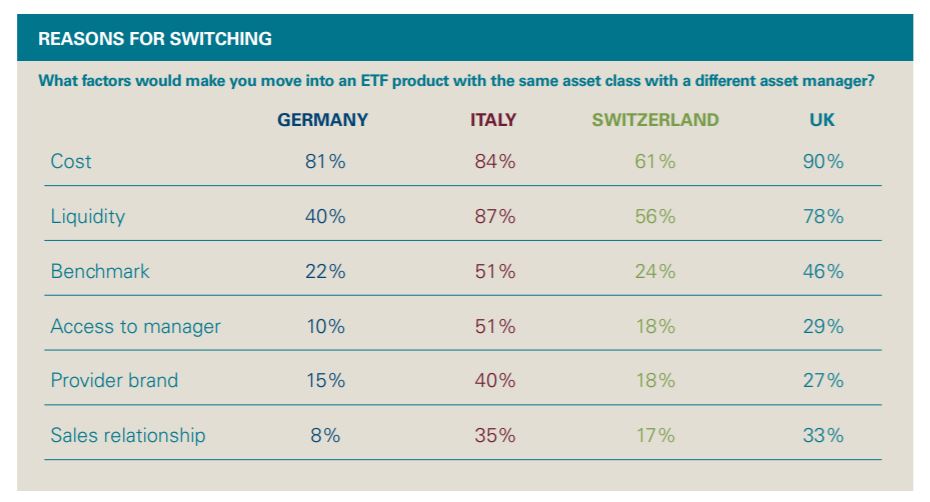

Cost is the key factor that would cause fund buyers from the UK, Germany and Switzerland to switch ETF provider however, for Italian selectors, liquidity is the top concern, according to a recent survey conducted by Vanguard.

The research, which surveyed over 400 European ETF buyers between January and March 2018, found 90% of UK fund buyers highlighted cost as the key factor which would make them switch asset manager, while liquidity and the benchmark was second and third with 78% and 46%, respectively.

German and Swiss buyers had the same top three as UK selectors while, cost was the second most important concern behind liquidity for Italian fund selectors with benchmarking and access to a manager was tied third.

Furthermore, the report said when factors such as cost and liquidity are closely matched, the impact of the provider’s brand increases and can in some scenarios even be a tiebreaker when the products are very similar.

“It is not all about cost, though,” it noted. “Buyers also value liquidity, the strength of relationship with the ETF manager, and the overall provider brand. These are not nice-to-have factors; they play a key role in driving provider selection decisions.”

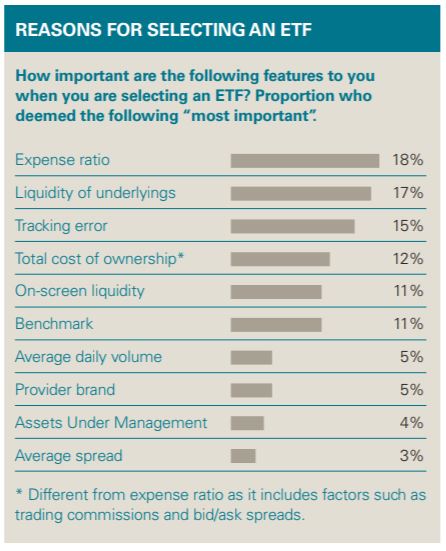

Overall, the survey found expense ratio was the most important factor for fund buyers when selecting ETFs, with 18% of respondents highlighting this.

Expense ratio was closely followed by liquidity of the underlying holdings, which scored 17%, while 15% of respondents noted tracking error.

Rounding off the top five factors was total cost of ownership and on-screen liquidity, which scored 12% and 11%, respectively.

With 17% of fund buyers noting liquidity as the most important factor, Vanguard said this “reinforces the important role ETFs play in allowing investors to enter and exit markets smoothly, and at scale”.

“[However], without doubt, cost is a primary consideration – even though costs in the ETF market have already been driven down greatly. Some have calculated that ETFs are now easier and cheaper to buy than futures.

“Elements such as benchmark and brand are also seen as important, with benchmarks offering specific exposure a much more prominent consideration.”