Thematic ETFs are set to be the fastest growing area of the European market over the next three years, according to an ETF survey conducted by PwC.

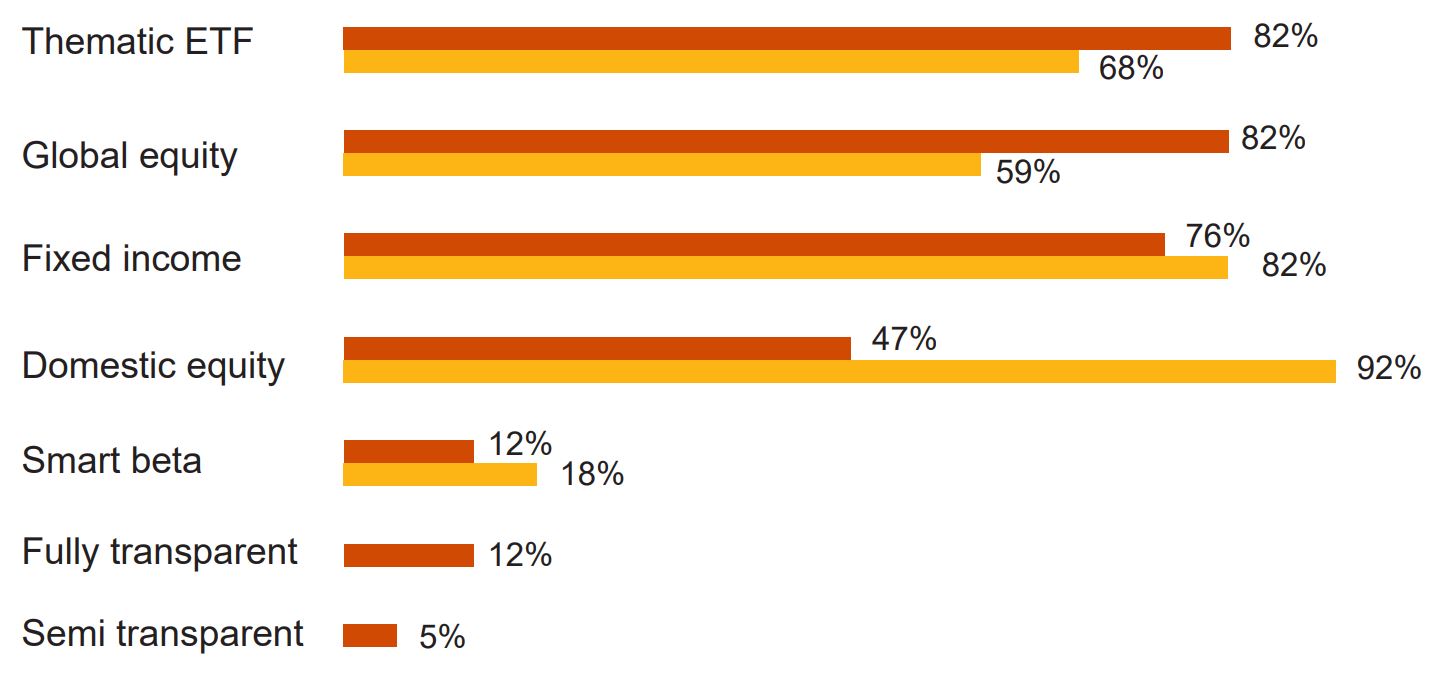

The survey, which interviewed 60 executives from ETF issuers, service providers, market makers and asset managers, found 82% of European respondents forecasted thematic ETFs to be the biggest growth area over the next 24-36 months, up from 68% in 2020.

Elsewhere, some 82% pointed to global equities while 76% said fixed income and 47% highlighted domestic equity.

Chart 1: Asset classes or investment strategies ranked by anticipated demand over the next two-three years (Europe respondents – 2020 vs 2021).

Source: PwC

The report, titled ETFs 2026: The next big leap, said a key driver of this growth was due to the access to sustainable themes such as clean energy or climate change ETFs offer.

Thematic ETFs has been one of the fastest growing segments in Europe over the past few years. There are currently 82 thematic ETFs listed in Europe with $41bn assets under management (AUM), up from under $10bn at the end of 2019, according to data from Global X.

Last year, the segment recorded $12.5bn inflows in Europe as investors used the wrapper to access disruptive themes such as artificial intelligence, clean water and hydrogen.

As Marie Coady, global ETF leader at PwC, said: “In addition to the low cost and liquidity benefits shared by all ETFs, thematic ETFs have particular attractions for investors.

“In particular, the portfolio transparency and diversification of securities enable investors to use ETFs to align their holdings with preferences in areas such as sustainable investing.”

Looking at the wider ESG market, the report warned ETF issuers run the risk of being left behind if they do not integrate ESG throughout their businesses.

The survey found some 46% of respondents predicted over half of their ETF launches over the next 12 months will be ESG focused.

“ESG is far more than just a compliance exercise,” Coady continued. “The shock of the pandemic has increased public pressure to tackle climate change. This has obvious implications for investment allocations and fund design.

“Looking ahead, ESG demands could also spur further development of active and thematic ETFs, which are not tied to traditional market-cap weighted indices.”

If ETF issuers want to grow and evolve with the market, the report stressed the importance of moving quickly. The development of active, crypto and thematic ETFs mean issuers must plan how to stay ahead of the curve, and ultimately their competitors.

Furthermore, the report also warned ETF issuers should prepare for greater scrutiny from regulators as the market becomes more complex and diverse.

Coady concluded: “The ETF market is diversifying as the development and adoption of non-traditional products such as ESG, thematic and crypto ETFs gather pace.

“The influx of funds worldwide together with accelerating innovation is opening up more investment opportunities and customer choice. The need to stand out in an increasingly crowded and competitive arena will spur further development.

“However, regulatory barriers remain in some markets, which are inhibiting or slowing down the pace of product innovation compared to other markets. The winners will be those who adapt at pace, seizing the opportunities that ESG and this new post pandemic environment will bring.”

Related articles