Hedge fund managers who fail to beat their indexes face career damage and annual salary losses of $500,000, a new study has found.

The study, which may shed light on why active managers mostly underperformed their benchmarks last month, found that hedge fund managers careers are tethered to their medium-term performance.

When they perform well, a virtuous cycle of greater fee revenue and investor inflows is triggered. This translates directly into greater pay and promotions for hedge fund bosses, found the research published in The Review of Financial Studies.

When performance is weak, however, a vicious cycle kicks in. Investors rush to the exit, not wanting to be part of a dud fund, which leads to declining fee revenue. This causes hedge fund managers to be demoted and take salary cuts.

At its worst, when hedge funds get liquidated, the career effects are permanent. Much of the career damage comes from the fact that the reputations of star managers take an irrevocable hit.

The authors concluded: “Persistently poor performance tarnishes the managers’ reputation in the labor market...[this] can act as a discipline device for managers, complementing performance pay.”

The study took hand-collected data on 2,000 asset management executives between 1994 and 2014.

Executives were then classified based on their rank, total pay, and the firm they worked form. Their total pay was inferred using disclosure documents, such as "10-K" forms, and triangulated where necessary from other industries.

Hedge fund bosses are lavishly paid. Source: Ellul, Pagano, Scognamiglio

In their sample, the average hedge fund executive’s total compensation was over $1.5 million a year, with compensation rising with experience.Careers and fund performance were then tracked using data from TASS, Bloomberg and individually scraped from other sources (like professional websites) by the authors.

To determine whether poor performance undermined career advancement, the authors used matched pairs, comparing managers from similar backgrounds where one group succeeded and another failed.

The results found that there was a sharp divergence in pay between fund managers that performed well and those that performed badly and were subsequently closed. With the cost of failure coming to around half a million dollars a year in salary.

Number of active managers outperforming halves

“Following the liquidation of their funds, on average top executives (e.g., CEO, CFO, CIO, etc.) suffer an imputed compensation loss of about $500,000…high-ranking managers of funds liquidated after two years of average underperformance suffer job demotion and an imputed compensation loss,” it found.

The study found that the brunt of career scarring was felt by senior management. Junior staff were relatively spared the fallout of fund liquidations.

It also potentially offered insight into why asset managers failed to buy the coronavirus dip last month. The authors noted: “The labour market appears to penalise more severely the managers of funds that fall short of their benchmark in good times…than those that do so in bad times.”

In other words, managers have a get out of jail card in the bad times, meanwhile, they are discouraged from holding cash in the good times.

It also shines a light on another potential strength of index investing and ETFs: manager career risk is removed as a variable.

Curiously, the study found that asset managers were more accountable than other kinds of finance professionals. Banking, for example, was a mixed bag. The authors noted that some weak bankers – like those who signed off on residential mortgage backed securities in the run up to 2008 – suffered no career setbacks. Whereas other bankers, like those who underwrite bad syndicated loans, would often “switch to a lower-ranked bank, and face demotion”.

Other factors than performance also played a crucial role in determining manager success. Gender, the authors claimed, also played a part. Successful women were not as highly paid as successful men.

The economy also played a crucial role. The authors found that those entering the workforce after the dotcom bubble in 2000 had less prosperous careers than those who entered before it – even when later entrants' funds performed better. The authors attributed this to the fact that the economic fallout of the dotcom bubble was pushed down onto junior staff members, which inhibited advancement:

“Managers who started in the 2000s did not benefit from the earlier boom of the hedge fund industry and instead were hit by the crisis...while their seniors had already reached top positions that sheltered them from the effects of the crisis.”

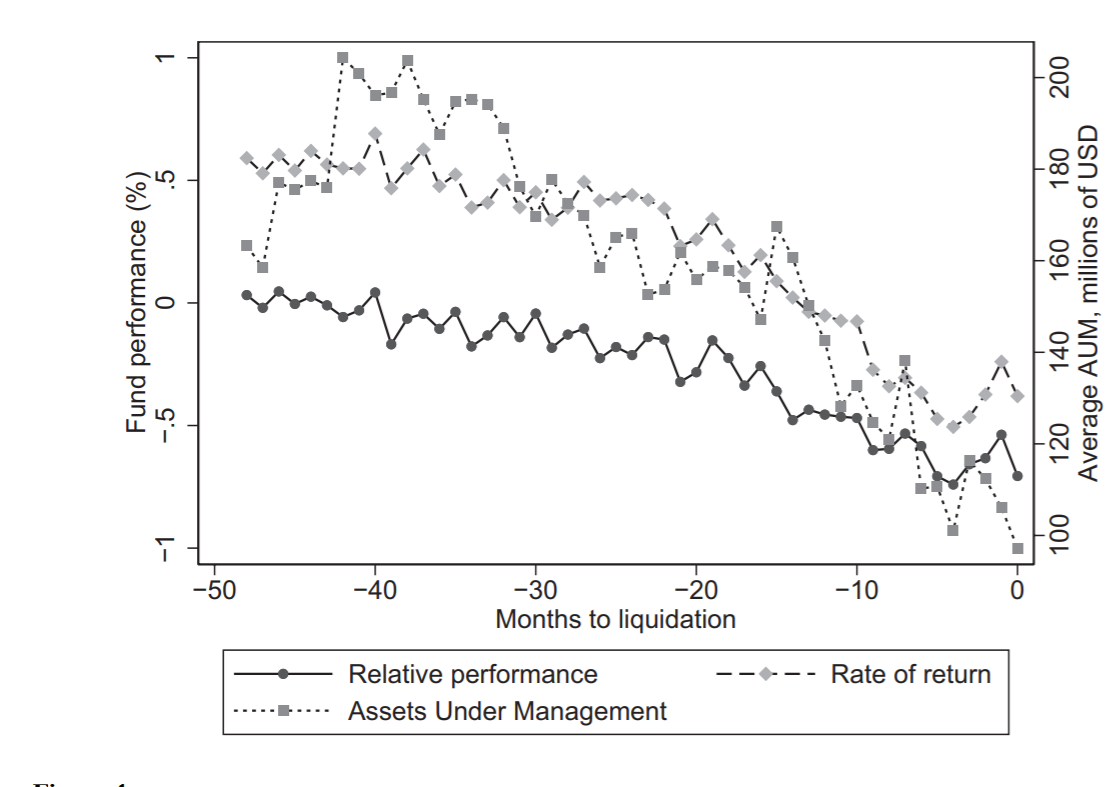

Assets under management and liquidation were robustly associated with performance. Source: Ellul, Pagano, Scognamiglio

The results were consistent with previous research on mutual funds, which found that mutual fund managers' decisions were also influenced by fears around career risk.

Sign up to ETF Stream’s weekly email here