The call for the return of fixed income as a viable asset allocation play at the start of the year was certainly premature, however, ETF investors look set to reap the benefits in 2024.

Investors have been aggressively allocating to fixed income ETFs in 2023. According to data from ETFbook, bond ETFs have accounted for 45% – or a record $65bn – of all ETP flows in Europe, punching above their 23% market share of assets under management (AUM).

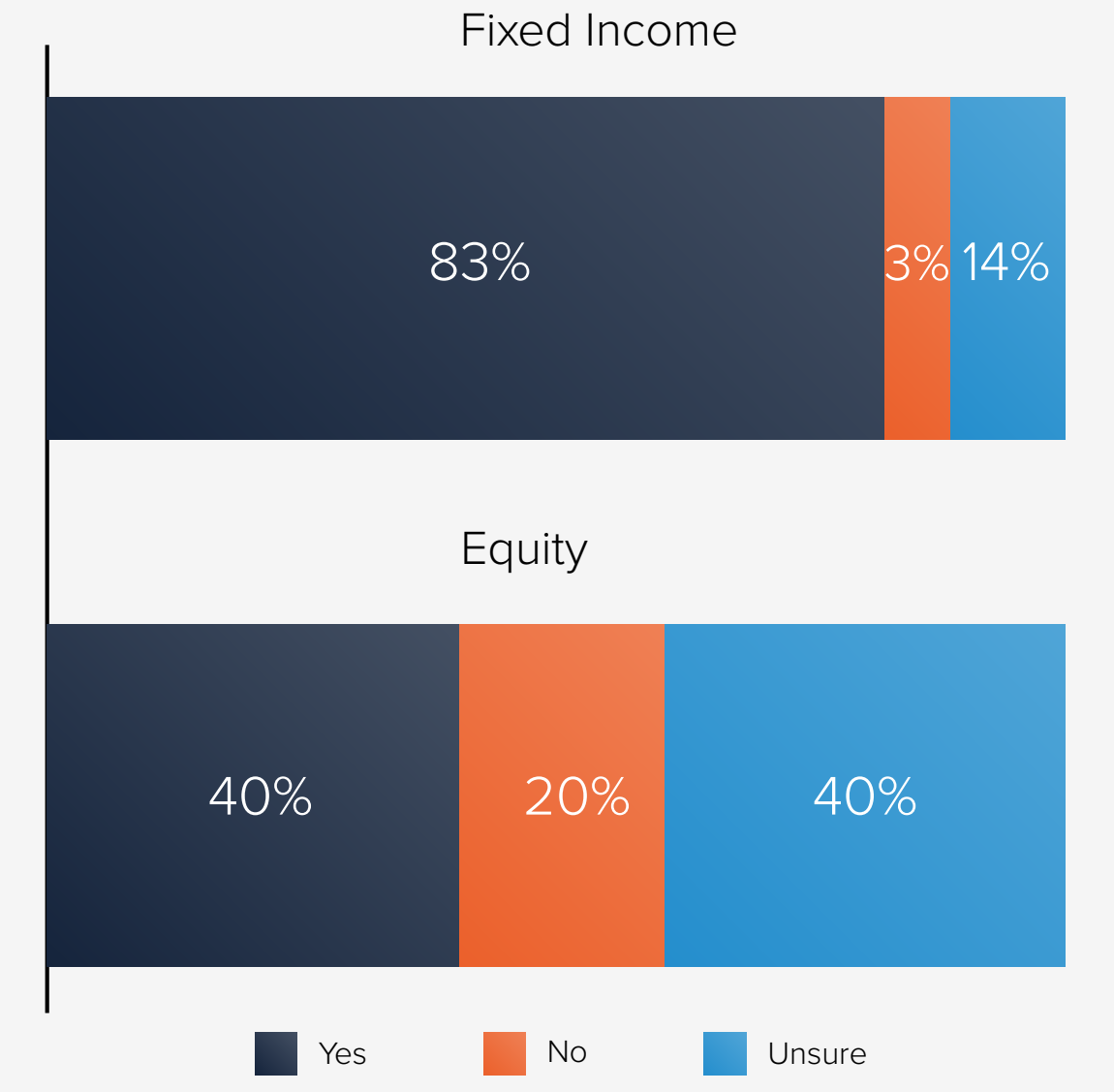

This looks set to continue next year. In a recent survey of European professional investors conducted by ETF Stream, 83% of respondents stated 2024 will be the year of fixed income versus 40% for equities.

Chart 1: 2024 will be the year of

Source: ETF Stream and JP Morgan Asset Management

While the US economy’s unexpected resilience has been one of the main drivers of returns in 2023, there are signs of a slowdown.

“The narrative today is resilience,” Nathan Sweeney, CIO of multi-asset at Marlborough, told ETF Stream.

“Everyone believes the US economy is strong but cracks are appearing, particularly when looking at the consumer. Delinquencies are picking up in credit cards and auto loans are at a higher level than in 2008.”

US Treasuries in vogue

In the face of a slowdown in the economy, the Federal Reserve will be forced to cut interest rates, a boon for long-duration US Treasuries, in particular.

Markets are currently pricing in a 44.6% chance the US central bank will reduce rates by 25 basis points (bps) at March’s Federal Open Market Committee (FOMC) meeting as well as forecasting a 66.5% chance the rate will be 50bps lower or more by the end of H1.

“This policy-driven cycle favours an overweight duration position in sovereign debt, as lower rates and a bullish steepening are ultimately priced in,” Matthew Nest, global head of active fixed income at State Street Global Advisors (SSGA), said.

“We believe that the US Treasury market offers the cleanest way of capturing this move in market pricing.”

This is why fund selectors have been slowly adding duration this year to be ahead of any sharp reversal in the US economy’s fortunes.

For example, the iShares $ Treasury Bond 20+yr UCITS ETF (IDTL), which has a 26-year weighted average maturity, currently offers a 4.4% yield.

Furthermore, a strategy such as the Lyxor US Curve Steepening 2-10 UCITS ETF (STPU) is another option for fund selectors who believe the picture is not as rosy as it was six months ago.

“As the impressive resilience of the US economy fades in 2024, we believe that sovereign fixed income offers investors a rewarding opportunity,” Nest added.

Meanwhile, the short end of the US Treasury yield curve is yielding over 5%, an attractive price to lock in given the market uncertainty.

Overall, the recent ETF Stream and JP Morgan Asset Management survey found 48% of respondents believe government bonds will play the most important role within their fixed income allocation in 2024.

Chart 2: Which part of the bond market will play the most important role in 2024?

Source: ETF Stream and JP Morgan Asset Management

A word on corporates

In contrast, a slowing economy, especially in the US, will have a negative impact on credit as refinancing issues begin to kick in and default rates spike.

“A slowing economy and advancing credit cycle will present challenges to corporate income and balance sheets,” Nest explained.

“Therefore, we expect that there will be more rewarding entry levels for credit investors in the coming quarters.”