Judging by the huge positions in volatility-related ETPs in the US, there is almost certainly an army of investors betting on an imminent correction. A parallel debate centres around the prospects for inflation/stagflation, while yet another debate swirls around the possibility of another taper tantrum following a bout of monetary tightening. In a sense, all these debates are interrelated.

At their core, these debates hinge on the question of whether we collectively believe that multiple turning points are likely to emerge in the next few months. In no particular order of importance, I would highlight three key debates:

Is this the start of an inflationary cycle?

Is this the beginning of the end of QE in its current form?

Is this the peak bubble and are we due for a big market correction?

Over the last few months, everyone and their mother has been throwing their analytical tools at these debates. As you would imagine, the answers are about as clear as mud, hedged in by a multitude of caveats and warnings.

Analysts at French investment bank Société Générale for instance have been attempting to answer the obvious tightening question – if policy tightens, which asset classes might do better?

In the bank’s regular Practical Quant Investor publication, the analysts reminded us that the consensus view is that “accommodative policy should support equity valuation through lowering the cost of capital and stimulating economic activity and firms’ aggregate earnings, while monetary tightening would lower equity prices given its implied higher discount rate and/or lower expected economic activity and aggregate earnings”.

The problem of course is that different monetary regimes are associated with different policy regimes, with loose monetary policy tending to coincide with recessions and poor economic growth, while restrictive monetary policy and rising interest rates are generally indicative of stronger economic prospects, particularly in periods of benign inflation, which supports strong equity performance.

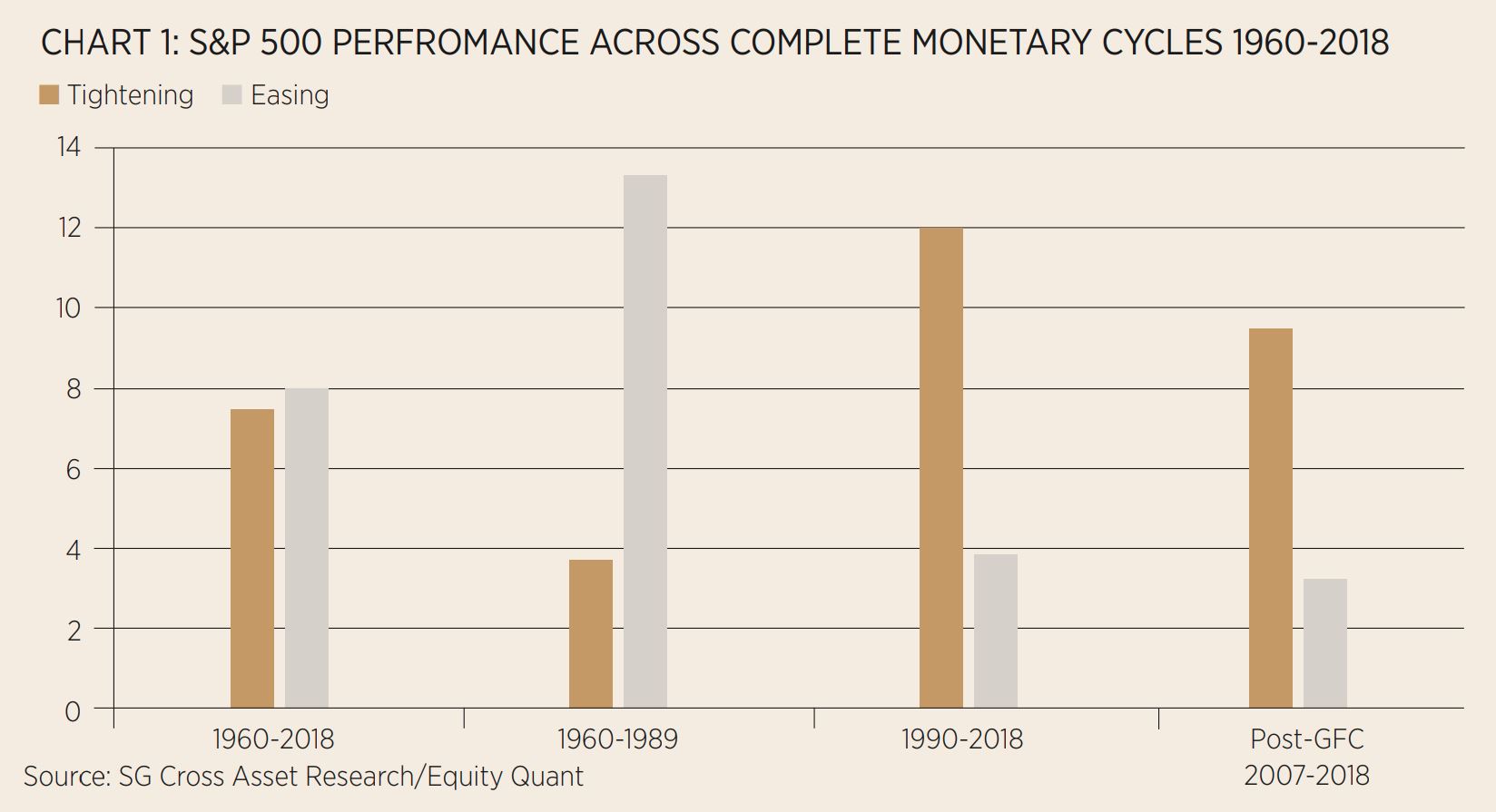

It is – as political economists like to remind everyone – regime dependent. Still, recent data from the last few decades does give us some clues. Most recent cycles of tightening for instance have not coincided with rampant inflation and have thus been positive for equity investors (see Chart 1 and 2). The SG analysts observed that the “S&P 500 has registered annualised returns of about 12% per annum across tightening phases versus only about 4% during monetary easing phases over the 30 years since 1990”.

And what of different factors and styles within the equity space? “At the equity level, cyclical strategies, particularly value and size, tend to fare better during monetary easing, partly because the easing phase overlaps with the period of early economic recovery in the business cycle that is highly conducive for a cyclical rebound.

Defensives such as quality and low volatility struggle during the tightening phase with the economy charging and markets in full-rally. On the other hand, relative to their challenges during monetary easing, growth-oriented strategies, including profitability that caters to high-quality profitable firms and secular growth strategies tend to do well during the tightening phase.”

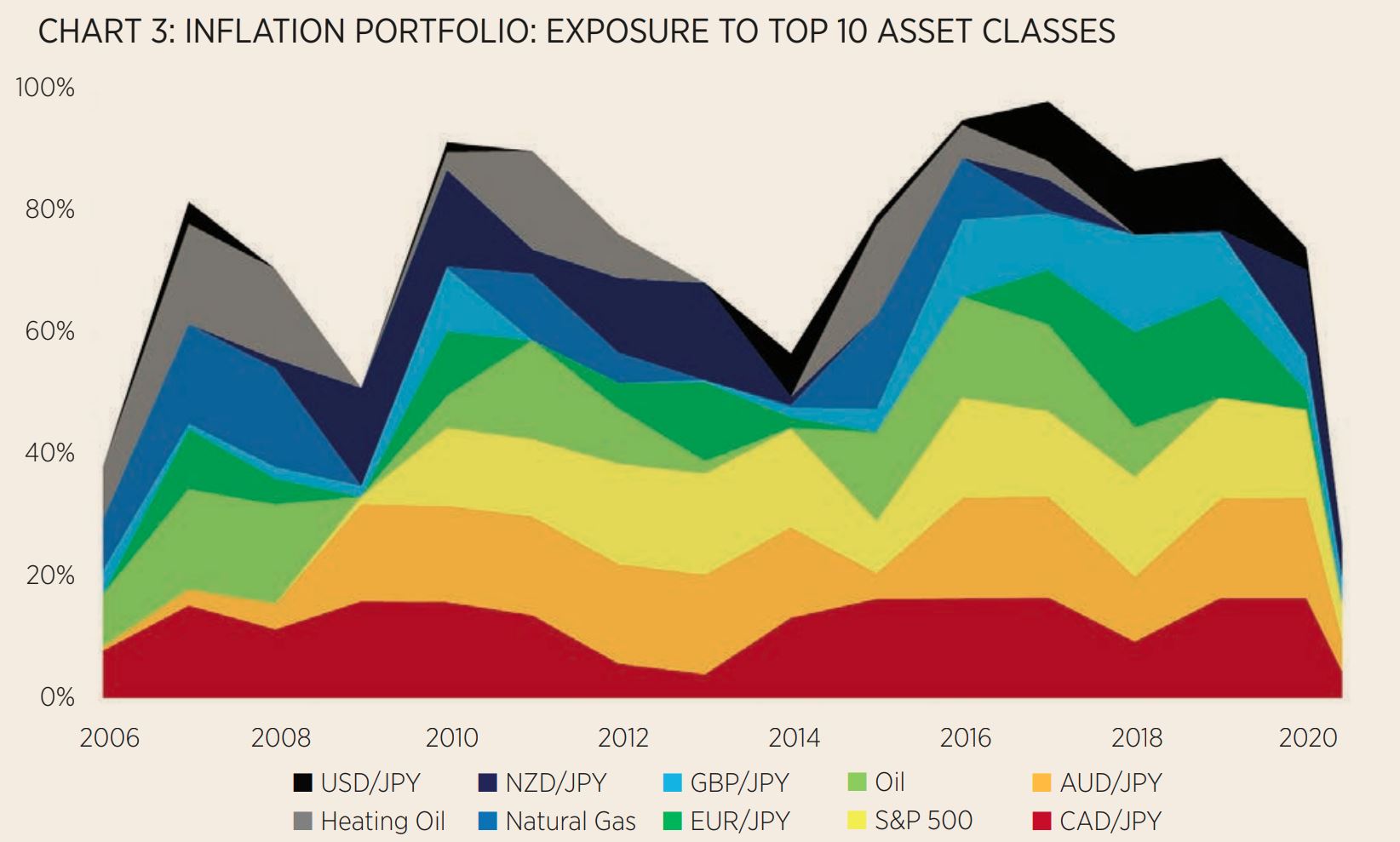

Nicolas Rabener, founder and CEO of FactorResearch, attempted to answer a different question – what to invest in if you think that inflation is about to become a more persistent challenge. In a recent report, Rabener creates a framework to select asset classes from a set of 59 indices that are highly correlated to the US 10-year breakeven inflation rate using daily data and a one-year lookback. Specifically, he selected the top 10% of indices that were most highly correlated, which results in a concentrated portfolio of six securities. The set of indices comprises all available asset classes – equities, bonds, commodities and currencies.

One immediate challenge becomes obvious – daily inflation data is really only available from 2006 onwards, with a range of 0% to 3% for key inflation rates. That is hardly a rerun of the 1970s! Chart 3 shows the challenging conclusions. Whilst investors might have expected a portfolio dominated by commodities like energy or gold, in reality, an inflation-proof agenda looks hugely eccentric and would have featured a range of currency pairs (AUD/JPY and CAD/JPY) plus heating oil, natural gas and oil.

As Rabener reported: “The majority of the portfolio was comprised of currency pairs and specifically developed market currencies like the USD and GBP against the JPY. Japan’s inflation rate has been close to zero over the last two decades, while countries such as the US and the UK have mildly positive inflation, which is reflected in the performance of these pairs.”

Lurking not so subtly in the background of all these debates is an obvious truth – what really matters over the next few years is political economy. One can throw any number of macroeconomic and financial models at these challenges, but very quickly we return to politics. Are we about to enter a new political era in which old financial models become much less relevant? In other words, when we say ‘regime change,’ do not we really mean policy regime change?

Vincent Deluard, global macro strategist at StoneX, is at least honest about this political economic dimension. Last month he released a fascinating note, titled A Calculated Gamble: Five alternative 60/40 portfolios for the 2020s, which put political regime change at the heart of the strategic debate. And he, rightly in my view, nails one key point – that the classic model of portfolio diversification, the 60/40 portfolio – no longer works. “The golden age of lazy asset allocation is over”, Deluard declared.

Deluard’s innovative answer is to construct five portfolios consisting of 60/40 hedges. In each portfolio, a key policy risk is addressed with a binary hedge between two different asset classes. In no particular order, these five are as follows:

China slowdown: International value stocks/ China government bonds

Secular growth: US pharmaceuticals/Latin America local currency bonds

Super fragile/anti-fragile: Super fragile (Taiwanese stocks and European banks)/anti-fragile (gold, bitcoin and the yen)

US renaissance: US Infrastructure, home[1]builders, and US regional banks vs big tobacco, long term Treasuries

Geopolitical risk: India/Africa and frontier markets vs Russian bonds

As Deluard correctly observed: “If investors want to achieve high single-digit returns in the 2020s, they must accept that volatility will exceed the smooth returns that the 60/40 portfolio provided in the past four decades. They must also be ready to invest in risky places, such as Russia and Taiwan, esoteric assets, such as bitcoin, and ugly sectors, such as European banks and Latin American local currency bonds.

The past decade rewarded the lazy and the conformist: passively owning the largest stocks combined with a defensive position in the world’s risk-free asset was enough to generate high single-digit returns with minimal volatility. In the next decade, success will be determined by the courage to venture out of the beaten path and the skill to combine these risks intelligently.”

My own take on these debates is, as you would expect, to be cynical of great sweeping claims. I am not convinced we are on the edge of an inflationary precipice. I also do not think we are edging closer to war with China. And as for markets, I am not yet convinced we are at peak bubble. But once we dig into the political regime changes, big changes are obvious.

Take monetary policy for instance. The risk of policy error is great – a core view of Deluard – but that is because central bankers have got too close to the progressive view that inflation is just one risk amongst many and that running an economy hot is a great idea. Also, I suspect that, come the next downturn or recession, we will see new monetary weapons introduced such as a weak form of MMT.

As for fiscal policy, it seems obvious to me that tax rates are rising to fund higher government spending. That in turn is likely to lead to greater risks from running an economy hot to get to full employment.

As for globalisation, it seems to me too early to call peak integration – alternative venues to China such as Vietnam are booming. That said, it is hard not to believe that with governments and big corporates worried about extended supply chains, some form of localisation will not have a big impact.

Quite how these play out in portfolio terms is entirely up for grabs, but I would suggest that there is one likely scenario – political and financial volatility starts to rise again.

This article first appeared in ETF Insider, ETF Stream's new monthly ETF magazine for professional investors in Europe. To access the full issue,click here.