Some ETFs deserve lots of assets and get none. Other ETFs deserve no assets and get lots.

Eric Balchunas, Bloomberg's ETF talking head, made an interesting point about this. He said Xtrackers' China A shares ETF (ASHS) was like one of those movies that critics rave about yet flops commercially because it struggles to find an audience. (Like Alfonso Cuaron's Children of Men).

ASHS was the first US ETF to own the full gamut of small and mid cap A shares. And was the first to do so directly through an RQFII license from the Chinese government. ETF critics and product experts heaped praise on it. Yet over 4 years, ASHS has gathered only $22M under management. So while ASHS won the critics' choice, it never found buyers.

Which made us wonder: Are there any Australian ETFs like this? Which Australia-listed ETFs are well made, yet lack the assets they perhaps deserve? Below are our ideas.

iShares Edge MSCI Australia Multifactor ETF (AUMF) - $13M

UMF picks and weights Aussie stocks based on quality, value, size and momentum. Rather than bringing out a suite of single factor funds and asking investors to time the market with them, BlackRock rolled all the factors into a one-stop-shop.

AUMF was the first multi-factor ETF in Australia. It outperformed its market-weighted competitors in 2018 and has a higher historical yield. Yet the product has struggled to find a market, perhaps due to limited investor awareness of factors.

ETFS Global Core Infrastructure ETF (CORE) - $6M

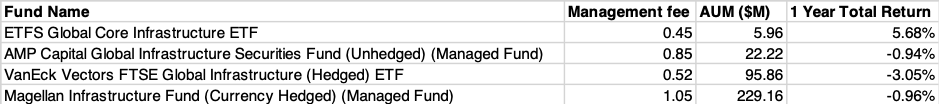

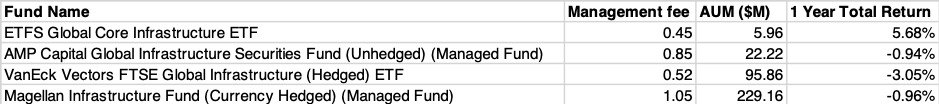

CORE is something of a puzzle. Of the three infrastructure ETFs with 12 months trading history, CORE has the least assets by far. Yet, bizarrely, it has been the best performing and the lowest cost.

Source: ASX, December 2018 ETF Report

Vanguard Global Value Equity Active ETF (Managed Fund) - $12M

The first generation of value ETFs were a miserable failure. MSCI, the index provider, had to pull its original value index because it kept picking the wrong stocks. The second generation of value ETFs were Charlie Munger-style quality at a reasonable price funds (a good example is Vanguard's US-listed VTV). The third generation were deep value plays of various kinds (DVP, RPV, GVAL - all in the US).

VVLU is something of a fourth-generation value ETF. It's actively managed with help from Vanguard's quant team (who are some of the best in the business). With PE ratio of 9 and a PB of 1, the value factor is very much in the cross-hairs. Despite it plainly being a well-constructed fund, VVLU has yet to find its market.

UBS IQ MSCI Japan Ethical ETF (UBJ) - $4M

Japan is a really interesting place to put your money.

For investors looking to access its opportunities, UBJ is a good way to go. It is not a cross-listing, meaning investors do not have to worry about US taxes. It's currency hedged, so the yen is not an issue. The product trades on reasonable spreads and is the cheapest Japan ETF on market.

Why has it struggled? We are not quite sure. But perhaps at this stage investors believe there is closure risk.

VanEck Vectors Australian Bank ETF (MVB) - $40M

The banks are very powerful and make lots of money. And when your banks are very powerful and makes lots of money it makes sense to own them. And own all of them.

MVB provides a neat and easy parcel for doing that. Yet Aussie investors seem to have steered clear of it, preferring to buy bank shares directly.

It's unclear why. Perhaps they don't like the equal weighting. Or perhaps they don't like the fees and spreads - which are on the higher side, considering MVB has only seven holdings, all of which are extremely liquid. Still, given Aussies love of bank shares this product makes more sense than its AUM indicates.