One of the major advantages of ETFs is the ease at which investors can enter and exit positions due to the intraday liquidity the structure provides.

However, this has fuelled the narrative from critics that ETFs encourage short-term trading and are mainly used to make tactical allocations.

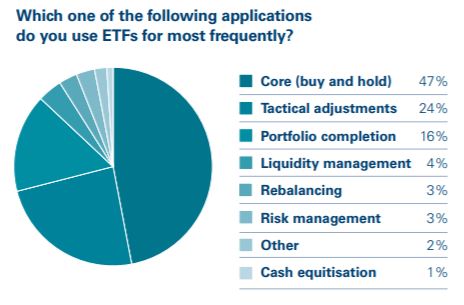

While the tactical use of ETFs still remains an option, a recent survey from Vanguard has found this is not the most favoured way fund buyers use the ETF wrapper.

The research, which surveyed over 400 European ETF buyers between January and March 2018, found 47% use ETFs as part of their core holdings while just 24% use them to make tactical adjustments. Some 16% buy ETFs for portfolio completion and 4% for liquidity management.

The report said: “The ETF market is more sophisticated and nuanced than many investors realise and although tactical use of ETFs does exist, it is far from the most popular reason for buying ETFs.

“Among three of the four countries analysed, the most popular motive is buy and hold, suggesting investors recognise ETFs as a long-term investment tool.”

Source: Vanguard

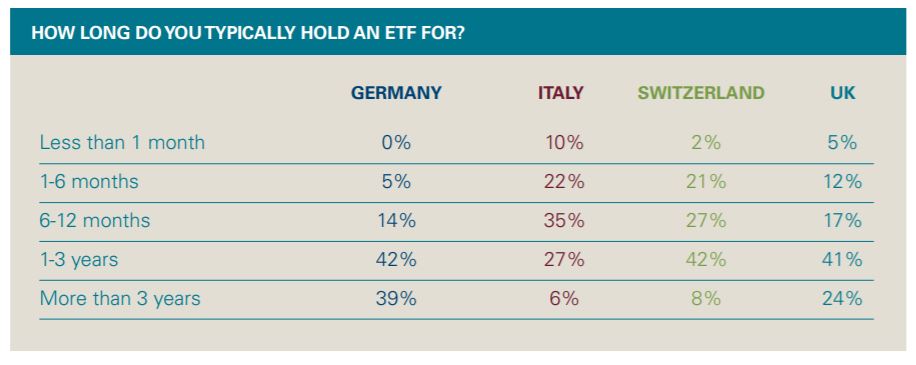

For UK fund buyers surveyed, the most cited length of time they held an ETF for was between 1-3 years with 41% of respondents stating this while this was also the case for German and Swiss buyers with 42% of respondents highlighting this time period.

Some 35% of Italian fund buyers hold ETFs for 6-12 months, the highest score out of all the time periods while just 27% said 1-3 years.

Meanwhile, Italian and Swiss fund buyers typically hold ETFs for a shorter time than their German and UK counterparts with just 6% and 8% owning an ETF for more than 3 years. The most Germans hold ETFs for more than 3 years (39%) while 24% of UK fund buyers typically own an ETF for this time period.

“Regional differences in ETF use are also reflected in the length of time buyers hold ETFs for,” it said. “The majority of Italian buyers hold an ETF for less than a year; in Germany and the UK, however, holding periods are longer with most buyers holding ETFs for between one and three years.”

Source: Vanguard