Global equity markets are in confident form, with emerging markets equities are leading the way. The MSCI World index added 0.7% last week, driven by a renewed enthusiasm for high beta stocks. Emerging Markets were particularly strong, gaining 2.0%, leaving EM up a remarkable 27.9% this year. This enthusiasm for emerging market stocks is partly analysts who reckon that corporate earnings will increase markedly this year - according to analysts at French Bank Societe Generale, earnings growth in emerging markets is likely to hit 18% in 2017 before falling back to 11% in 2018.

But analysts at rival investment bank UBS warn that inflows into EM funds which invest in local corporates is beginning to slow down. Citing EPFR data the UBS analysts observe that "GEM funds saw inflows of $625mm last week, less than half the prior week's print and the smallest inflow in six weeks. This sharp deceleration in inflows, despite the 2% week-over-week gain in the MSCI EM Index, was likely a delayed investor reaction to the 3.6% EM pullback in late-September, in line with our view that fund flows follow the markets, not lead them. EMEA funds saw inflows of $169m - above Asia ex-JP ($78m) and LatAm ($69m) combined - which is a 33-week high in USD terms for the region. Dedicated GEM funds ($309m) absorbed just 50% of the weekly inflow. Across countries, China, Korea, Russia and India saw the biggest inflows, while only Taiwan had outflows (-$71m)."

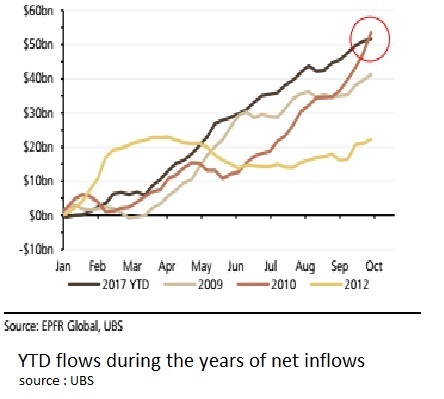

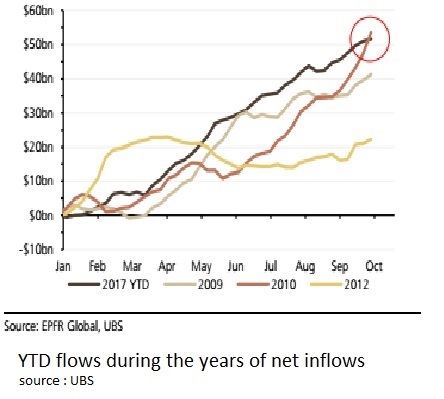

Crucially last week's net inflows were entirely directed to EM ETFs ($1.3bn). "Cumulative YTD inflows to EM now stand at $51.6bn, which has now dropped 3.7% below 2010's record run-rate for this time of year. Almost 100% of the YTD inflows have gone to Dedicated GEM funds; net inflows to LatAm ($2.5bn) and Asia ($1.4bn) have been significantly smaller, while over $1.7bn has left EMEA funds."

According to the UBS report investor interest in Russia, Mexico, Malaysia, and Peru turned more crowded last week. On the other hand, Taiwan, Brazil, Indonesia, the Philippines, and Greece became less crowded. "Russia has climbed 11 positions in our model rank since late-August, when it was the second least-crowded EM. Brazil and India remain the most crowded major EMs, while China and Taiwan are the least crowded big markets."