Gold exchange-traded commodities (ETCs) have seen huge inflows this year amid the rapid spread of coronavirus and low interest rates however one product brought attention to the landscape in recent weeks for all the wrong reasons.

The Perth Mint, one of the world’s largest gold ETC providers, has been in the press for its use of conflict gold.

There is absolutely no evidence that the Perth Mint was directly involved with such practices. But the Australian Financial Review, Australia’s largest business newspaper, has alleged that the Mint, knowingly, bought $200 million of gold from a Papua New Guinean company that dealt in conflict gold.

The allegations – if proven true – would contravene the all-important standards for gold set out by the London Bullion Market Association, which runs the world’s largest precious metals exchange. And could threaten the Mint with a loss of LBMA accreditation making it very hard to sell its ETC to investors.

But the revelations also provide a chance to reflect on gold ETCs which have had a truly stellar 2020.

Surging flows? Thank interest rates

The amount of new money that has entered gold ETCs in 2020 has been substantial. According to the World Gold Council, there has been over $30bn inflows into gold ETCs this year. This means that globally there is now more than $200bn inside gold ETCs.

And if ETF history teaches us anything, it is that inflows follow – and can then help extend – strong performance.

RegionFund NameFlows (US$M)Flows (% AUM)USSPDR Gold Shares12,478.829%USiShares Gold Trust4,435.025%EuropeiShares Physical Gold ETC4,398.063%EuropeInvesco Physical Gold ETC3,183.245%EuropeAmundi Physical Gold ETC1,420.8133%USSprott Physical Gold Trust1,044.642%USSPDR Gold MiniShares Trust837.274%EuropeXetra-Gold733.37%

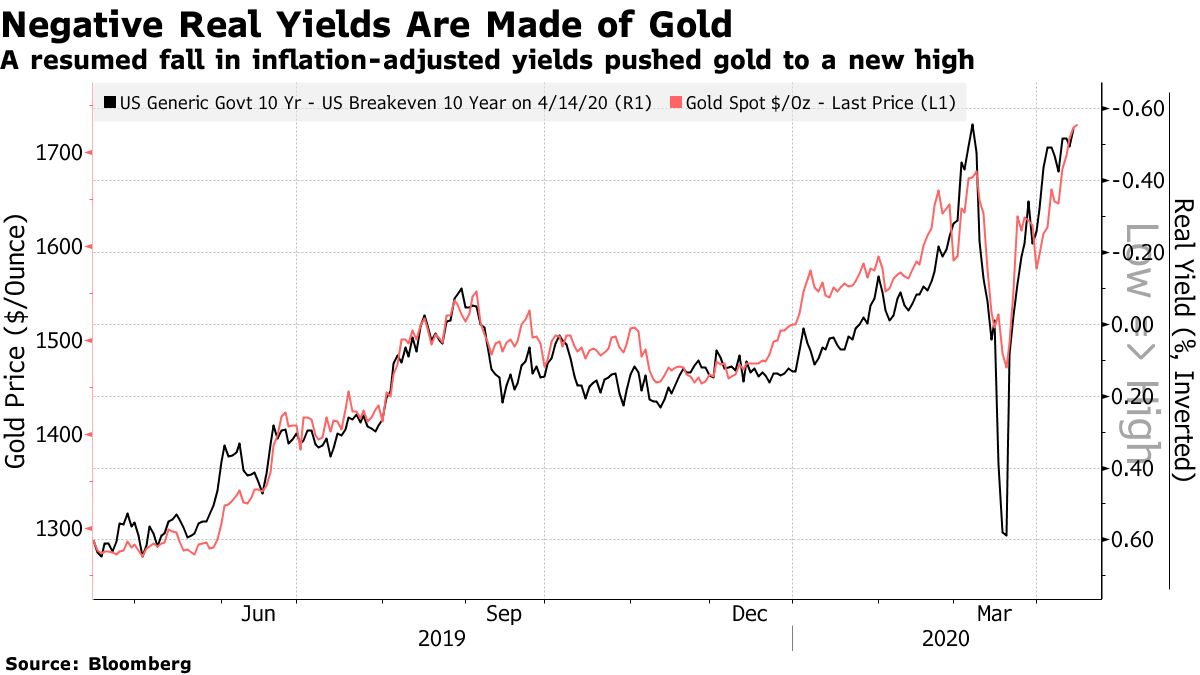

On the face of it, the performance of gold – and the subsequent inflows – correlates closely with interest rate sentiment. The performance of gold ETCs over the past five years has moved in tandem with highly interest rate sensitive long duration US government bond ETFs. These long duration ETFs usually give expression to which way the market thinks interest rates will go.

RegionTickerFund NameTERAUM (US$M)USGLDSPDR Gold Trust0.40%62,983USIAUiShares Gold Trust0.25%24,885EuropeIGLNiShares Physical Gold ETC0.19%12,557Europe4GLDXetra-Gold0.36%12,149EuropeSGLDInvesco Physical Gold A0.19%11,008EuropePHAUWisdomTree Physical Gold0.39%8,099EuropeGBSGold Bullion Securities0.40%4,675

With real interest rates now negative in many parts of the world, the values of most assets are getting revised upwards. However negative interest rates can be especially good for gold. Why? Because the greatest weakness of gold - that it produces no yield - gets taken off the table. (As no yield is preferable to a negative real yield).

As John Authers, the market commentator, notes: “Over the last decade, the relationship between the precious metal and real yields has been close — and the decline in the latter is now bringing gold up toward its 2011 high.”

What this means for investors considering gold ETCs is a big question – and potentially the biggest – is which way they think interest rates will go. The question is less what the supply/demand equation looks like. Less still whether Indians are getting married.

Gold ETCs or gold miners ETCs?

Investors considering gold ETCs are often met with a debate about whether to buy gold ETCs or gold miners ETCs.

The debate is an old one. Much of the reason that gold ETCs were invented in the first place was investor impatience with gold miners. For the ten years leading up to 2003 – when gold ETCs were invented – gold miners had underperformed the spot price of gold. Much as they have underperformed in the decades leading up to today.

The underperformance of gold miners posed in 2003 – and poses now – is something of a puzzle. Oil majors outperform the oil price. Pharmaceuticals outperform drug prices. Insurers outperform insurance premiums. And it makes sense that they should. Companies shares offer, in effect, a leveraged call option on what they produce.

That gold miners should therefore underperform a rising gold price makes little sense – and has become the subject of academic literature.

But gold miners may have strengths elsewhere.

According to VanEck, which runs the world’s largest gold miners ETC by far, gold miners “have historically outperformed gold during gold bull market cycles in the past.” In other words, gold miners ETCs can be good for short term trades during bull runs. This is because of the “optionality to gold through earnings and resource leverage,” the company says.

Gold miners can be useful for short term traders

This puts gold miners in a different basket to gold ETCs, which are usually held as safe havens when markets are suffering. In which case it may be fairer to benchmark gold miners against leveraged gold trading instruments like ETNs. Here we see that gold miners do well.

Conclusions

People tend to form very set views about investing in gold. I have sat in conference halls and meeting rooms where people express perplexity at why anyone would invest in gold. These sceptics include the highest profile investors in the world – such as Warren Buffett and Jack Bogle.

But gold has been used as a store of value for millennia now – defying sceptics and critics all the way. Which way gold goes in the short term is anyone’s guess. But in the very long term at least, the results are in.

ETF Insight is a series brought to you by ETF Stream. Each week, we shine a light on the key issues from across the ETF industry, analysing and interpreting the latest trends in the space. For last week’s insight, click here.

Sign up to ETF Stream’s weekly email here