Value has significantly underperformed its factor counterparts since the Global Financial Crisis (GFC) in 2008 due to a variety of factors including quantitative easing and the rise of technology but does this mean it is the end for the factor or is this just a part of the economic cycle?

A recent report from Research Affiliates claimed the death of value could be being overexaggerated as a result of overcrowding and simply "bad luck".

The report states that since 1963, the value factor has produced the most attractive market-adjusted returns compared to its peers and that the downfall of its performance has only been since the GFC 13 years ago.

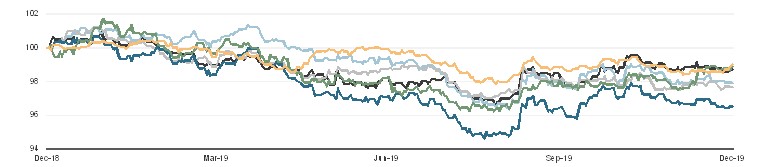

Measuring factor performance in 2019

Throughout 2019, value negatively performed across all regions whereas quality saw strong performance across all regions except for the UK, most likely due to Brexit uncertainty at the start of the year.

Value's relative performance

Source: FTSE Russell

According to data from FTSE Russell, emerging markets saw its quality stocks climb roughly 4% throughout this period whereas value stocks with this regional exposure fell roughly 1%.

Marlies van Boven, managing director, research and analytics at FTSE Russell, told ETF Stream that in tandem with strong performing quality stocks, growth has been outperforming as well.

Van Boven said: “In the US, the Russell 1000 has been very heavily driven by the FAANG stocks which suggest growth stocks have outperformed and left value behind.”

The technology disruptors, such as FAANGs (Facebook, Amazon, Apple, Netflix and Google), are being highlighted as a big factor for value’s underperformance.

As Inigo Fraser-Jenkins, head of European quantitative strategy at Alliance Bernstein, said in a note last year: “Technology has disrupted industries in a way that may permanently destroy ‘moats’ that used to exist around certain industries.

“If Amazon is going to continue to destroy other parts of the retail sector, then why should we expect mean-reversion to still hold? We agree that this dynamic is likely behind part of the underperformance of value.”

The question currently being asked by van Boven is once we are out of this quantitative easing cycle, do we go back to normality or this the new normality?

“We are in the cyclical trend where inflation and growth expectations are much lower than we have ever seen before,” van Boven added.

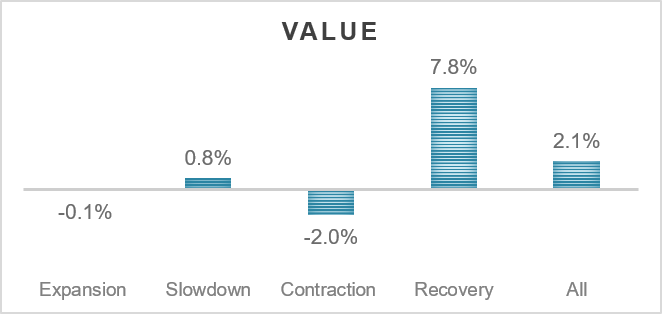

Between 1953 and 2019, FTSE Russell found value to perform best when economic cycles are in recovery and worst when markets are contracting. Therefore, value is sensitive to both growth and inflation expectations and does best when growth is picking up and inflation remains low.

Value’s factor performance over economic cycles (1953-2019) – Source: FTSE Russell

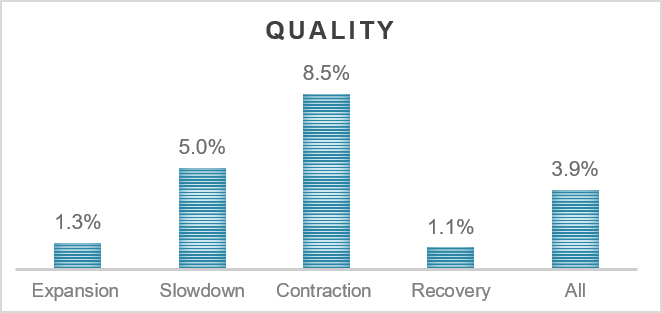

In comparison, quality stocks perform best when growth is down, regardless of inflation. Therefore, the factor outperforms on average when markets are contracting or are in slowdown cycles.

Quality’s factor performance over economic cycles (1953-2019) – Source: FTSE Russell

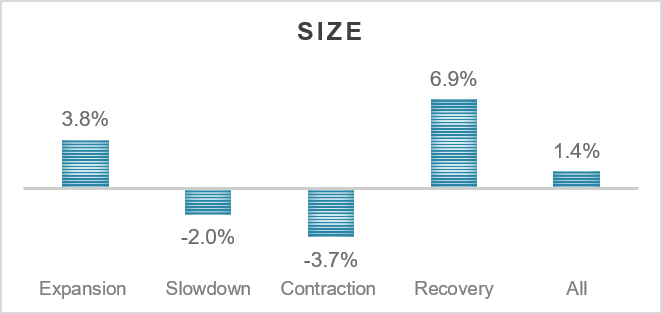

Alternatively, size stocks are similar to value such that they are sensitive to growth but not necessarily inflation. Hence, it performs in recovery cycles and during expansion but suffers when markets contract.

Size’s factor performance over economic cycles (1953-2019) – Source: FTSE Russell

Van Boven added there was a lot of geopolitical and macro uncertainty last year that saw value sink with a brief rebound at the end of August/September. As investors realised their pessimism was overdone, value still ended the year down.

Nicolas Rabener, managing director at FactorResearch, said value cannot be dead because investment strategies simply cannot die.

“Except in the context of a stock market that is shut down due to war or socialism, investment strategies cannot die,” Rabener argued.

“Naturally, strategies can become unprofitable and most of the ones focused on generating outperformance are unattractive.”

Rabener compared the down performance of value over the last decade to the unattractiveness of holding small caps between 1980 and 2000. This trend lasted significantly longer than the current slump for value and this is put down to cyclical trends having significantly long up and downward performances.

The micro and macros perspective of the value factor does not highlight anything unusual, according to Rabener. There have not been any structural changes that would make the value factor unattractive from a medium to long-term perspective, it is "business as usual".

Similarly, van Boven agrees: “I do not think value is dead. Between 2009 and 2014 when quantitative easing was quite strong, value had a number of rallies but since then, the Federal Reserve System in the US has focused on normalisation instead of quantitative easing which on top of macro uncertainty has seen investors turn very risk-averse.”

Van Boven concluded: “A more stable economic outlook and a bit of relief from the height of macroeconomic risk will see value most likely rebound.”

However, not everyone is as optimistic. Fraser-Jenkins said: “The outperformance of value might require higher interest rates, which could be structurally difficult to achieve in the foreseeable future.”

ETF Insight is a series brought to you by ETF Stream. Each week, we shine a light on the key issues from across the ETF industry, analysing and interpreting the latest trends in the space. For last week’s insight, click here.