Between Sustainable Finance Disclosure Regulation (SFDR) chaos and heated ESG debates, sustainable asset allocation has become an increasingly sensitive issue for investors. However, one sure-fire route for exposure to impactful companies is thematic ETFs and perhaps two one-stop-shops from Rize ETF and DWS could offer a unique angle by capturing multiple megatrends within individual baskets.

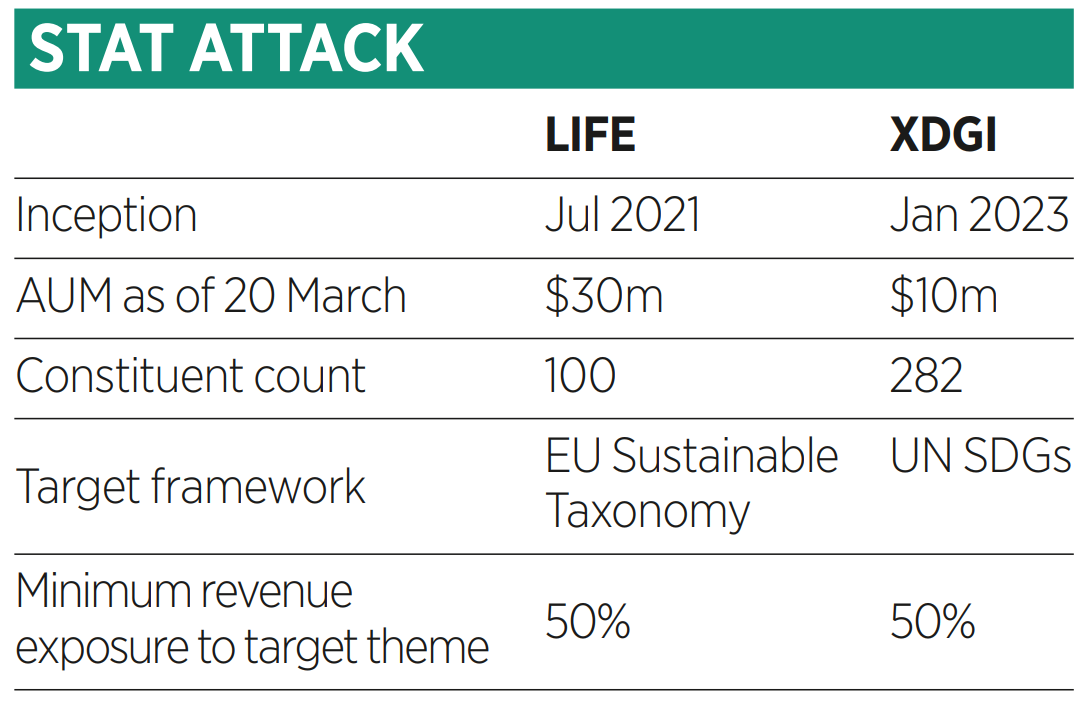

Europe’s first impact smorgasbord ETF arrived courtesy of the $30m Rize Impact 100 UCITS ETF (LIFE) in July 2021, with the product going on to become one of four nominated for ETF launch of the year at ETF Stream’s first annual ETF awards.

Meanwhile, in January 2023, ETF Stream revealed DWS had broken ground in the impact thematic space with a seven-strong suite of ETFs including the $10m Xtrackers MSCI Global SDGs UCITS ETF (XDGI).

With both ETFs amassing around $5m in new money apiece in the two months to 20 March and both falling close to 7% over the trailing one-month period, it is perhaps more appropriate at this early stage to differentiate the strategies by looking at what makes them tick.

Rize ETF’s LIFE

Starting off with the larger and longer-standing ETF from thematic specialist Rize ETF, LIFE captures 100 companies included in the Foxberry SMS Environmental Impact 100 index.

Foxberry’s benchmark aims to offer exposure to companies addressing the six environmental objectives highlighted by the EU Taxonomy for sustainable activities including climate change mitigation, adaptation, sustainable use and protection of water and marine resources, circular economy, pollution prevention and biodiversity/ ecosystem protection and restoration.

The index only captures companies that Sustainable Market Strategies finds derive at least 50% of their revenues from at least one of the six Taxonomy tenets, with a market cap of more than $250m and a low three[1]month average daily trading volume (ADTV) minimum threshold of $1m.

Companies are weighted by their Environmental Impact Score and liquidity, with the former determined using a “proprietary framework comprised of quantitative and qualitative indicators”.

In practice, this sees LIFE capture 10 subsectors including clean water, electric vehicles, renewables and hydrogen and waste management, with top weightings including battery manufacturer EcoPro, electrical hardware firm Rexel, architectural modelling specialists Ansys and renewable energy equipment supplier SMA Solar technology.

Rize ETF added Sustainable Market Strategies can engage companies to clarify their exposure to target subsectors and considers those with higher R&D spending or those likely to becomes leaders in these sectors.

Rize ETF also screens out companies it views as problematic such as Tesla for “poor governance” and Xinjiang Goldwind Energy for violating UN Global Compact principles.

However, its granular approach to sustainable revenue exposure might result in some difficult-to-answer questions. For instance, LIFE awards a top 10 weighting to heat and liquid pump and valve specialist Alfa Laval, which, while engaging in initiatives such as carbon capture, supplies products to the fossil fuel industry. For clients wanting to directly target impact companies, this may be difficult to explain.

DWS’s XDGI

Next is XDGI, which is the flagship of DWS’s seven-strong range targeting investment themes within the UN’s Sustainable Development Goals (SDGs). While other products in the suite target individual themes, XDGI tracks an expansive 282 companies across 15 subsectors captured by the MSCI ACWI IMI SDG Impact Select index.

Within this, the ETF offers exposure to companies listed in 23 developed and 24 emerging markets which MSCI deems as deriving at least 50% of their revenues from ‘environmental impact’ sectors such as alternative energy, energy efficiency, green building, water, pollution prevention and sustainable agriculture, or ‘societal impact’ themes such as nutrition, disease treatment, sanitation, contraceptives, affordable real estate, SME finance, education and connectivity.

XDGI’s index weights constituents by combining their market cap and the share of revenues they derive from target SDG subthemes, with each GICS sector capped at 20% and each stock making up no more than 4.5% of the benchmark.

Within sectors, companies are ranked by the SDG revenue score. This results in DWS’s ETF awarding top weightings to diabetes drug specialist Novo Nordisk, hygiene and sanitary product manufacturer Kimberly-Clark, pharmaceutical firm Bristol-Myers Squibb and renewable energy utilities Vestas Wind and Enphase Energy.

Like Rize ETF’s strategy, XDGI’s index provider MSCI also screens out UN Global Compact violators and companies involved in activities such as thermal coal production and weapons. It also outright excludes companies listed in countries including India, Russia, Saudi Arabia, Pakistan, Kuwait and Egypt and those flagged by its ESG Controversies scoring.

However, like LIFE, DWS’s ETF also features contentious names in its top 10 holdings. One example is Digital Realty – which likely earns its weighting for facilitating connectivity – however, it predominantly operates data centres in the UK and US, which probably is not the global impact the UN had envisaged with its SDGs.

Germany’s largest real estate company, Vonovia, also earns a top 10 weighting owing to its pledge to put solar panels on 30,000 properties by 2050. Given the company already owns more than 420,000 residential and commercial property units, this is not a company with impact central to its business model.

Which is most impactful?

The way the two ETFs target impactful companies differs greatly. DWS’s ETF is built for large inflows, with a broad-brush stroke basket of more than 200 stocks offered at a fee 20 basis points lower than Rize ETF’s strategy.

It is not surprising XDGI’s largest holding is the third-largest constituent of MSCI’s broad beta Europe benchmark. Rize ETF’s strategy, meanwhile, is based on more grassroots research and its low ADTV threshold may put some larger buyers off but ultimately allows it to capture potentially more specialised small-cap companies.

Overall, the biggest difference is how the two cast their impact nets. For Rize ETF, its focus is entirely on environmental impact. For DWS, impact also includes social themes.

While the former might afford LIFE a Sustainable Finance Disclosure Regulation (SFDR) Article 9 rating, XDGI’s focus on SDGs is perhaps more conceptually interesting. Whether SDGs as a framework for classifying impact investments in Europe will gather steam remains to be seen.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.