The Turkish Central Bank raised interest rates last week in a bid to prop up the declining Lira and stop investors fleeing Turkish markets. The Lira has depreciated just over 40% against the US dollar this year and the country's troubles are now sparking panic in emerging markets.

In the past month there has been a sell-off in Turkey, Indonesia and Argentina - all of which have also hiked their rates.

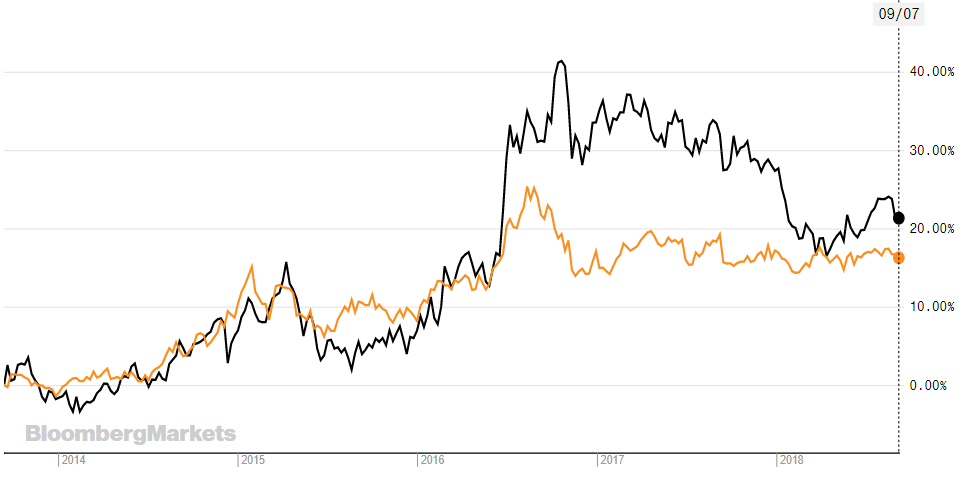

It's a blow to emerging market debt, which has seen stellar returns over the last couple of years. It's done better than comparable developed market government bonds, which have suffered low rates or in some cases negative yields. See graph below: The iShares J.P. Morgan USD EM Bond UCITS ETF (SEMB) is in black and the iShares Core UK Gilts UCITS ETF (IGLT) is in orange (both are in sterling).

Source: Bloomberg

A combination of a strengthening dollar, the Turkish crisis and Trump's trade wars have seen investors start to pull out of emerging market debt this year. According to Morningstar, €1 billion was pulled from Europe-domiciled ETFs in the Global Emerging Market Bond Local Currency category in March, April and May of this year.

However, this may not spell the end of the EM debt story and there are a number of reasons is could still be attractive.

One way investors might be able to get around the issue of a strengthening dollar is to buy EM debt in dollars. LEMB, which is the iShares JP Morgan EM Local Currency Bond ETF on NYSE Arca dropped -7.47% in the past three months compared to the iShares JP Morgan USD Emerging Markets ETF (EMB), which only fell -0.16% in the same time.

One of the issues that crops up when dollar strengthens and emerging markets sell off is that there is a broad decline in prices across emerging markets, but there are still countries and companies that have strong fundamentals and are unfairly punished as a result.

In the case of the recent sell off, there is a good argument that this was a result of specific country underlying fundamentals, such as Turkey and Argentina. This compares to countries such as India, which saw its economy grow 8.2% year-on-year in the second quarter of 2018, up 7.7% in the previous three months and beating market expectations of 7.6%. It is the strongest growth rate since the first quarter of 2016. Trading Economics reports that India has a bond yield of 8.13%. Similarly, Russia's GDP Growth Rate is expected to be 0.50% by the end of this quarter. It is expected to stand at 0.20% in 12 months time and in the long-term, the Russia GDP Growth Rate is projected to trend around 0.90% in 2020, according to Trading Economics econometric models.

If you're tempted to invest in EM debt be aware that accessing the debt isn't easy. Granted, there are a number of ETFs in this area, but they don't come cheaply and the variety isn't huge.

Morningstar only rates two local currency ETFs with a Silver rating. The iShares JPMorgan EM Local Gov Bond ETF (IEML) (in USD) has had a return of -11.18% since the beginning of the year. Its sterling counterpart (SEML) had a return of -8.41%, so it's clear what a strong dollar does. The ETF tracks the performance of the JP Morgan GBI-EM Global Diversified 10% Cap 1% Floor Index.

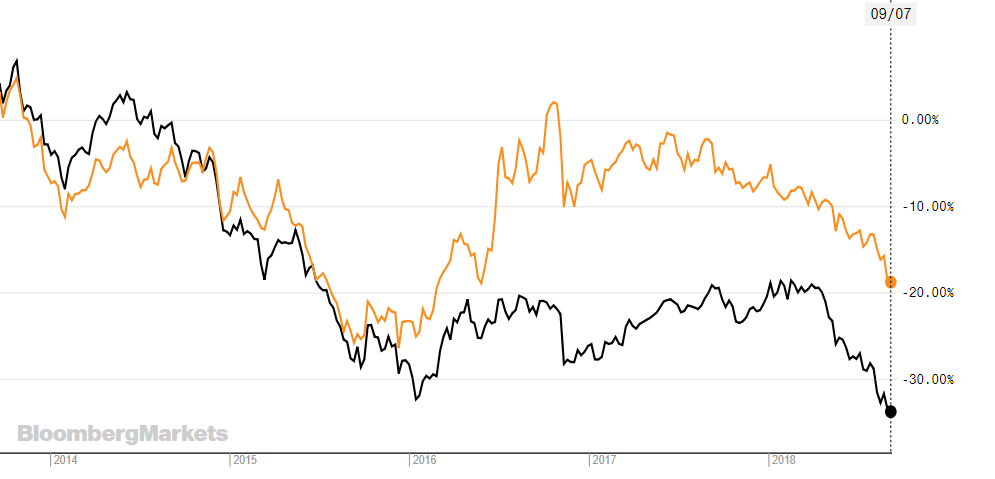

Below shows the difference of the ETF performance as a result of the currency; IEML is in black and SEML is in orange.

Source: Bloomberg

The other ETF that Morningstar rates as silver is the SPDR Bloomberg Barclays Emerging Markets Local bond ETF (EMDD). Again in USD it has returned -8.83% this year so far.

The local currency is something to take into consideration when investing in emerging market debt and hedging can help get around this. For UK investors when buying hard currency EM debt products you want to hedge into sterling, the same is true with ETFs and using the sterling version. As above, it can benefit on the returns.

The sell-off also shouldn't put investors off, Morningstar Investment Management comments that emerging market local currency debt is considered one of the least over valued fixed income asset classes at the moment.

Below is a list of ETFs tracking emerging market debt listed on the LSE.

EEMB

SEMB

IEMB

EMHG

IEML

SEML

EMDD

JPEA

EMLI

XQUA

&

0.35%

JPEE

FXRU

RMB1

&

0.50%

LEMB

JPMB

JPBM

EMCB

EMCO

HYGB

HYEM

EDVD

ETFTERYTD RTNINDEXiShares J.P. Morgan USD EM Bond UCITS ETF0.45%-2.59%J.P. Morgan Emerging Markets Bond Index Global Core IndexiShares J.P. Morgan USD EM Bond UCITS ETF0.45%-2.09%J.P. Morgan Emerging Markets Bond Index Global Core IndexiShares J.P. Morgan USD EM Bond UCITS ETF0.45%-5.20%J.P. Morgan Emerging Markets Bond Index Global Core IndexiShares J.P. Morgan USD EM Bond UCITS ETF0.50%n/aJ.P. Morgan Emerging Markets Bond Index Global Core IndexiShares JP Morgan EM Local Government Bond UCITS ETF0.50%-11.29%JP Morgan GBI-EM Global Diversified 10% Cap 1% Floor IndexiShares JP Morgan EM Local Government Bond UCITS ETF0.50%-8.13%JP Morgan GBI-EM Global Diversified 10% Cap 1% Floor IndexSPDR Bloomberg Barclays Emerging Markets Local Bond UCITS ETF0.55%-8.82%Bloomberg Barclays EM Local Currency Liquid Government IndexiShares J.P. Morgan USD EM Bond UCITS ETF0.45%-5.44%J.P. Morgan Emerging Markets Bond Index Global Core IndexPIMCO Emerging Markets Advantage Local Bond Source UCITS0.60%-11.5%PIMCO Emerging Markets Advantage Local Currency Bond IndexXtrackers USD EM Bond Quality Weighted ETF0.40% & 0.50%-4.32%Markit iBoxx USD Emerging Markets Sovereigns Quality Weighted IndexXtrackers II USD EM Bond ETF XUEM0.25%n/aFTSE EM USD Government and Government-related bond select indexiShares J.P. Morgan USD EM Bond UCITS ETF0.45%-2.58%J.P. Morgan Emerging Markets Bond Index Global Core IndexFinEx Tradable Russian Corporate Bond ETF0.50%-2.87%Russian Corporate Euro BondsFullgoal FTSE China Onshore Sovereign and Policy Bank Bond 1-10 Yr Index ETF0.40%0.91%FTSE China Onshore Sovereign and Policy Bank Bond 1-10 Yr IndexLyxor iBoxx USD Liquid Emerging Markets Sovereigns ETF0.30%-6.19%iBoxx USD Liquid Emerging Markets Sovereigns IndexJPMorgan USD Emerging Markets Sovereign Bond UCITS ETF0.39%n/aPerformance of bonds issued by the governments or quasi-government entities of EM countries globally denominated in USDJPMorgan USD Emerging Markets Sovereign Bond UCITS ETF0.39%n/aPerformance of bonds issued by the governments or quasi-government entities of EM countries globally denominated in USDSPDR BoA Merrill Lynch EM Corporate Bond ETF0.50%1.17%USD denominated EM corporate debt publicly issued in the US and domestic Eurobond marketsSPDR BoA Merrill Lynch EM Corporate Bond ETF0.50%-2.25%USD denominated EM corporate debt publicly issued in the US and domestic Eurobond marketsVan Eck Vectors EM High Yield Bond ETF0.40%n/aICE BofAML Diversified High Yield US EM Corporate Plus IndexVan Eck Vectors EM High Yield Bond ETF0.40%n/aICE BofAML Diversified High Yield US EM Corporate Plus IndexSPDR S&P EM Dividend ETF0.55%-6.88%S&P EM Dividend Opportunities Index