S&P has completed a major sector shake-up in the US - and the centrepiece of that shake-up is a new communications sector. This new sector includes some of the most glamorous US growth stocks such as Alphabet, Facebook and Netflix.

The new S&P 500 communications index includes companies that facilitate communication operations and offer media content and information. It includes stocks that have been taken from the telecoms, technology and consumer discretionary sectors.

It's unclear whether the new index will boost share price performance, especially since so many of these stocks have already had such a strong run over the last couple of years.

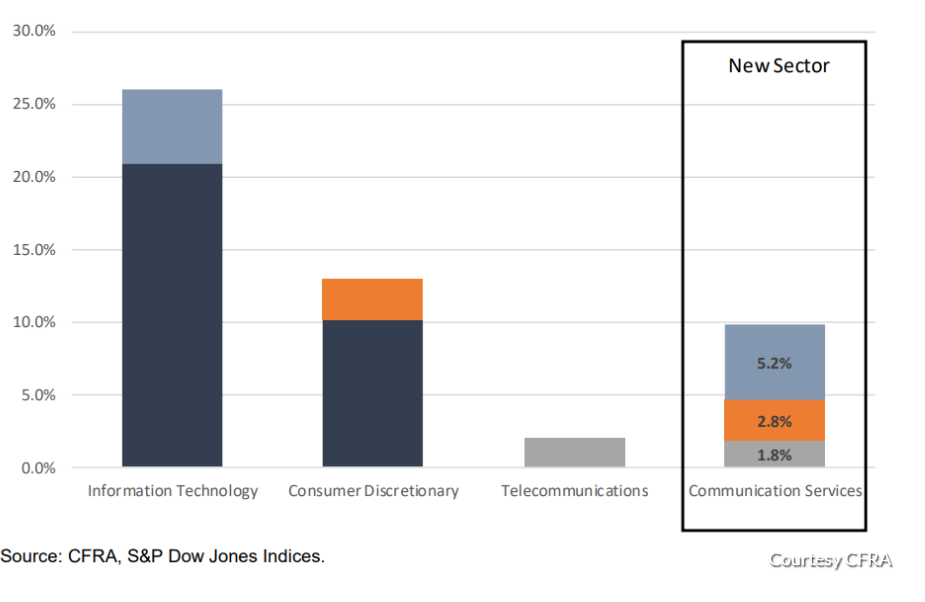

The move will essentially reclassify a load of equities as communications stock. According to data from CFRA, as reported via MarketWatch, the new sector will account for nearly 10% of the S&P 500's market cap. The weighting from the technology sector will drop from about 26% to 21% and consumer discretionary will drop to 10% from 13%. All telecom stocks will be reclassified as communications stocks.

The chart below, taken from MarketWatch shows how the new sector will be made up.

There are several things that need to be considered with this new sector, but two really stick out. Firstly, are the big stocks are overvalued? One example of this is Facebook, which has fallen in value this year by nearly 8%. Market watchers now argue whether it is even a well managed stock. Secondly, by concentrating all these stocks in one space, will it increase volatility?

Ben Seagar-Scott, chief investment strategist at Tilney Group Ltd, said "It's difficult to know how much of a 'success' the new sector will be in, though it does now have several of the FAANG stocks which have been key drivers of the broader index rally, and may arguably start to come under a bit of pressure. It also quite significantly shifts the nature of the sectors, especially telecoms and information technology (consumer discretionary to a lesser extent). There is a risk that some investors in ETFs tracking the GICS IT sector don't realise the sector will no longer have the big hitting names of Facebook and Alphabet (owner of Google). The other interesting development is that it will take what was the old telecoms sector from being more a defensive play to a much more growth-orientated sector."

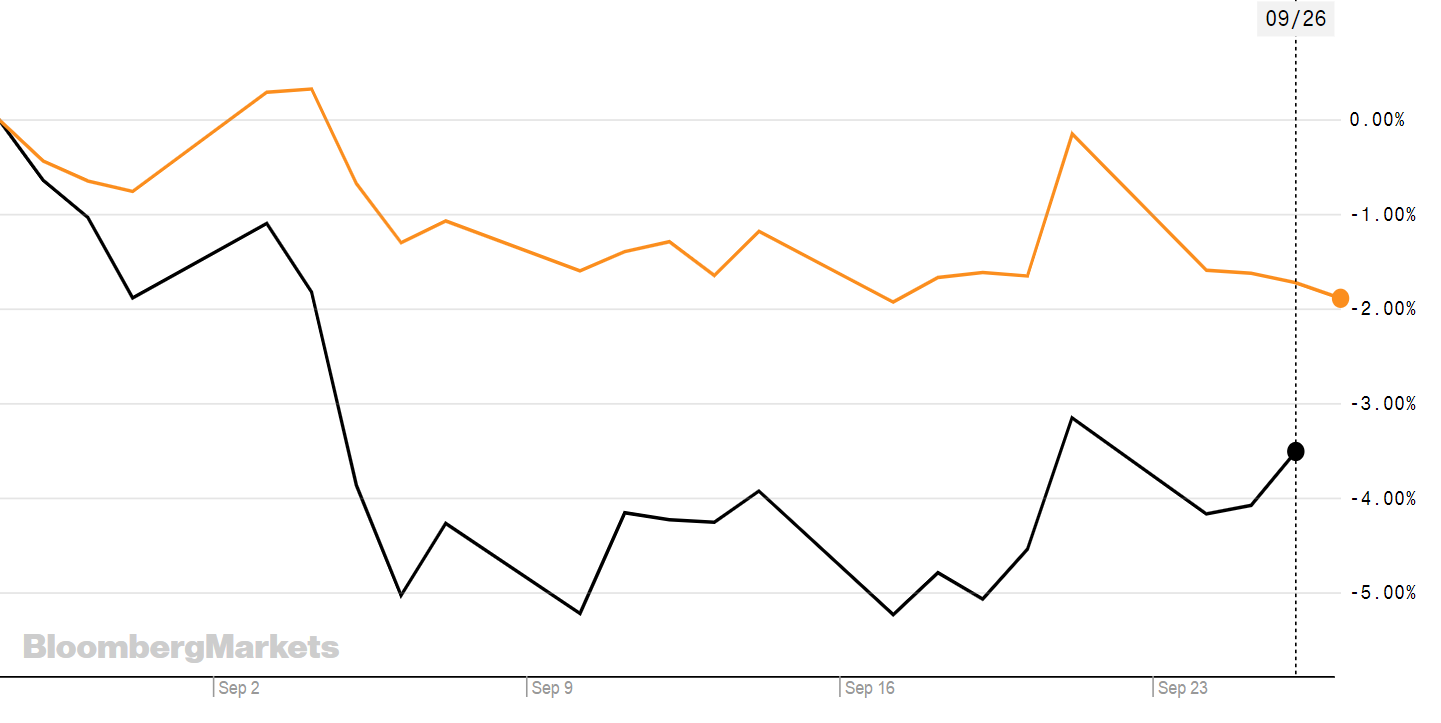

GXLC is State Street's SPDR S&P US Communication Services Select Sector UCITS ETF. It listed on the LSE in August in preparation for the new sector launch. Since inception it is down -3.4%, but it already has assets of nearly $69m.

Below is a graph that shows in orange SPDR S&P 500 ETF in sterling against its SPDR S&P US Communication Services Select Sector UCITS ETF, that was launched last month, also in sterling in black.

Source: Bloomberg

Despite the poor start, the new sector also has the backing of some big names.

Goldman Sachs chief US equity strategist said in a note to clients over a week ago that he recommends investors go overweight in information technology and communication services, and underweight consumer discretionary. He also commented that the new sector had nearly two times the risk-adjusted return of the previous telecom sector in this current bull run. He added that the reclassified sector's securities had returned 17% annually since 2009 against 9% from the old telecoms over the same time frame.

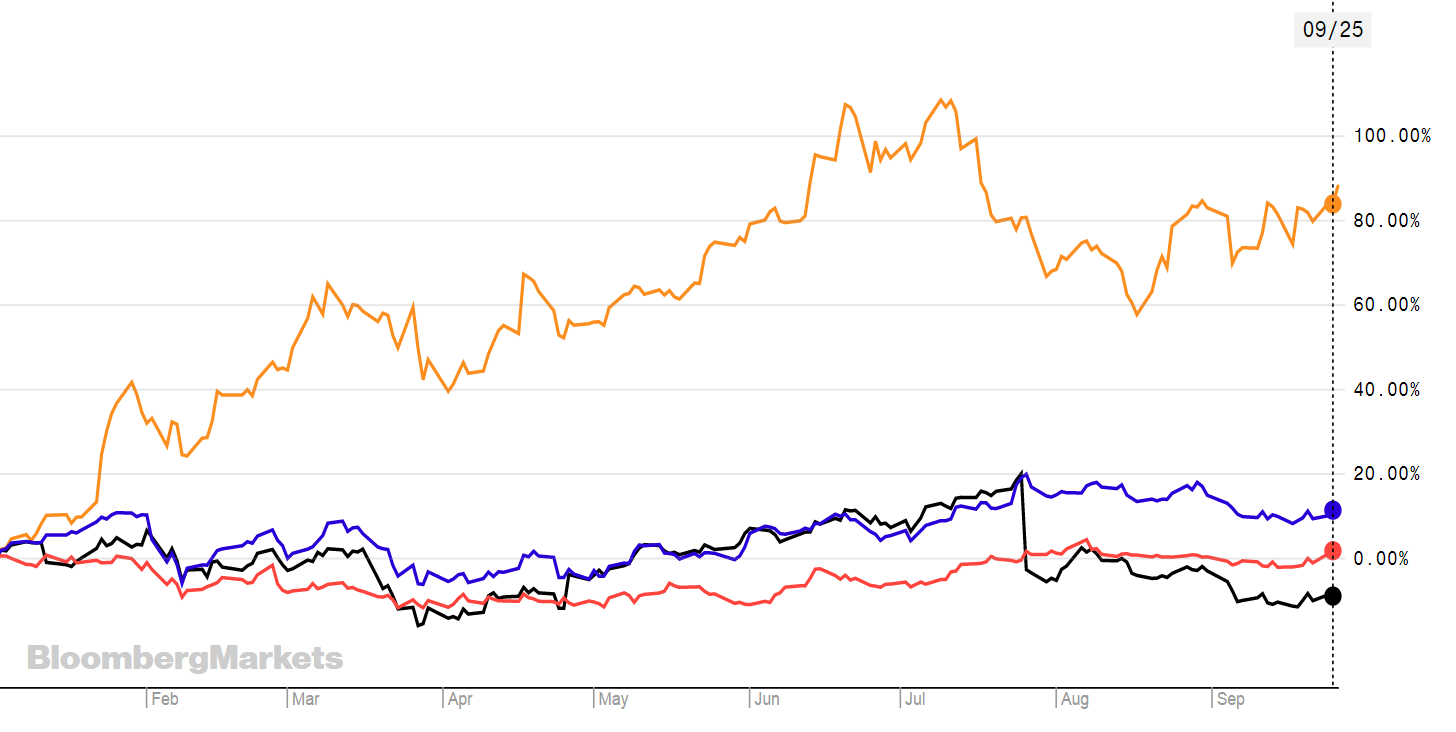

The state of the FAANG stocks included in the new sector this year to date are shown below and reflect what an impact their gains can have. Facebook (in black) is down -7.98% since the start of the year, Netflix (orange) is up 87.93%, Google (purple) is up 11.26% and Walt Disney (red) is also up 3.05%.

Source: Bloomberg

The change in the indices is a result of the developing and evolving tech, media and consumer industries. A change like this hasn't really happened before and it is something that investors need to be aware of.

Seagar-Scott added: "It's another reminder that the onus really is on the investor to understand what they're buying with these things - I think it is entirely sensible to have periodic reviews of sector classifications to make sure they fairly reflect economic reality. With the growth in areas such social media, mobile internet and streaming, these latest changes make a lot of sense….it's worth remembering that technically not all ETFs follow GICS, so it's worth checking the index details before investing."

Since the sector changes were announced there have been five ETFs launched on the London Stock Exchange.

GXLC

SXLC

IUCM

XLCS

XLCP

ETF TERLaunch DateIndexSPDR S&P US Communication Services Select Sector UCITS ETF0.15%17/08/18Large sized U.S. Communication Services companies in the S&P 500 Index.SPDR S&P U.S. Communication Services Select Sector UCITS ETF0.15%17/08/18Large sized U.S. Communication Services companies in the S&P 500 Index.iShares S&P500 Communication Sector UCITS ETF0.15%19/09/18S&P 500 Capped 35/20 Communication Services Index (NTR)Invesco Communications S&P US Select Sector UCITS ETF0.14%17/09/18S&P Select Sector Capped 20% (Communications) Net Total Return Index.Invesco Communications S&P US Select Sector UCITS ETF0.14%17/09/18S&P Select Sector Capped 20% (Communications) Net Total Return Index.