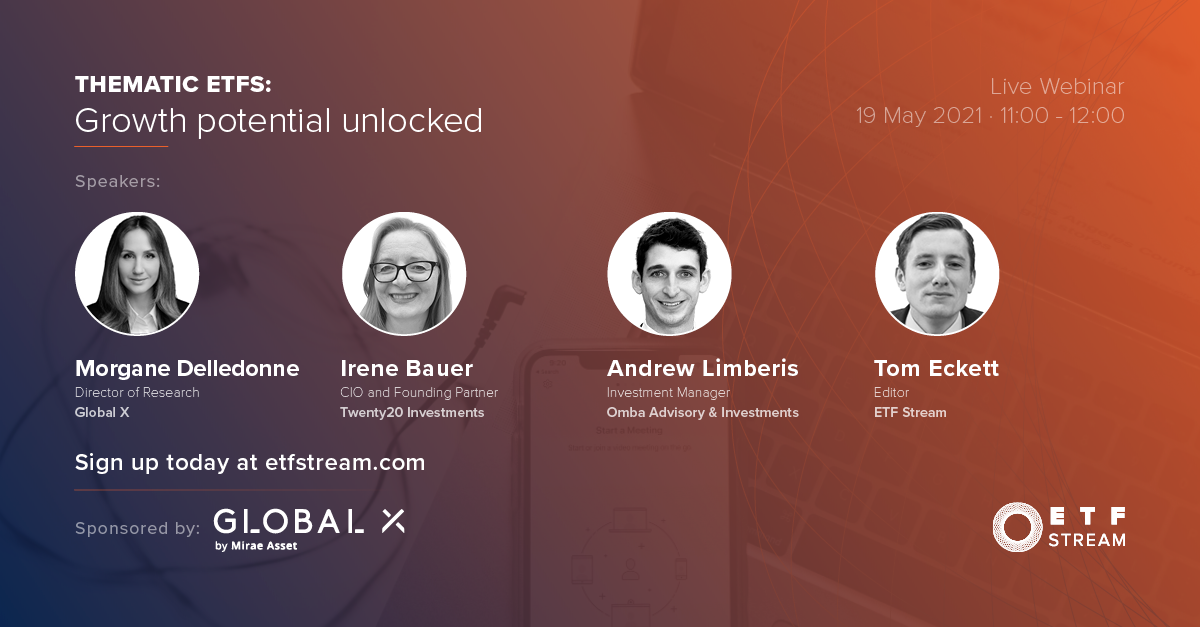

The post-COVID-19 environment, sustainable innovation and the key factors to take into account when selecting megatrends were some of the key areas covered duringETF Stream’srecent webinar on thematic ETFs in partnership with Global X.

The webinar, entitledThematic ETFs: Growth potential unlocked, started by looking at the recent surge across the thematic strategies and what this means for the product class.

Despite smart beta ETFs such as value reclaiming some of the spotlight since the turn of the year, thematic ETFs in Europe still booked their best quarter on record,ending Q1 with €29.4bn assets under management (AUM), up 26.7% from the end of the previous year.

European ETFs start 2021 with record quarterly inflows

Morgane Delledonne, director of research at Global X, said COVID-19 spurred the adoption of disruptive technologies to new consumers and created huge growth in certain themes, especially those related to digital experiences like ecommerce.

“We think the pandemic has acted as an accelerator across the board for thematics,” Delledonne said.

The concern now is that amid a rotation to value and inflationary concerns, a correction in growth stocks could lead to an extended drawdown for thematics.

Unphased, Delledonne said: “We try to capture structural shifts in the economy and society.

“These tend to be long-term in nature, so they take around five to 10 year to reach maturity.”

She added given the long-term view on these future themes, we should not view their valuations the same way as we would view global industry classification standard (GICS) sectors.

“Because thematic investing is structural, market timing is less important than for cyclical themes,” Delledonne continued. “Also, the P/E ratio does not reflect the true value of these themes, what you are paying for is the future sales growth they will provide.”

Areas to watch

Looking ahead, Delledonne said the narratives driving conviction in investment themes last year remain just as true today and the pandemic merely accelerated an inevitable direction of travel towards greater tech integration.

“Vaccines are helping economies open but not equally or at the same pace,” Delledonne continued. “The shift to online retail and shopping is here to stay and we do not think everyone will go back to the office five days a week.”

Cloud computing will also continue to benefit from demand for hybrid work arrangements, while increased tech integration will see cybersecurity services grow as individuals, companies and governments require greater protection for their virtual capital.

Andrew Limberis, investment manager at Omba Advisory and Investments, noted western ecommerce stocks make up large portions of many core index trackers so thematic ETFs offer avenues for diversification into areas such as retail in emerging markets.

“China has strong growth potential and there is a strong tilt to ecommerce – it also offers good diversification from many ETFs which are western focused,” Limberis said.

Both Delledonne and Limberis agreed the stratospheric rise of fintech in 2020 was also a sign of things to come.

“We believe digital payments trends will carry on as they allow customers to make payments through different methods, buy-now-pay-later schemes and even cryptocurrencies,” Delledone said. “We believe these will continue in the ‘new normal’ economy.”

Limberis warned that with many fintech disruptors still in early stages, there are challenges packaging these companies in an ETF wrapper.

“On the fintech side, this is a little bit more difficult to implement as a lot of fintech companies are not yet listed.”

Irene Bauer, CIO and founding partner at Twenty20 Investments, noted there are also challenges finding enough companies suitable enough in terms of operational purity and liquidity to target themes such as blockchain.

However, Bauer said investors can expect more products to come to market offering exposure to areas such as ESG, blockchain and cybersecurity as underlying themes develop.

Targeting themes

When navigating the thematic landscape, Bauer said individuals should be mindful of liquidity and theme purity, and the innate trade-off between these considerations.

“You need to look at the holdings and see what is actually in a product,” Bauer added. “It is good not to go purely by market cap as you may have companies in an ETF which are not as pure play as you would like.”

Limberis continued in a similar vein, saying investors should change their approach based on the underlying theme.

“It is a case-by-case judgement call based on the theme. There is a trade-off between purity and liquidity, with purity bringing risk and more likely to have more small-caps.”

SPDJI’s next consultation could prompt BlackRock clean energy ETF zenith

“In semiconductor ETFs, for instance, pure play ETFs often exclude Samsung, which is obviously a massive player within semiconductors but also other areas,” Limberis said.

Vindicating a more pure-play and targeted application of thematic ETFs, Limberis said his company favours a core-satellite approach to investing, with themes added in areas offering exposure to growth opportunity not covered by broad, core indices.

“GICS are not dead. We will see some evolvement of them. From an investment standpoint, they offer a more diversified framework than a specific theme,” Limberis resolved. “However, thematics will see better growth in percentage terms, if not in absolute dollar terms.”

Sustainability

Another key talking point for thematics is the seminal role they have had in pumping vast sums of money into sustainable investments, with European clean energy ETFs collecting $5.3bn inflows since the start of 2020, as at 23 April.

Limberis thinks clean energy is just the tip of the iceberg, with 2020 acting as an inflection point for investment in sustainable themes as a whole.

“On the environment side, there will be more demand for clean energy, clean food and packaging. Valuations are not particularly high, so these are areas of interest for us.

“We are expecting a massive shift to things like solar and wind. The mindset of the end consumer has also completely changed,” Limberis added.

Of course, clean energy remains at the front of the sustainable narrative. Limberis remains positive about this subtheme, saying recent underperformance – as well as solar power’s current status as the cheapest source of electricity – offers an attractive entry point for renewable power investment.

Investing in emissions reduction: A 2050 view

Delledonne also pointed out the staying power of sustainable themes, with mega cap companies joining national governments in making largest-scale investments. Amazon, for instance, are continuing to invest in solar facilities and are in the process of rolling out their electric delivery fleet.

“This is the initial stages of a decade-long process that will cost trillions of dollars,” Delledonne noted.

Delledonne concluded thematic ETFs will also continue to play a crucial role in the realisation of the initiatives such as the United Nations Sustainable Development Goals, by advancing support for crucial technologies such as carbon capture and plant-based foods.

To watch the full webinar, click here.