If you want access to the sustainable ETF sector, or to have some kind of sustainable tilt in your portfolio it's easy to get. There are over fifteen environmental, sustainable and governance (ESG) focused ETFs available on the London Stock Exchange. There are three water ETFs, over twenty socially responsible investing (SRI) ETFs and two dedicated sustainable ETFs.

The most recently launched was the THINK Sustainable World UCITS ETF (TSWE) in January. Since inception to the time of writing it had returned 2.2%.

The other sustainable ETF, iShares' Dow Jones Global Sustainability Screened UCITS ETF (IGSU), has been around since 2011 and has a three month return of 12.4%.

The comparative ESG ETFs, iShares MSCI World ESG Screened UCITS ETF (SDWD) launched in October last year has a three month return of 14.1% and costs 0.20%.

So, what is the difference between them and what impact does it have on your investment?

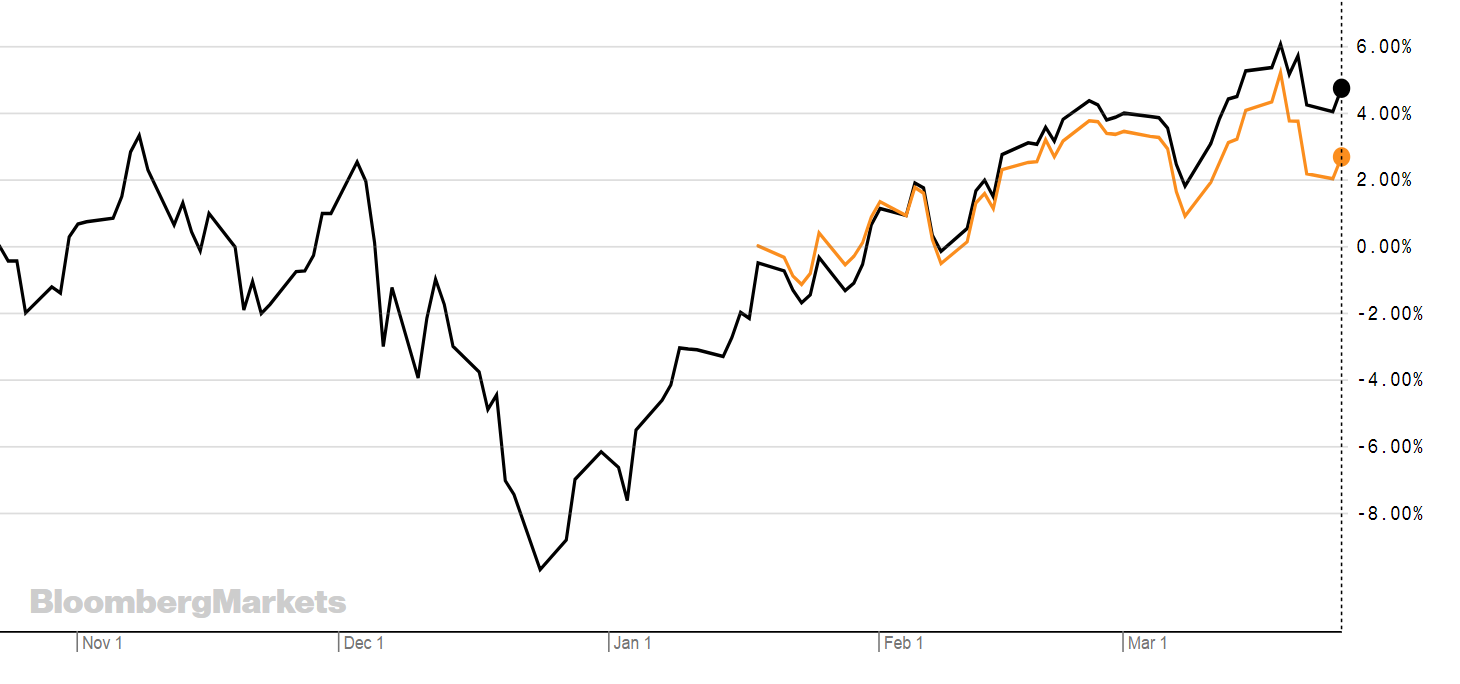

The graph below shows SDWD in black and IGSU in orange. As you can see there is little difference in performance, perhaps SDWD fell a little harder at the end of last year, but the uptick since has been marginally stronger.

Source: Bloomberg

It seems right to group ESG and sustainable investing together in the same camp, and in fairness it is. But there are some subtle differences in the ETFs on offer between ESG ETFs and sustainable ETFs.

The differences come down to the underlying index. In the case of SDWD and IGSU the underlying indices are different.

The top five holdings in the index SDWD tracks (the MSCI World ESG Screened index) are Apple, Microsoft, Amazon, Facebook and Alphabet - some of the biggest equity stocks in the S&P 500. In fact, over 60% of the worlds stock in the index are from the US. If the S&P 500 gets hit, then it's likely SDWD will too.

This is also because the MSCI World ESG Screened Index is based on the MSCI World Index and includes large and mid-cap securities across 23 Developed Markets (DM)* countries. The index excludes companies from the parent index that are associated with controversial, civilian and nuclear weapons and tobacco, that derive revenues from thermal coal and oil sands extraction and that are not compliant with the United Nations Global Compact principles.

IGSU tracks the Dow Jones Global Sustainability Screened index, where the top five holdings are Microsoft Corp, Nestle, Visa Inc, Bank of America and Novartis. US companies account for 43%, so while the majority it's not more than half.

The Solactive Sustainable World Equity Index has a similar set up. It tracks the performance of a selection of the top 250 shares from global developed markets which have been screened according to sustainability criterias set by EIRIS. The selection model filters the shares according to a liquidity threshold and comprised the top ranked shares based on free-float adjusted market capitalization.

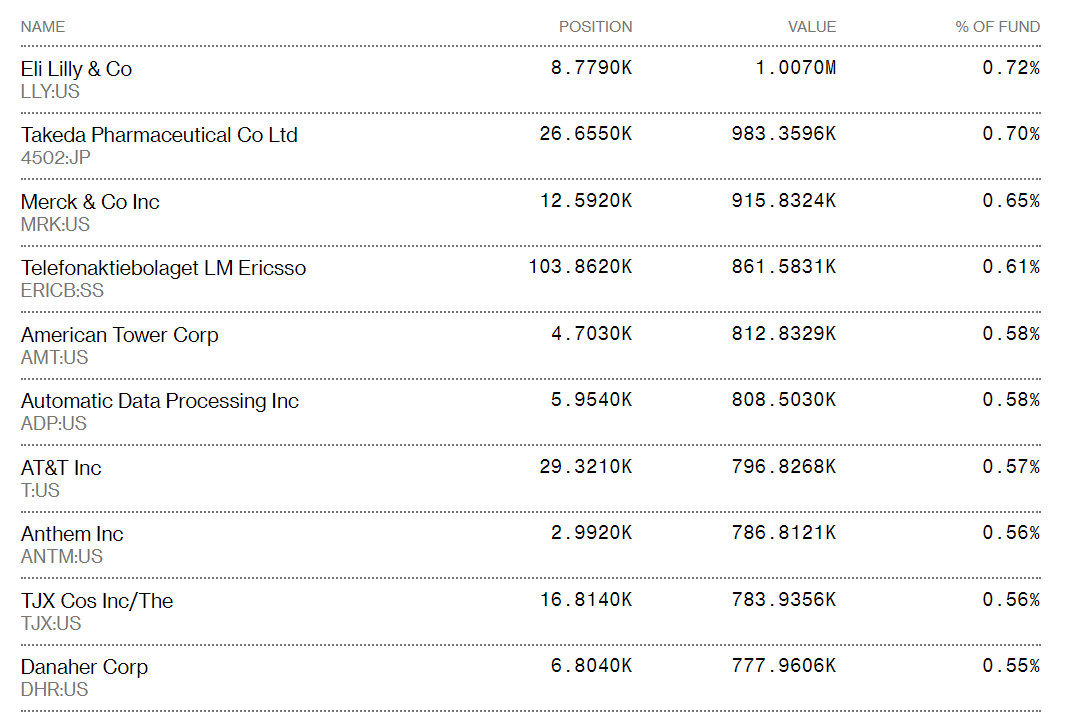

The top holdings in the TSWE look like this.

Source: Bloomberg

SDWD in black and TSWE in orange.

Source: Bloomberg

The question is why you would choose the THINK ETF over the better-known iShares one. Firstly, at 0/3% it's cheaper than the iShares offering of 0.6%.

Another thing to consider is the type of exposure you want.

Yes, the MSCI index has better known names, but as we saw at the end of last year equities crashed, and these stocks weren't immune. (See the graph above in December)

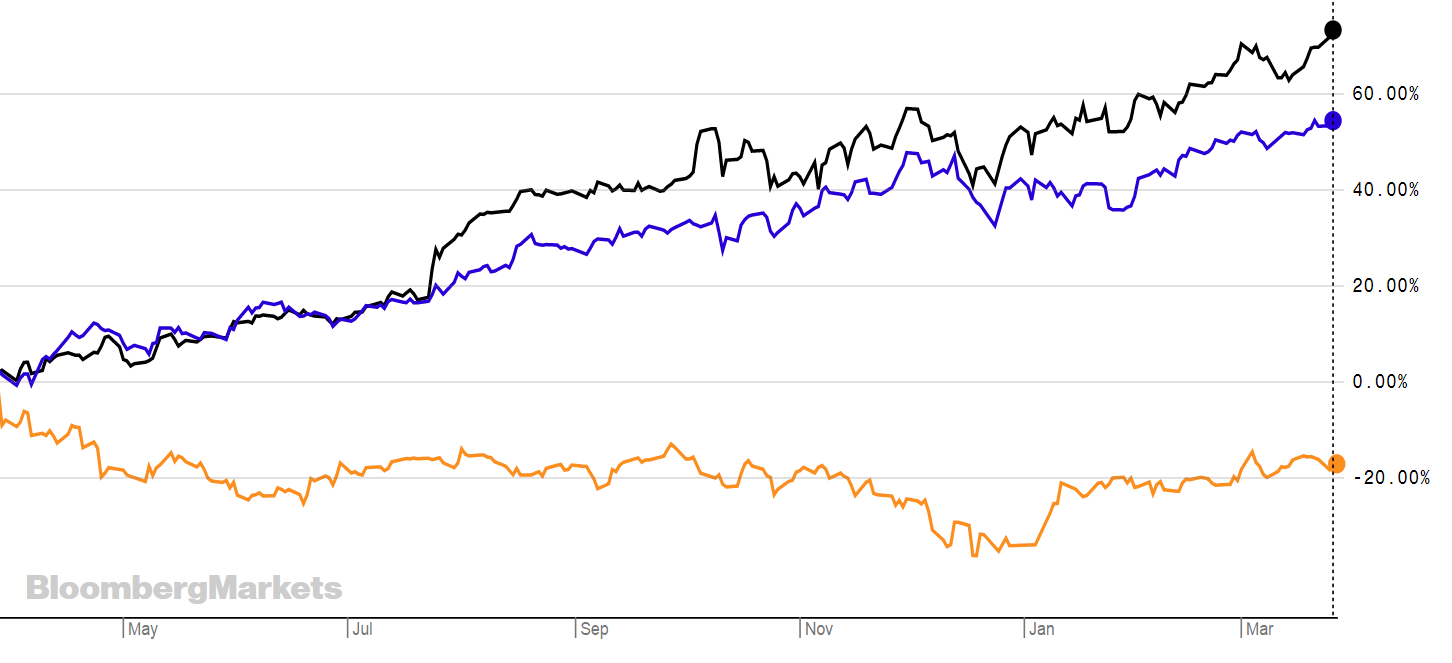

The Solactive index wasn't immune either (see chart below), but its drop was less aggressive than large cap US equities. While the Solactive index fell 7.5% between December 13th and 24th, the S&P 500 fell -11%.

Source: Solactive

The top three holdings in Solactive's index - (see below) LLY in black, 4502 in orange and MRK in purple are taken as an example - didn't really react at all in December last year. Suggesting that the index is more stable and less prone to aggressive drops in times of volatility.

Source: Bloomberg

The THINK ETF is still young, so it's not possible to say how it has weathered downward trending markets. However, as above it seems that sustainable ETFs do fair better in downward trending markets. But it is worth checking what holdings are in the ETF.

The sustainable ETFs available on the London Stock Exchange are listed below.

RTN

IGSU

IGSG

TSGB

TSWE

ETFYTD TERINDEXiShares Dow Jones Global Sustainability Screened UCITS ETF9.24%0.60%Dow Jones Sustainability World Enlarged Index ex Alcohol, Tobacco, Gambling, Armaments & Firearms and Adult Entertainment IndexiShares Dow Jones Global Sustainability Screened UCITS ETF5.57%0.60%Dow Jones Sustainability World Enlarged Index ex Alcohol, Tobacco, Gambling, Armaments & Firearms and Adult Entertainment IndexTHINK Sustainable World UCITS ETFn/a0.30%Solactive Sustainable World Equity Index, which offers exposure to stocks from developed markets worldwide. The stocks have been screened on several sustainability criteria.THINK Sustainable World UCITS ETFn/a0.30%Solactive Sustainable World Equity Index, which offers exposure to stocks from developed markets worldwide. The stocks have been screened on several sustainability criteria.