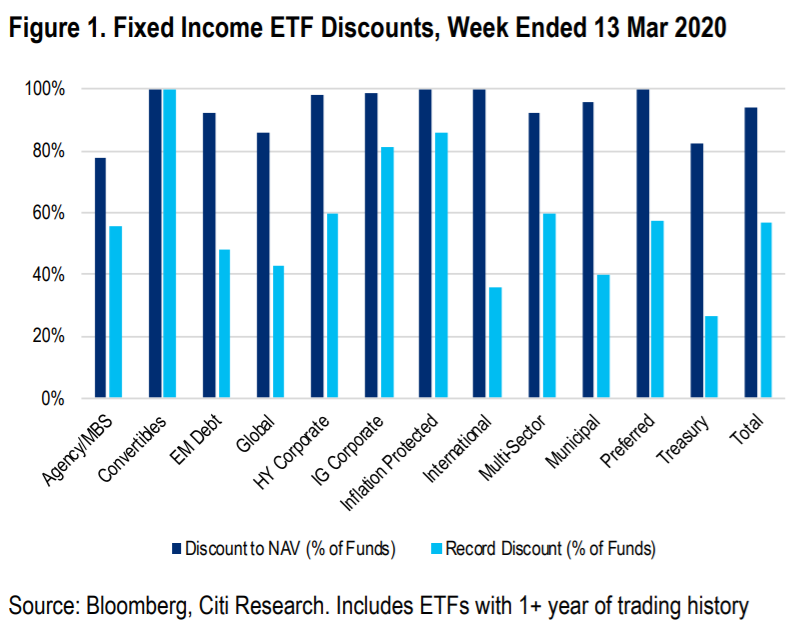

Bond ETFs around the world have blown out on discounts the over past three weeks.

The global market meltdown triggered by the coronavirus has caused the majority of global bond ETFs to trade at prices below their net asset values (NAV).

Almost no bond ETF has been spared. But Vanguard’s $50 billion total bond market ETF, BND – one of the largest ETFs in the world – has been singled out for trading at a 6.2% discount while its open-ended mutual fund counterpart was still trading at NAV.

According to a research note from Citi, investment-grade corporate ETFs have been particularly hard hit, with 80% of them trading at all-time high discounts.

Discounts are common in other investment vehicles such as close-ended funds. But ETFs have been thought to be immune, as the way they are created and destroyed – a process known as "creation-redemption" – usually allows traders to iron them out.

However, the ongoing crisis suggests ETFs may be less immune to discounts than once thought with market makers choosing to stay on the sidelines.

Discounts can frustrate investors because ETFs have been marketed as being able to tightly track their indices in all market conditions. But how much of a problem at ETF discounts, really?

During periods of high volatility, investors often have to pay premiums to unwind trades, especially in illiquid markets such as high yield.

The fact investors could trade out of the bond ETFs at all, it could be argued, even when the liquidity of the underlying bonds evaporated is testament to the structure.

As the US-based ETF Think Tank says: “Transparency and liquidity are some of the key client alignment growth factors for ETFs. However, when ETFs shine the light of transparency on less liquid assets, investors may not like what they see.”

Fixed income ETFs can also play a role in “price discovery”. Because ETFs trade throughout the day just like shares, it is likely to be far more accurate at pricing its underlying securities compared to the NAV which is calculated at the end of the day through a pricing policy.

Athanasios Psarofagis, ETF analyst at Bloomberg, explains: “NAVs for some bonds likely lag well behind during periods of market stress, leading to discounts that create a clear arbitrage opportunity for market makers to step in and profit.”

So although investors will be unhappy with the discounts, there is an argument to make that bond ETFs are trading at fair value.

This, along with the fact investors can still access the market during periods of illiquidity, highlights why discounts may not be as negative as first appears.