BlackRock cemented its dominance over the European ETF industry in 2020 accounting for 50% of total flows while DWS, Legal & General Investment Management (LGIM) and Credit Suisse AM all enjoyed strong years as well.

Overall, the ETF market in Europe continued its rapid rise last year despite market headwinds resulting from the coronavirus pandemic.

According to data from Morningstar, ETFs this side of the pond saw €102.7bn inflows over the past 12 months, just shy of the record €107bn set in 2019, with investors eager to put their cash to work following the volatile start to the year.

In particular, the major growth area last year was ESG ETFs which saw assets increase by a massive 137% to €90.4bn taking the segment’s market share to 8.6% of the total European ETF ecosystem, up from 4.2% in 2019.

Jose Garcia Zarate, associate director, passive strategies research, at Morningstar, commented: “The trend in favour of sustainable investment has been building for some years; the COVID-19 pandemic has provided a key boost.

“ESG remains a top priority for most ETF providers in terms of product development for 2021.”

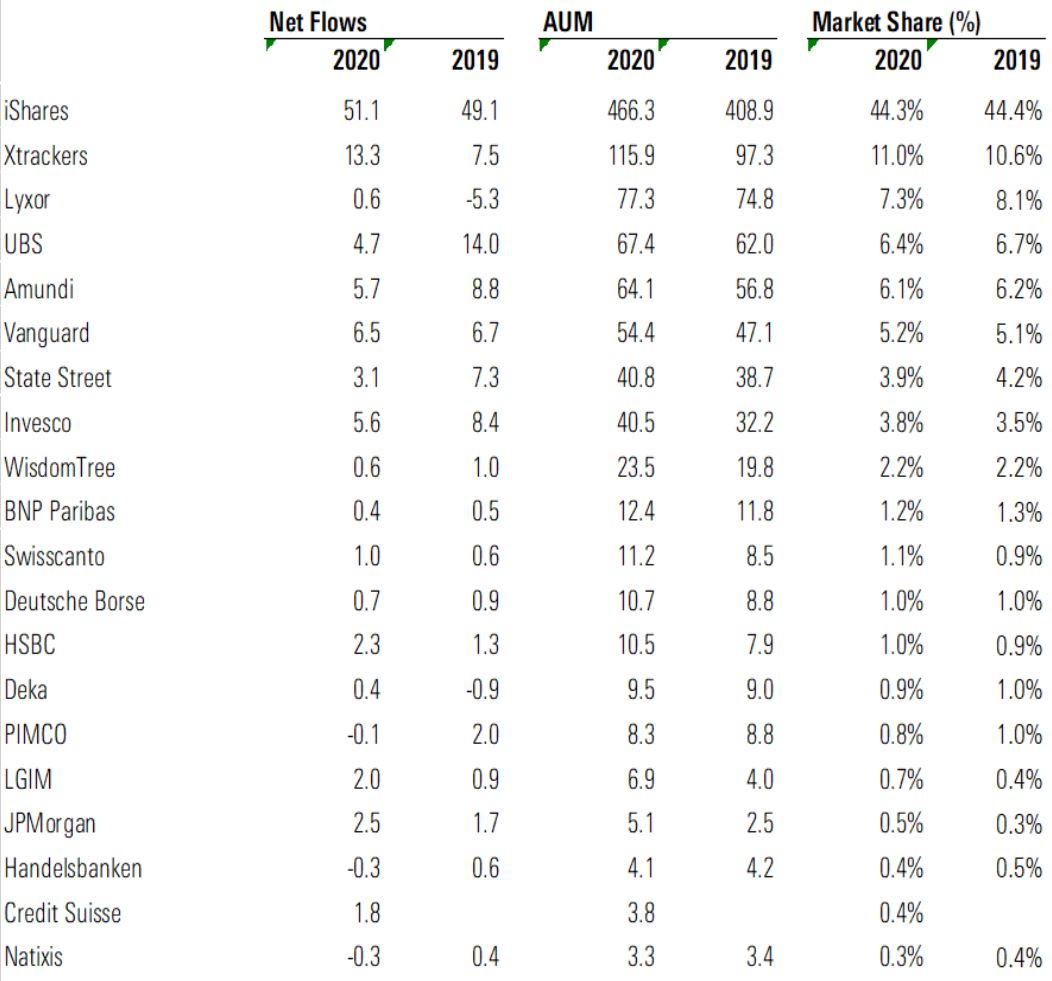

Benefitting from this monumental shift to sustainable investing, the world’s largest asset manager, BlackRock, saw €51.1bn inflows into its European ETF range for the year, up from €49.2bn in 2019, taking the firm’s assets under management (AUM) to €466bn, a 44.3% market share.

DWS cemented its position as the number two ETF issuer in Europe following inflows of €13.3bn last year. This means the German asset manager’s total AUM is €115.9bn far ahead of Lyxor in third with €77.2bn.

The French asset manager saw its market share fall to 7.3% from 8.1% in 2019 following relatively small inflows of just €581m.

It has been rumoured since September 2020 that parent company Société Générale is eyeing a potential sale of Lyxor with rivals such as Amundi, BNP Paribas and JP Morgan lining up bids, it was revealed last November.

Vanguard’s slow march up the issuer rankings tables continued last year with the US giant seeing €6.5bn inflows over the year.

The firm has €54.4bn AUM across just 22 ETFs following the closure of four active factor ETFs last December meaning there is an average of €2.5bn assets in each strategy.

Amundi, Invesco and UBS Asset Management also all had strong years seeing €5.7bn, €5.6bn and €4.7bn inflows, respectively, with all three issuers doubling down their focus on ESG.

The Swiss asset manager currently sits in fourth spot with €67.4bn AUM, just ahead of Amundi which has €64bn.

Elsewhere, HSBC GAM’s push into ESG ETFs at the start of the year paid dividends with the UK asset manager seeing €2.3bn inflows for the year.

Highlighting this, the firm launched a six-strong low carbon ESG ETF range last June which offer exposure to a number of regions including US, emerging markets and global equities.

LGIM’s continued push into thematic ETFs meant the issuer saw €2bn inflows over the year taking its total AUM to €6.9bn.

In particular, the $2.3bn L&G Cyber Security UCITS ETF (ISPY) saw over $600m inflows in 2020 highlighting the increasing shift to megatrends.

Furthermore, Credit Suisse AM made a strong start to its re-entry into the European ETF market with inflows of €1.8bn. So far, the Swiss ETF issuer is focused entirely on ESG ETFs, a strategy that has worked so far.

JPMAM saw €2.5bn inflows into its European ETF range last year driven largely by growing demand for its active equity ESG ETF range with investors pouring over $250m into the JPMorgan Global Emerging Markets Research Enhanced Index Equity (ESG) UCITS ETF (JREM).

Europe’s first white-label ETF platform HANetf punched above its weight last year with strong flows into three strategies, in particular.

The EMQQ Emerging Markets Internet and Ecommerce UCITS ETF (EMQQ) saw its assets jump to $240m after seeing some of the best performance across all European-listed ETFs with returns of 81%.

Meanwhile, the Royal Mint Physical Gold Securities ETC (RMAU)’s AUM jumped to $380m amid strong demand for gold ETCs in 2020 while bitcoin’s surge sent the BTCetc Bitcoin Exchange Traded Cryptocurrency (BTCE) hit $500m AUM in the second week of January just six months after launching on Deutsche Boerse.

Source: Morningstar