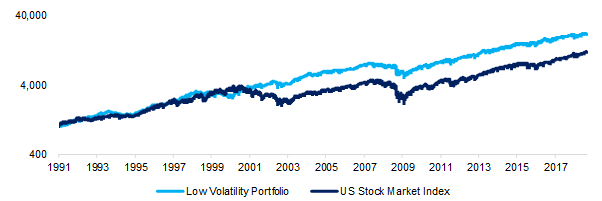

A low volatility portfolio outperformed the US stock market for 27 years

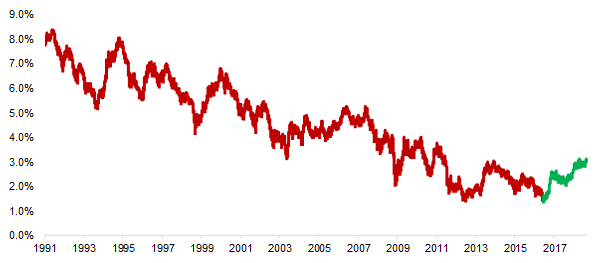

Low volatility stocks have been performing well as a result of declining US interest rates

Low volatility ETFs are formatted to hold a long-positions and become sensitive to the changes in interest rates

Low volatility ETFs account for $46bn AUM in the US, according to a recent

by Nicolas Rabener, managing director at FactorResearch. This figure is understandable given the recent financial crisis which will make any investor think twice about investing in a new fund. Given it's been 10 years since the crisis, people still need the reliability from low volatility stocks and ETFs because another crisis could be right around the corner.

The appeal for low volatility funds is the reduced risk they offer investors. However low risk usually means low returns. Rabener said, since 1991 a portfolio comprised of the top 10 per cent US equities ranked by price volatility managed to outperform the US stock market. Evidently, low volatility would always be the logical option given its performance, even during the dot com crash of 2001 and financial crisis of 2008.

Low volatility strategy vs US stock market

Source: FactorResearch

According to Rabener, the reasoning for the underperformance by the US stock market was due to 50 per cent of the underlying stocks were either in the real estate or utilities sector. Both of which had the highest volatility by sector breakdown so sheds a bit of light on why the low volatility portfolio outperformed the stock market.

Interest rates in the US had been steadily declining over the last 30 years. This was a good thing for companies which are highly leveraged as they can refinance the debt with lower interest rate. However this isn't the case anymore. Since 2016, interest rates have started to rise meaning companies can't benefit from refinancing debt.

US 10-year treasury yield

Source: FactorResearch

Constructing a long-short portfolio would enable an investor to counteract the rising interest rates as it would be less sensitive to the adjustment, says Rabener. ETFs do not have this luxury as the majority of which are in the format of long-only positioning.

Rabener concluded by saying: "Low-volatility stocks were great for risk reduction over the last few decades, protecting capital during equity market downturns. But the long US bond bull market may have run its course, and if bond and equity markets correct simultaneously, low-volatility stocks may not provide so safe a haven."

Therefore if interest rates continue to rise then low volatility ETFs might not be producing the same returns seen over the past 20 years.