VanEck’s semiconductor ETF has broken through $1bn assets under management (AUM) in Europe as buzz around artificial intelligence (AI) sees the large cap tech names soar in H1.

While the VanEck Semiconductor UCITS ETF (SMH) and its US-listed equivalent now house more than $10.5bn combined, recent momentum has been driven by performance rather than investor flows into the strategy.

SMH has seen $14m inflows so far this year, as at 9 June, however it has returned a considerable 49% over the same period, according to data from ETFLogic.

The strong performance of Europe’s largest semiconductor strategy is led by its high conviction basket of 23 stocks, especially its concentration in its top positions.

Its five largest allocations – Nvidia, Broadcom, ASML, Taiwan Semiconductor Manufacturing Company (TSMC) and Advanced Micro Devices (AMD) – comprise 51.3% of the strategy and have returned 176%, 54%, 33%, 31% and 102% so far this year, respectively.

Leading this has been the dominance of AI headlines inspired by the likes of ChatGPT and Bard which have been a boon for companies supplying the hardware underlying the next generation of AI innovation.

The posterchild of this has been Nvidia, which recently became the seventh US company to earn a $1trn valuation – inspiring a new investing moniker, ‘the magnificent seven’.

While Nvidia claims the top spot in every semiconductor ETF in Europe, its peer group of seven mega-cap tech, communications and consumer discretionary peers have added a combined $3.6trn in market cap so far in 2023 while the other 493 S&P 500 constituents have added a comparatively meagre $100bn.

SMH currently has a 13.4% allocation to Nvidia, however, rival product the Lyxor MSCI Semiconductors UCITS ETF (CHIP) had a weighting as high as 25.3% to the company in May. Both products will cut the company to 10% allocations at their next respective rebalances.

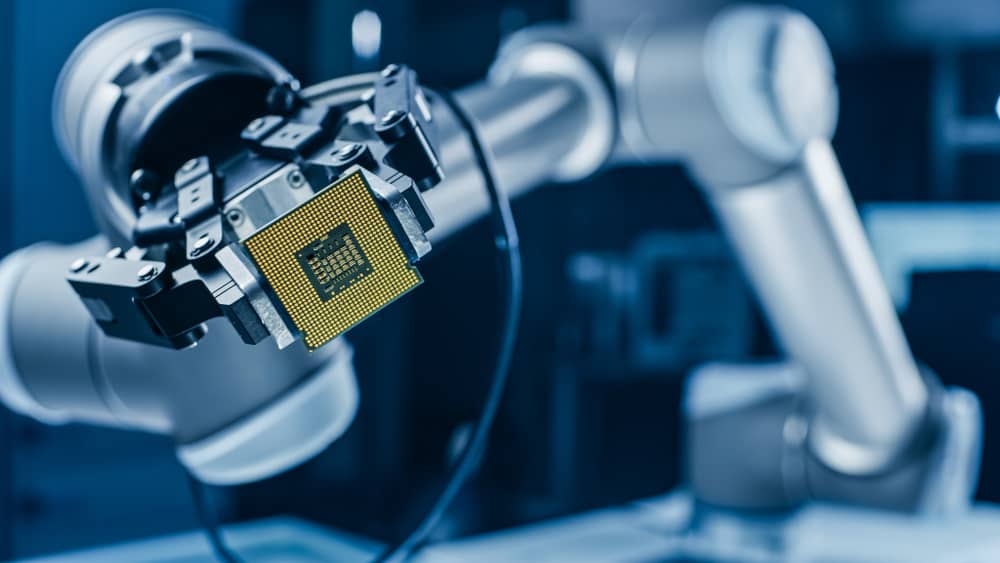

Commenting on the market cap milestone, Martijn Rozemuller, CEO of VanEck Europe, said: “The development of future technologies such as robotics, cloud computing or autonomous driving and the currently widely discussed artificial intelligence, is leading to a growing demand for advanced computer technology.

“The research and development effort in the industry provides competitive advantages for established semiconductor companies, which can have a positive impact on their performance and profits and provide a motive to invest in shares of such companies.”

While many tout the transformational potential of technologies such as AI, a number of commentators are becoming increasingly wary of the investor speculation surrounding the theme and how long positive sentiment can be sustained against a backdrop of question marks over monetary policy and potential recession.