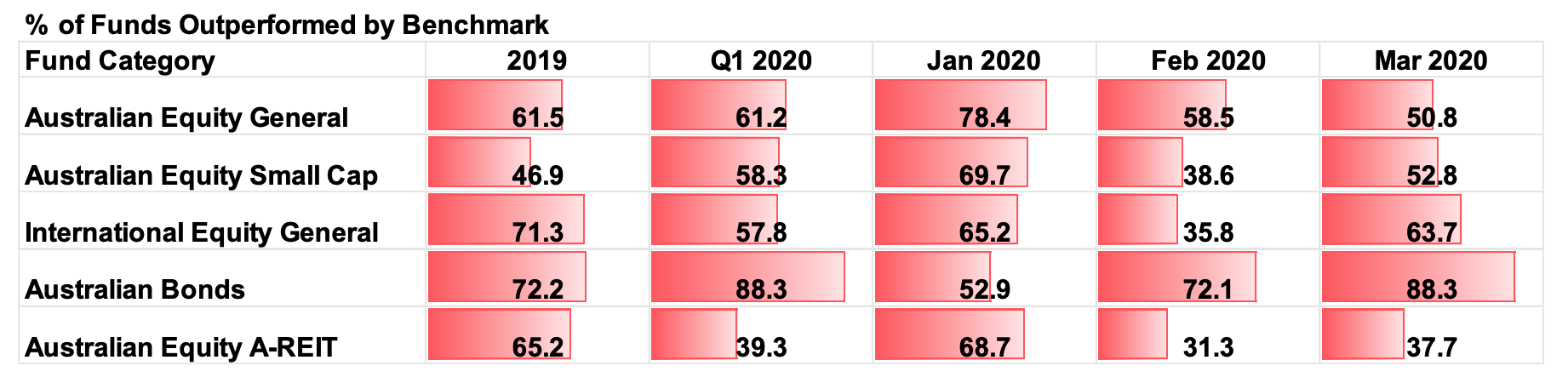

Aussie fund managers were crushed by the index in the first quarter, despite the worst market sell-off in a decade.

A mere one-third of active equity managers beat the ASX 200 – and by extension ETFs that track it – in the quarter.

SPIVA Europe: Active funds underperformed - again

While active managers – true to the popular notion – did better in March, during peak sell-off, than during January, in peak euphoria, even in March only a minority of active managers beat their index.

“A lot of people think that down markets are a great opportunity for active managers as they can show their asset allocations and stock selection skills,” Priscilla Luk, a managing director at S&P, told ETF Stream.

“March was the worst [of the sell-off] and we noticed that more than half the funds underperformed the benchmark.”

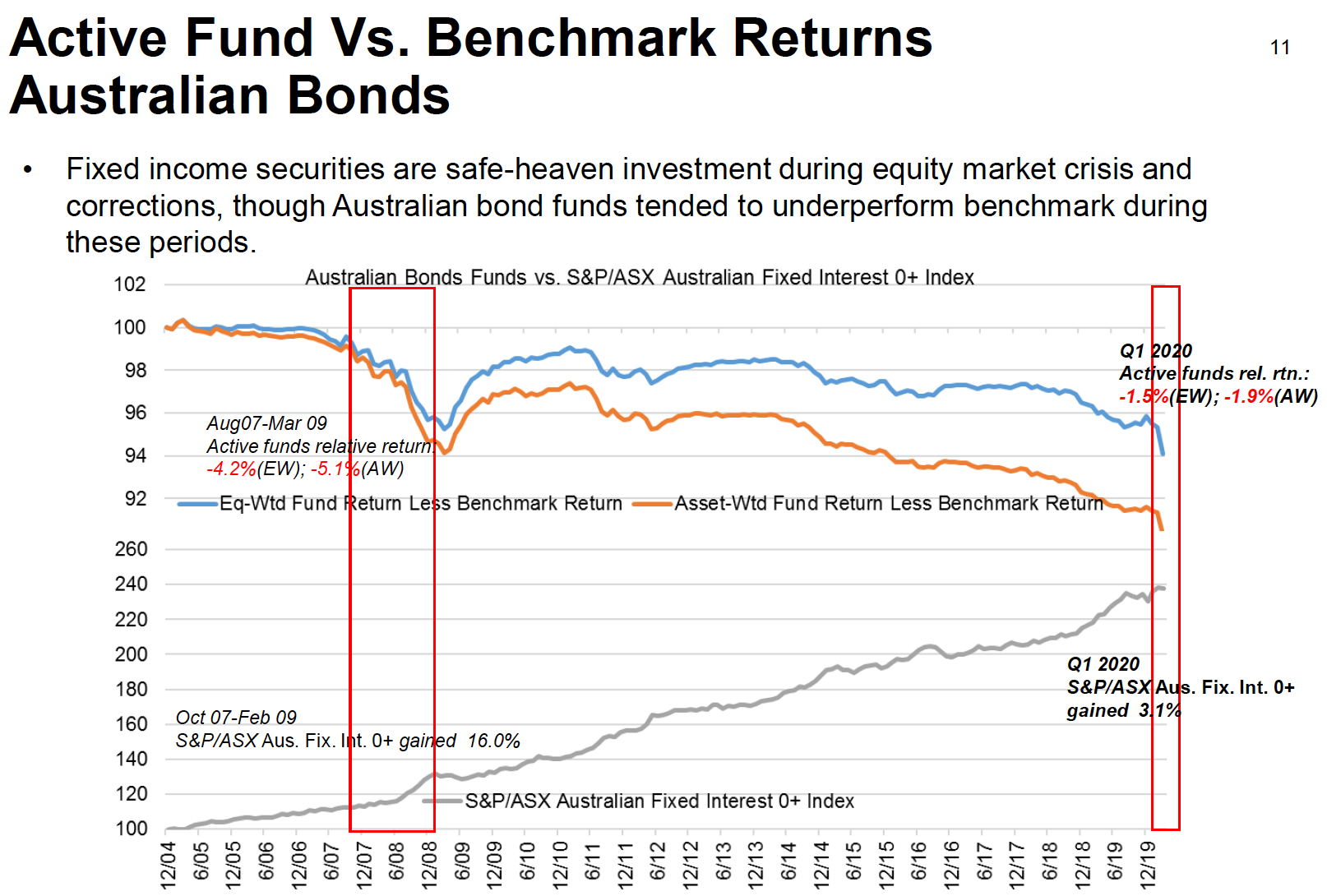

While equity managers underperformed, bond managers were flushed down the toilet. Just 10% of Aussie bond managers beat the index in March, in one of the worst months on record.

The good news: property

There was good news, however, to be had elsewhere for managers.

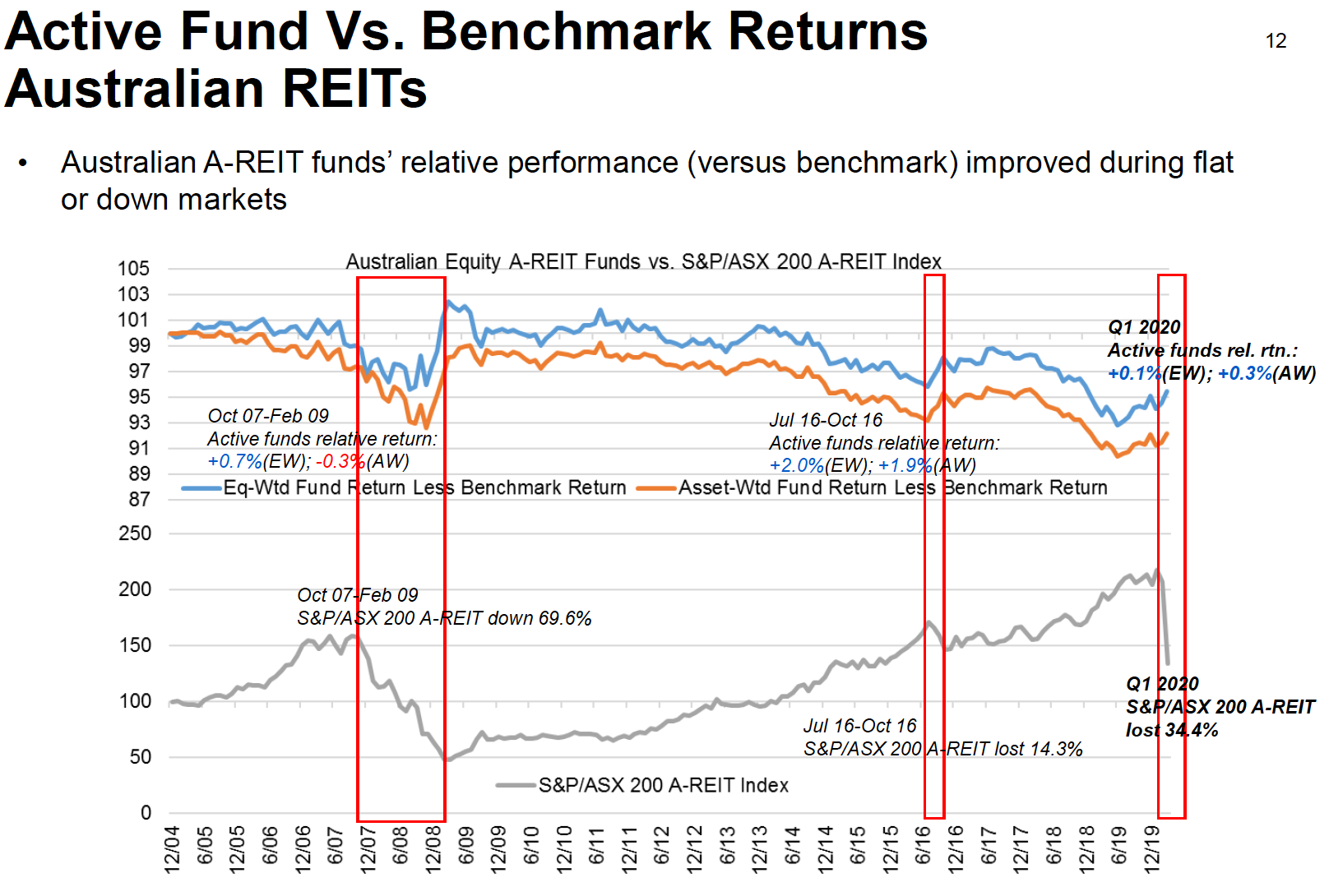

The best news came from the Australian property market – which is measured through Australians real estate investment trusts (AREITs). A two-thirds majority of AREIT managers beat the index in both February and March – which meant that active managers came out on top over the quarter.

Australia bans LIC sales commissions

Active outperformance in the property sector owes to index funds being caught as the bagholders for a number of value trap stocks. These include, most importantly, shopping centres Scentre Group and Vicinity.

Shopping centres and malls have been hammered by the coronavirus as shoppers stay home and buy online instead. Even before the coronavirus began sweeping the globe, active managers had been underweighting shopping malls due to the rise of online shopping.

Active managers also took other cues that shopping malls were in decline, such as the founders of Scentre Group – the Lowy family – selling out completely in late-2019. This meant many managers were well positioned when the virus hit.

BlackRock and Vanguard – across their various funds and ETFs – are among the largest shareholders of Scentre Group. This suggests that index funds and ETFs were left as the bagholders during the sell-off.

According to Luk, AREIT managers have done well in previous sell-offs too. Suggesting that this may be an area where managers add value in certain scenarios.

“There are a smaller range of securities, [and managers] have their expertise that works better. We have seen [AREIT] managers outperform in several large market sell-offs. They have done well when the market is down.”

Sign up to ETF Stream’s weekly email here