The role of authorised participants

The role of authorised participants in the creation-redemption process is what separates ETFs from other investment structures such as mutual funds and investment trusts.

ETF creations and redemptions occur in the primary market where an authorised participant is responsible for ensuring an ETF trades at fair value, usually in line with its net asset value (NAV).

While creation-redemption is relatively straightforward in equity ETFs – where baskets tend to be fully replicated – it is a more nuanced process in fixed income ETFs where custom baskets are used.

Custom baskets in fixed income ETFs

Unlike their equity counterparts, fixed income ETFs sometimes track indices with a huge number of securities. The Bloomberg Global Aggregate Bond index, for example, offers exposure to over 25,000 securities from 2,500 issuers across 24 local currency markets.

Similar to tracking the index, when creating new shares of a global aggregate bond ETF, authorised participants will use a custom basket that does not include all the underlying securities but is designed to mirror the characteristics of the index.

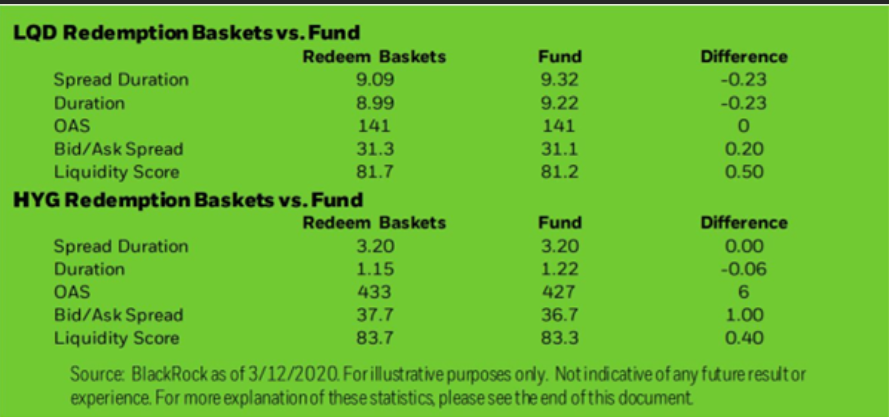

This process will consider factors such as duration, liquidity, credit quality and bid-ask spreads. It is the role of the ETF portfolio manager to ensure bonds an authorised participant includes in the creation basket match the characteristics of the underlying index.

Chart 1: Custom redemption basket composition versus fund comparison for LQD and HYG (2/18/20-3/12/20)

However, there is a degree of flexibility. Custom baskets allow the portfolio manager to deliver securities in the redemption basket that the ETF is overweight while taking in bonds that the ETF is underweight.

The flexible nature of this process has led to criticisms from academics that have warned authorised participants – the majority of which are large banks – can offload bonds they no longer want on their books in custom ETF creation baskets.

This is why the role of the ETF portfolio manager is crucial as they need to determine if the custom basket meets the required parameters of the underlying index.

The creation-redemption mechanism also enables ETFs to play an important role in less liquid markets. During the March 2020 coronavirus sell-off, ETFs acted as a tool for price discovery by reflecting the true price of the market when the underlying bonds stopped trading.

Highlighting this, the iShares $ Corp Bond UCITS ETF (LQDE) traded 1,000 times on 12 March 2020 while its underlying securities changed hands just 37 times, according to data from BlackRock.

This mechanism is an important aspect of the ETF structure. Investors must understand the nuances, especially with fixed income ETFs where there is more customisation.

Key takeaways

Unlike mutual funds and investment trusts, ETFs trade on both the primary and secondary markets

While equity ETFs often fully replicate the underlying index, fixed income ETFs utilise custom baskets containing a subset of securities that still reflect the index's characteristics.

The need for custom baskets introduces flexibility for portfolio managers