Lower management fees may help ETFs absorb more of the futures market, a new report by SocGen suggests.

One of the things ETF providers dream about at night is eating the futures market. The dream is that institutional investors and traders ditch index futures and migrate over to ETFs.

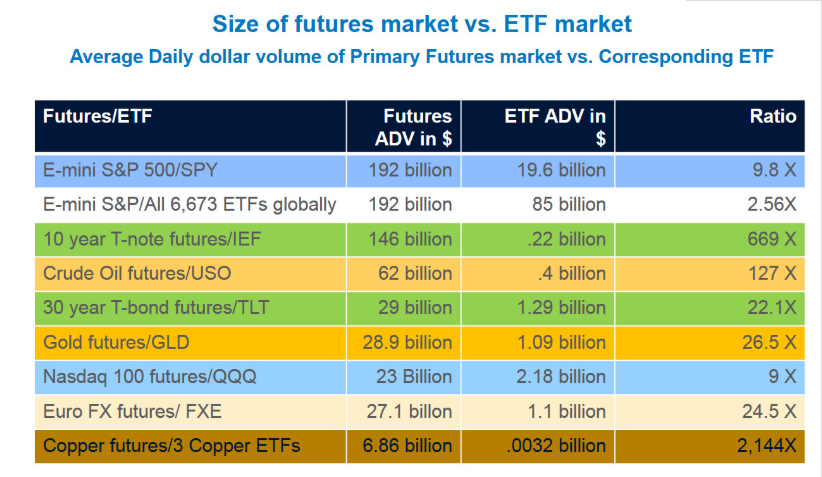

Looking at the numbers it is easy to see why. One type of futures contract - the E-mini S&P 500 - has double the average daily trading volume of every ETF globally combined. Which makes the futures market a potentially delicious honeypot for ETF providers, promising more assets under management and greater liquidity.

Image source: CME Group

Yet such a shift has proved a hard sell.

While ETFs have strengths vis-à-vis futures - no expiry dates or roll, less counterparty risk, more indexes. Institutions making short term trades or hedges prefer futures, as they trade more after the close, do not need to be fully funded, and can be cheaper.

But are institutions right to prefer futures? Perhaps not.

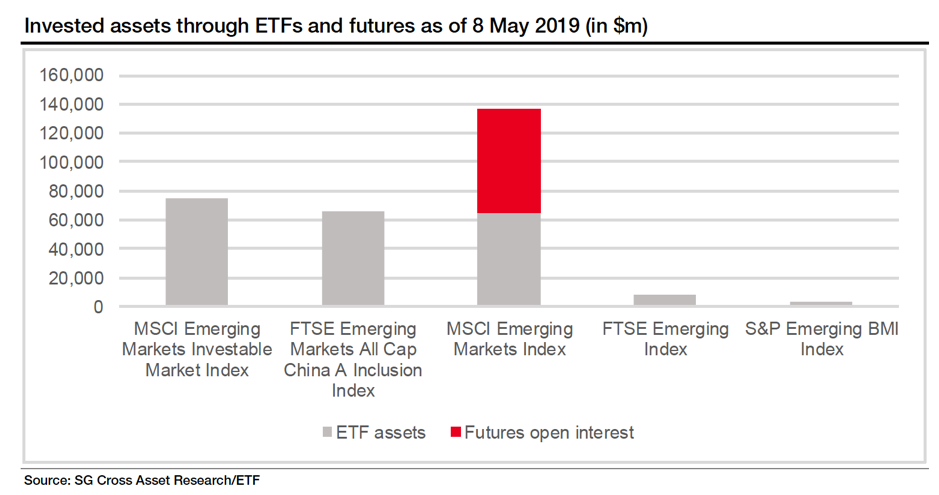

A new paper from French investment bank SocGen suggests ETFs may provide the cheaper more reliable tracking tool, at least when it comes to tracking emerging markets.

Taking the MSCI Emerging Markets Index (TR), the most popular EM index, as a case study, SocGen compared how cheaply and reliably futures and ETFs tracked the index.

For ETFs, this was measured by tracking error. Where tracking error was composed of management fees, cash drag, securities lending yield and replication quality. For futures, it examined costs of funding, by looking at quarterly rolls.

It found that the biggest cause of ETF tracking error was the management fee – by far – meaning that the most expensive ETF drifted almost five times as far from the index than the cheapest. The type of replication – physical or synthetic – mattered less.

“In general, the primary driver of [tracking error] is the management fee. Typically, the MSCI EM ETFs with the lowest management fees tend to be the most efficient structures,” the study said.

“The MSCI EM Futures seem to be an efficient solution over 12 months, based on the current [costs of funding], but some ETFs with low management fees seem to be interesting alternatives.”

The study however excluded trading costs. It also, importantly, excluded the margin costs from clearing houses that futures incur.

The review adds to a growing body of literature that compares the benefits of ETFs with futures for institutional investors.