Results are in for Q1 of 2018 for Australian ETFs.

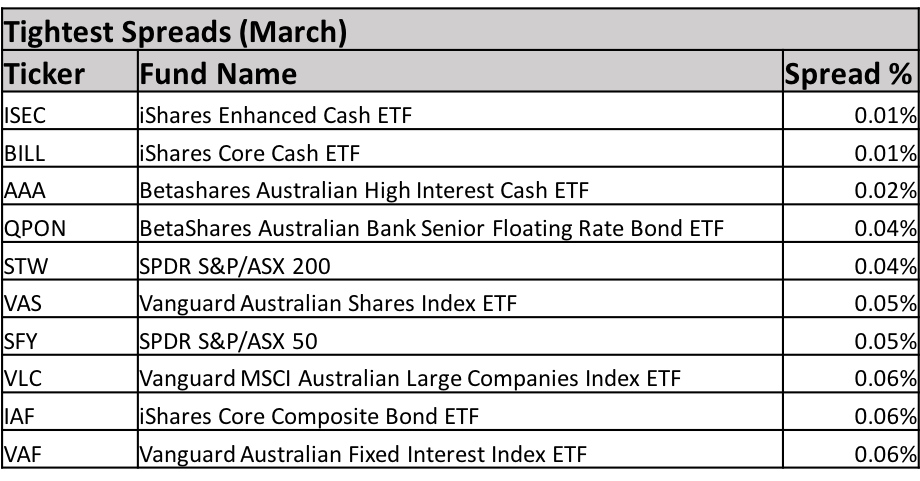

Spreads and Liquidity

The most traded and liquid ETFs in Q1 were cash ETFs. In Australia, cash ETFs provide access to what are, in effect, term deposits - but without the lockup periods. Interest rates available to retail investors are higher in Australia than in Europe, making cash a more attractive asset class.

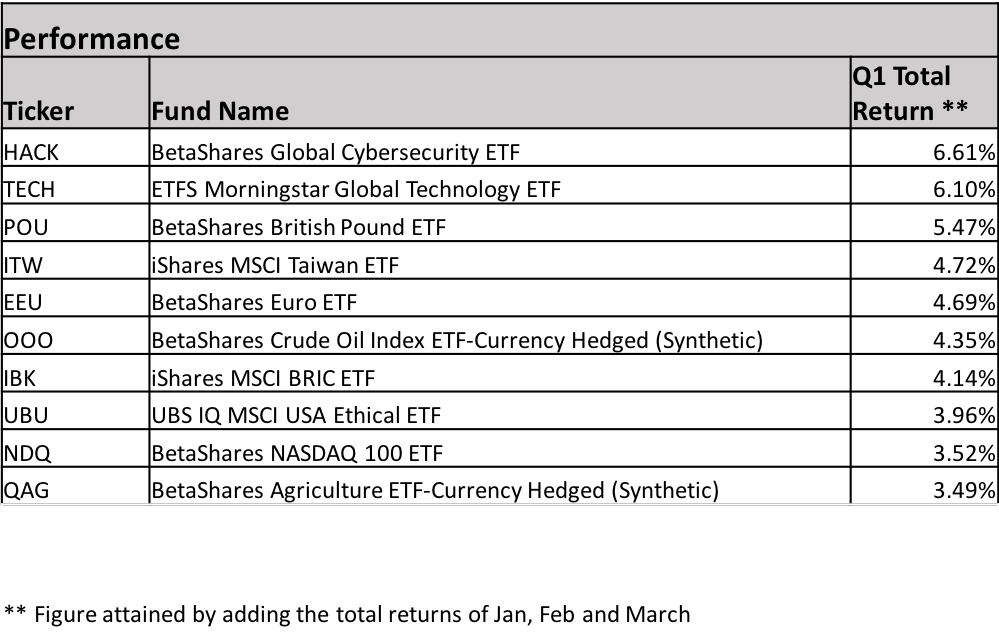

Best performing

The top performers were tech ETFs, reflecting the booming global tech sector (particularly in the US and China) which has charged much of the bull run the past few years.

Highest Yielding

The top yielders have mostly been smart beta ETFs, designed expressly to harvest yields. They've also mostly been global. The results that high yield ETFs can be true to label.

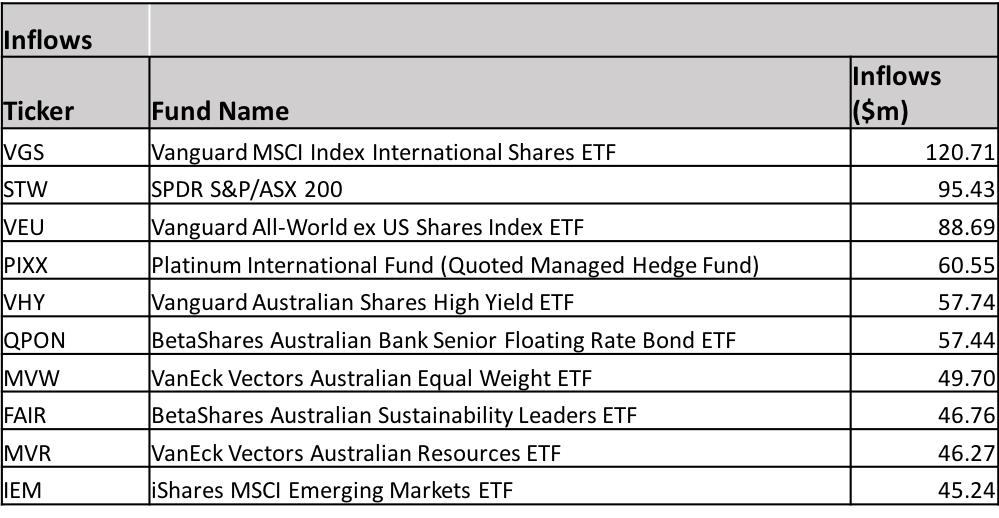

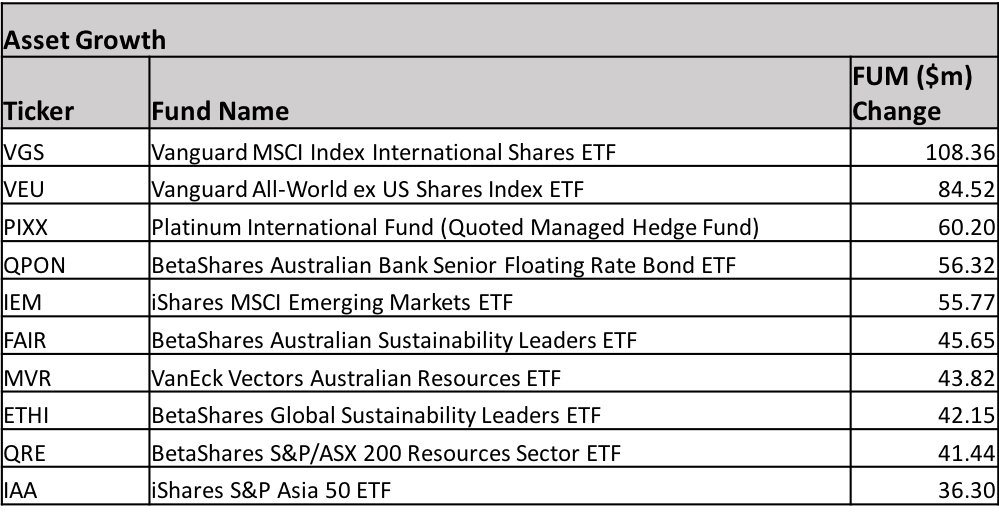

Popularity (inflows and asset growth)

Inflows into equity ETFs in Q1 were smaller than in other quarters, reflecting the February correction. The Australian market continues to be the favourite of Australian investors.

Asset growth offers a slightly different picture (asset growth is how issuers get paid), tilting more international, more and more sector focussed.

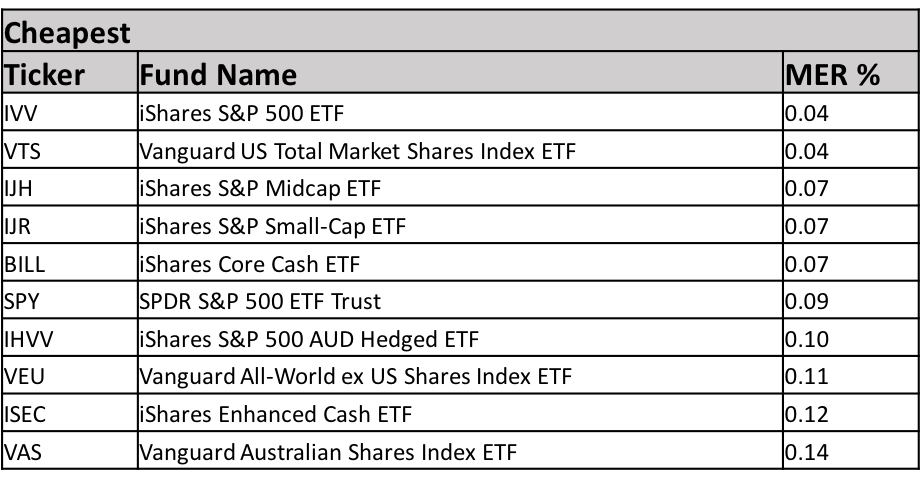

Cheapest

Vanguard and BlackRock appear locked in a race to the bottom on fees. It's interesting that the cheapest ETFs in Australia are international trackers. This partly reflects the higher listing costs in Australia, a smaller securities lending market and lower asset bases.

Acknowledgments and sources:

All data comes from the ASX and their investment products reports in January, February and March. Many thanks to Andrew Weaver, Andrew Campion, Matthew Gibbs and Martha Wood for their assistance.