Academics from the University of Pennsylvania have found a connection between poor environmental, social and governance (ESG) scores and increased credit risk.

The study, entitled ESG, Material Credit Events and Credit Risk, argues companies whose ESG performance is strong are less prone to changes in their credit rating.

This link, the research noted, was certainly the case for companies which experienced black swan events such as the Volkswagen emissions scandal in 2015.

When it was discovered Volkswagen had been installing software on diesel vehicles that allowed them to pass emission tests, the company’s credit spreads widened 187% to 2.16%.

This was also the case for others events as well like Wells Fargo’s aggressive sales practices which led to the Federal Reserve not allowing the bank to grow assets past 2017 levels until it had shown meaningful improvements on ESG issues.

In the study, co-authors Witold Henisz and Janes McGlinch, both of the University of Pennsylvania’s Wharton School, looked to demonstrate these patterns observed in case studies are “generalisable”.

ETF Insight: Are ETF and index providers taking ESG seriously?

To do this, the duo extended the same process to a broader sample of 342 companies across 13 industries, excluding financials, between 2009 to 2017.

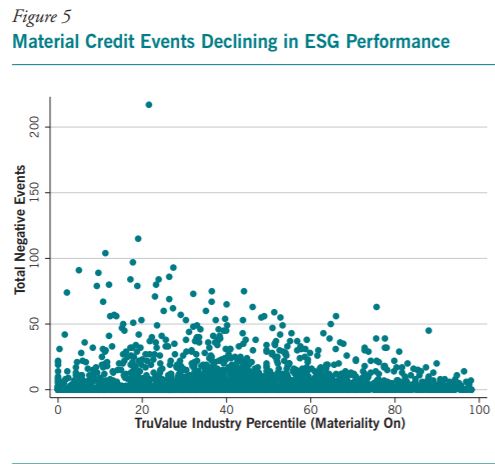

Using Truvalue Labs data, the study found “clear evidence” that higher-performing companies on ESG criteria experienced a lower number of material events.

Source: Henisz and McGlinch (2019), ESG, Material Credit Events and Credit Risk

The duo explained: “These studies and initiatives collectively argue that, given the longer-term horizon of creditors and their focus on downside risk, investors when pricing fixed income securities should, like investors in equities, take account of the risk mitigation benefit from higher ESG performance.

“It appears that the ESG performance measures highlighted in our qualitative and sector-specific research are both predictive of material events that influence credit risk and capture additional information beyond the incidence of those events.”