Adding to its existing range of global ESG Leaders ETFs, Xtrackers has launched its regional product for the US. The Xtrackers MSCI USA ESG Leaders Equity ETF (USSG) is comprised of US-based companies with the greatest ESG performances compared to its peers in the same sectors.

For those that might not know what ESG is, it is Environment, Social and Governance, meaning companies cannot be included if they work within tobacco, alcohol, gambling etc. They must also comply with the United Nations human and labour rights.

USSG's management fee is 0.10%.

The underlying index's methodology includes the security of the highest ESG rating if it represents at least 50% of the market cap.

There is a reoccurring argument when it comes to ESG ETFs which is, "will my returns be affected if I choose the ESG product?". While institutional investors are optimistic ESG integrated portfolios will outperform in the future, ESG ETFs are not for the high short-term returns. USSG is one of these examples.

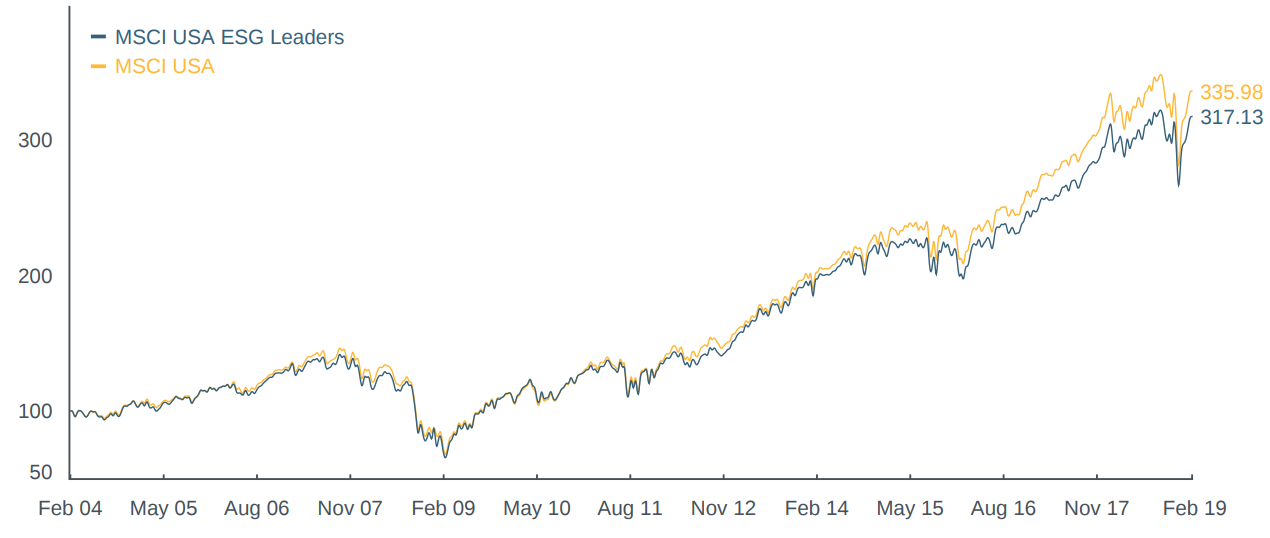

USSG's benchmark, the MSCI USA ESG Leaders index started to underperform in 2015 compared to the MSCI USA Index. However the graph below shows the index has still been producing significant returns, despite a disappointing 2018. Since 2015, the index has climbed over 50%.

Source: MSCI