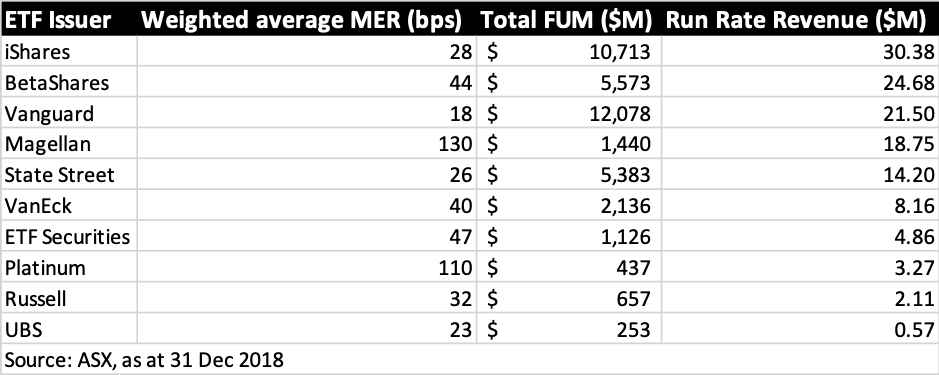

Australian ETF providers killed it in 2018, generating more revenue than ever before - in spite of the volatility that rocked global capital markets throughout the year.

While revenues were high all around, they were higher for some than others. In this piece we take a look over Australia's ETF industry in 2018 to see who made money and how.

BetaShares

If the Australian ETF industry had a standout winner for 2018, it would arguably be BetaShares.

The company has the second highest revenue stream eclipsed only by global behemoth iShares. BetaShares believes in growth, and in an effort to get taller, the company reinvests a substantial amount of its earnings, putting it into building more products, more staff and a better marketing machine. This shows up quite clearly in the numbers.

At the end of 2018, BetaShares had more products than any provider. More voice share in the media. The second fastest growing asset base, and the second largest nose count (second in both instances to Vanguard). The ETF industry is a numbers game, and on many counts 2018 was the year BetaShares led the pack.

Vanguard

Vale Jack Bogle. The founder of this not-for-profit continues to be the darling of Australian advisors, planners and self-directed investors alike. Vanguard's reputation is outstanding, and a look at the 2018 data shows why.

Despite having the largest asset base of any ETF provider, Vanguard chooses to keep its fee low and so makes less money than both BetaShares and iShares. (And make no mistake: it's a choice). The firm takes low fees seriously and has the lowest average MER of any firm.

In 2018, Vanguard had the highest FUM growth rate of any ETF provider, ASX data indicates, and overtook BlackRock to become Australia's biggest ETF provider. On its current growth trajectory, Vanguard Australia will have an ETF market share of 50% by late 2021.

BlackRock iShares

On the surface, 2018 may look like a year BlackRock would rather forget. As a result of increased competition and the compression of management fees across the industry, the company's share price fell from an all-time high of $590 in January 2018, down to $370 in late-December - a decline of almost 40%. And indeed, in Australia BlackRock lost its crown to Vanguard as the country's top ETF provider.

Source: Class

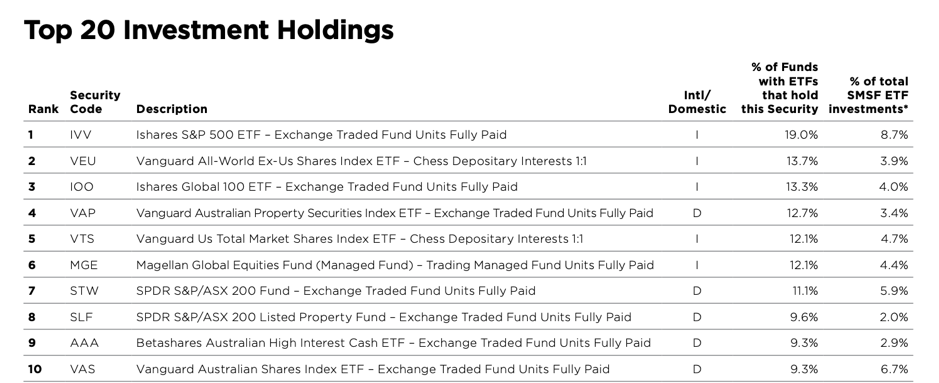

But behind the scenes in 2018 BlackRock scored goals. Through a stroke of genius product innovation, the company restructured all its cross-listed US ETFs as Australia domiciled funds. Meaning that BlackRock's S&P 500 tracker IVV - still the runaway favourite ETF with self-managed super funds - no longer required filling out US paperwork. Every investor and advisor that has experienced the tedium of the W8-BEN will have no doubt rejoiced.

The company also continued to capture market share in the lucrative cash ETF space and remains Australia's richest ETF provider.

ETF Securities

2018 was a big year for ETF Securities. No longer attached to the European mothership, the Australian arm had to fly solo. And fly solo they did. Owing largely to the success of ROBO, an ETF that tracks the global robotics and automation industry, the company saw its assets swell.

The success of ROBO was followed closely by TECH, an ETF built in conjunction with Morningstar, that tracked the global tech sector.

Its sleeper product, GOLD, which was the world's first gold ETF and launched gold products worldwide, might just come into its own this year if volatility continues.

VanEck

Jan van Eck's Australian subsidiary had a big year too. The company's assets bulged thanks to one product in particular: the Australia Equal Weight ETF (MVW), which has put rocket fuel in VanEck's revenue growth.

Debate continues to surround MVW. For some, it is perhaps the best ETF on the Australian market. This is reflected by its 2018 performance, in which it beat its market-weighted competitors for a fourth year running. For others, MVW is simply a bet against the banks, which have had a rough time the past few years.

Beyond MVW, the company's product suite continues to pack a punch. QUAL, the fund that tracks quality global companies, earned the nod from BetaShares, which then rolled out a cheaper copycat. While ESGI brought a mean set of teeth to Australian environmentally and socially aware ETFs.

With $8 million in run rate revenue we suspect that VanEck Australia began breaking even in 2018.

State Street

State Street continued to lose market share in 2018, partly because of its refusal to lower fees. But it's also due to the fact that the company has not rolled out any new Australian products in almost three years.

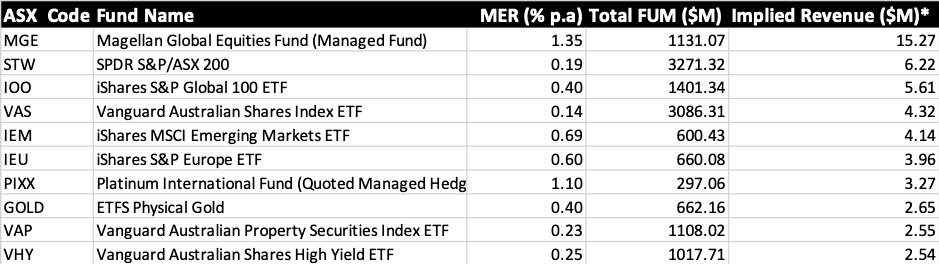

STW continues to be a formidable cash cow. Indeed, compound interest on STW seems to be the one thing keeping State Street in the game.

With $14 million run rate revenue and no big expenses on the likes of product listings, we suspect that State Street was comfortably cash flow positive in 2018.

Magellan

Not quite an ETF provider in the traditional sense of the word, but Magellan continues to have the most profitable ETF by far - thanks to the Magellan Global Equities Fund charging a very high 1.35% fee.

In 2018, however, we took particular note of how Magellan tore up its $20M naming rights deal with Cricket Australia over the ball tampering scandal. To get access to the once in four-year headline event - i.e. an Ashes series on home soil - Magellan had to sign a three-year deal, which included sponsorship of test series with less visibility and interest throughout the following years. (i.e. The Sri Lankan tests in Canberra).

The ball tampering scandal gave Magellan the great excuse to exit the deal early, having bagged the majority of the upside. They truly are professional investors.

Source: ASX

****

Featured imaged, clockwise: Kris Walesby (ETFS), Alex Vynokur (BetaShares), Christian Obrist (iShares), Arian Neiron (VanEck), Evan Reedman (Vanguard), Meaghan Victor (SSGA)