That governments are non-innovative is one of the foundational myths of capitalism.

Throughout history, governments have been as innovative as businesses. Aircraft, computers, anti-septics, the internet, microchips, biotech, GPS: these and many other modern inventions came from governments and resulted from state spending.

And now there's one other area where government is trying to innovate: ETFs.

Western Australian government: ETF provider

The Perth Mint, an organ of the West Australian government, has entered the American ETF industry in attempt to shake up gold products.

As part of its entry, the group has wheeled its Perth Mint Physical Gold ETF (AAAU) onto the New York Stock Exchange, with some help from the white labeller Exchange Traded Concepts.

"We make a profit every year and it goes back to the coffers of the Western Australian government," said Jerry Hicks, a manager at the Perth Mint.

"Don't be deceived by the fact that we're government owned. We're very innovative… Taxpayers own us and we're here to deliver something good."

How Perth Mint is different

AAAU works much the same as other major gold ETFs: it's created and redeemed with allocated bullion, where the bar list is updated daily.

But AAAU is slightly different from its competitors in that it is structured as a debt on the balance sheet of the Western Australian government. It is not structured as units in a grantor trust - like most gold ETFs.

This structure has advantages, Mr Hicks argues in that investors don't have to worry about vaults getting robbed or what insurance arrangements are in place.

Image: Perth Mint

"If the vault falls over, where do you go? If the gold is found to be fake or impure, where do you go? With us you have the government standing behind everything we do. Companies fall over. Governments don't fall over. When you're investing in gold it's all about holding an asset that's been trusted as a store of wealth for centuries."

A second competitive advantage - and what is perhaps most interesting and different about AAAU - is how investors can choose to have the gold delivered to their front door.

The Perth Mint is not the first gold ETF to allow delivery - that title goes to Gold Bullion Securities in the UK. But it is the first to allow delivery of all different kinds of pretty coins and bars.

AAAU investors can have gold delivered as kangaroo bar, a coin with the Queen's head or as big bullion bars with the Perth Mint swan. No other ETF provider offers anything like it.

"We can deliver gold to you. We make it ourselves," Mr Hicks said.

"We've been refining gold for 120 years… we're the number one refiner of newly mined gold and our total throughput, including recycled gold, is equivalent to approximately 10% of global annual production."

"There are only a few refineries that are accredited for good delivery on the five major commodities exchanges: Chicago, New York, London, Hong Kong and Shanghai."

Gold ETFs commoditised

Core exposures are being commoditised in the ETF industry, in gold as elsewhere.

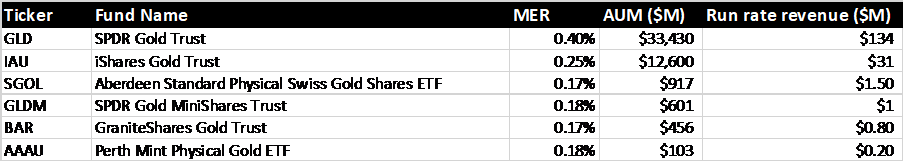

The past two years, providers have lowered the fees on their US-listed gold ETFs down to 17 and 18 basis points.

Source: ETF Stream, issuer websites; data shows assets in US gold ETFs

From what we can tell, gold ETF fees cannot go too much lower than their current levels. This is because several of those basis points disappear on storage fees for the gold (banks that hold the bullion in their vaults have to be paid). While another few go on fund administration.

This leaves perhaps 10 bps at best left for the ETF provider. By our estimation, breakeven AUM for a gold ETF charging 17 bps would be roughly $300m.

"It's a fight in the ETF industry - it's a race to the bottom," Mr Hicks said.

"When we planned to launch we had a fee in mind which was very competitive. But the price war kicked off so we had to sharpen our pencil very significantly."

But Mr Hicks says that his product is worth the money.

"For one extra basis point you're getting a sovereign guarantee and the option to take physical bullion."

"We have a Rolls Royce fund in a world of Kias."